L R AS Published on Sunday 19 February 2017 - n° 180 - Categories:India

Many unknowns surround the Goods and Services Tax (GST) in India

There are many unknowns surrounding the Goods and Services Tax (GST) in India. The cost for solar could be US$67 per kilowatt. This tax, which

was due to come into force in April, is already postponed to July.

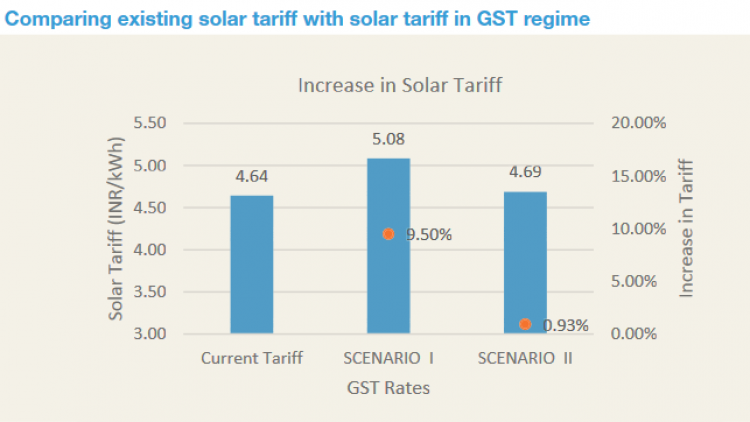

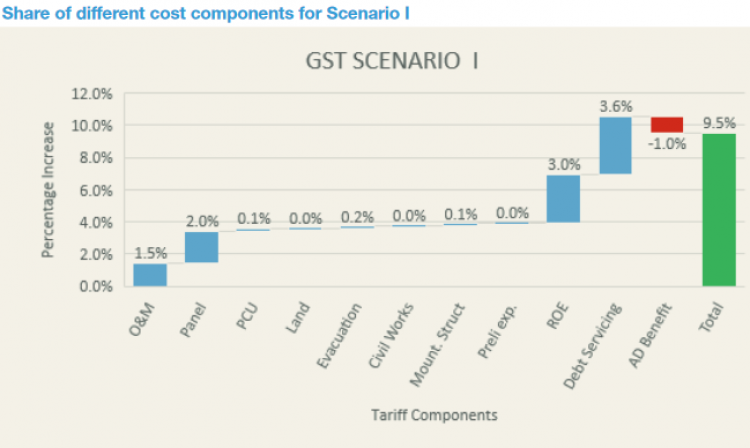

According to simulations, the introduction of this tax would increase costs by 9.5%, which could hamper the deployment of the second phase of 20 GW solar centres. States would be affected differently depending on whether or not there are already subsidies.

Exemptions for solar energy have been requested.

The main advantage of this tax would be to improve the competitiveness of Indian solar cell and panel manufacturers. India's latest budget abolished customs duties on tempered glass and halved the duties on parts used to manufacture tempered glass. The trade unions are asking the government for clarification on the application of this tax to solar energy, as well as compensation for the introduction of this tax.

EnergyTrend of 14 February 2017