L R AS Published on Tuesday 11 June 2019 - n° 280 - Categories:Thread of the Week

le Fil de la Semaine n°280 of June 11th

THIS WEEK'S NEWS HIGHLIGHTS

Articles marked with two stars are reserved for subscribers to the Solar News.

Items marked with a star are reserved for subscribers to Le Regard sur le PV.

If there were only five texts to read this week :

FRANCE

* Voltalia sets targets for 2023**

THE WORLD

* The Chinese policy towards photovoltaic in six points: ** **

*Weak activity of Chinese manufacturers in the 1st quarter **

PRODUCTS

* Tendency to increase the size of the platelets **

* Examination of the reliability of the panels by PVEL***.

FRANCE

* Cape Verde Energy creates a business *

* Total Eren to build a 256 MW power plant in Australia

* Solar Technology to build 32 MW in India

.

.

THE FILE

* News announced at the SNEC exhibition**

.

.

THE WORLD

* The Chinese policy towards photovoltaic in six points :**

*Weak activity of Chinese manufacturers in the 1st quarter **

* Doubling of storage facilities in the first quarter in the United States **

* National preferences in India and US retaliation**

.

.

THE PRODUCTSS

* LONGi launches stacked cells**

.

MISCELLANEOUS

* Businesses are driving the energy transition**

* We would have found out why there is light-induced degradation (LID) *

* Protecting Europe by carbon footprinting is not a good idea *

TITLES

.

FRANCE

* Voltalia sets targets for 2023

Voltalia presented its development programme up to 2023, with a reminder of the 2020 objectives.

| 2018 | 2020 | 2023 | |

| installed capacity MW | 911 | 1.000 | |

| installed capacity + construction | 911 | 1.600 | 2.600 |

| ebitda in €M | 76 | 160/180 | 275/300 |

| solar in the group | 14% | 19% | 30% |

To achieve this, Voltalia is relying on a rapidly growing market, high energy needs and the competitiveness of renewable energies. It sells its energy under long-term inflation-indexed contracts with an average residual maturity of 17 years. This allows an internal rate of return in excess of 10% in developed countries and 15% in emerging countries.

The proposed acquisition of Helexia, owned by the Mulliez family via Creadev, also a Voltalia shareholder, will provide expertise in the installation of large solar roofs for businesses. This will create a new development pole

In order to achieve this 2023 objective, the company will call on its shareholders or lenders.

The company will

.

* Cape Verde Energy creates a business

Cape Verde Energy's co-construction offers dedicated to local authorities and territories are successful, as they meet their needs to drive an energy transition process on their territory. Cape Verde Energy accompanies them in a pragmatic and operational way in their local renewable energy production projects.

It is an association between local authorities who know the needs of their territory, and the technical competence of Cape Verde Energy which wants to become a reference actor of the territories for the production of decentralised renewable energies consumed locally in a logic of short circuit.

Already, eight local authorities or EPLs have placed their trust in CVE and ten others are getting ready to do so.

Tecsol of 6 June

Editor's note Cape Verde Energy's strategy is interesting because it establishes collaborations with local authorities. These have small or medium sized projects that correspond to the company's know-how. When a project has gone well, the local managers will again call on this company. A business is created, which is not the case with the construction of power plants where, once the site is completed, another client must be found.

* Total Eren will be able to build a 256 MW power plant in Australia.

Total Eren obtains financing for the 256 MW Kiamal solar power plant in Australia (State of Victoria). The electricity will be sold under four sales contracts and in the form of renewable energy certificates. The plant is scheduled to come on stream in 2019.

PV Magazine of 5 June

* Solar Technology to build 32 MW in India

Technique Solaire has obtained financing for the construction of two power plants totalling 32.5 MW in India. These two power plants benefit from an electricity sales contract with two Indian distribution companies.

The company has reportedly already installed 75 MW of solar power and has 250 MW under development in France and abroad.

PV Magazine of 6 June

NDLR These two plants account for almost half of the company's facilities. That's quite something. Moreover, any activity abroad reinforces the presence in France.

.

.

THE SUBSIDIARY

* News announced at the SNEC exhibition

- At the SNEC exhibition in Shanghai, several collaborations were announced such as the one in Tongwei with LONGi to supply the latter with high quality polysilicon. Similarly, Zhonghuan Semiconductor has reached an agreement with GCL Poly to increase its monosilicon wafer production capacity by 25 GW over the next three years.

- There are rumours of financial support by state-owned entities to major PV manufacturers, as well as reduced activity to better respond to changing market conditions.

- Innovation is increasing its pressure on panel manufacturers and seems to be more intense than in previous editions, with some panels presented having a power of more than 300 W and even 400 W. PERC technology is still favoured. The panels are shingled, half-cut cells, glass covered, glass with transparent back sheets, as the case may be.

- Heterojunction and TOPCon technologies were also highlighted. Even perovskite cells have made their appearance. However, some speakers at round tables urged attention to the stability required of perovskite and the use of lead to achieve high efficiency, as more and more countries are demanding lead-free products.

Another group of high-performance panels has been panels using MWT (Metal Wrap Through) technology.

- While leading manufacturers have been innovative, companies with low margins and reduced cash flow are likely to find it difficult to compete. Some major manufacturers want to move to 166 mm side cells (previously 156.75 mm) to provide more exposure area. LONGi has announced that it will convert 30% of its production capacity to cells of this size. This will force the rest of the industry to switch to such cells. Manufacturers will have to change their equipment, from silicon producers to panel producers. Many manufacturers will not have the financial means to change their equipment.

- LONGi estimates that the Chinese market will stabilise between 40 and 50 GW over the next few years. For 2019, it anticipates a volume of installations in China of 35 to 40 GW, including 25 GW in the second half of 2019. A first batch of grid parity projects with a volume of 15 GW will be installed by the end of 2020. Some observers consider this figure to be optimistic and are awaiting indications from the government. This encourages manufacturers to seek outlets abroad.

PV Magazine of 7 June

Editor's note The change in cell size is in line with the evolution of the sector: small steps to increase the yield of cells and therefore of panels. Only the change in size obliges to review the whole industrial installation, which has a cost. If it is not certain that this change in size was only decided to eliminate part of the competitors, it will contribute to it, and will help to concentrate the sector a little more.

.

.

THE WORLD

* The Chinese policy towards photovoltaic in six points :

The Chinese policy in six points:

- All solar photovoltaic projects in China will be sorted and managed in two categories: subsidised and non-subsidised (grid parity projects). No public funding will be available for grid parity projects, but there will be no limitation on quotas. They must be managed by provincial governments, with administrative management and a local network with connection control.

- All subsidised photovoltaic projects are classified into five categories : (a) residential rooftop, (b) large-scale photovoltaic installations, (c) poverty alleviation photovoltaic projects, (d) distributed photovoltaic systems, and (e) special projects, including Top Runner and grid supported projects.

- A total annual subsidy of RMB 30 billion (US$445 million) has been confirmed by the Chinese Ministry of Finance in 2019. This budget will cover facilities in categories a, b, d and e. Photovoltaic poverty alleviation projects (c) have been given the highest priority, without subsidy limitation quotas, and will be supported by additional funding.

- For the four categories, the payments and budgets are as follows: a) residential: 0.18 RMB / kWh with an allocated budget of 750 million RMB, i.e. about 111 million USD or about 3.5 GW, according to a calculation by the China Photovoltaic Industry Association (CPIA). This budgeted amount is to be taken from a total of 30 billion RMB. (b) Large-scale photovoltaic installations: three regions are defined with 0.40 RMB, 0.45 RMB and 0.55 RMB for regions 1, 2 and 3 respectively, down from 0.50 RMB, 0.60 RMB and 0.70 RMB in 2018 (Editor's note: this is probably a price per megawatt.). (d) Distributed PV projects: administered via an auction system, with ceiling prices of 0.10 RMB/kWh.

- All (b) utility PV projects, (d) distributed PV projects and (e) special projects will participate in auctions to obtain the subsidy from a single pool of funds at the country level. Bidding projects will submit a price/kWh price to the National Energy Administration (NEA) and thus enter into a ranking system of all Chinese PV projects. The winning projects will be those with the lowest price. Higher prices will be excluded. The regulations for the tendering process are currently being drafted and will be published by NEA shortly. When the funding pool is exhausted, projects with higher bids will not receive any subsidy.

- The policy will come into force on1 July 2019. Utility type projects completed between July 2018 and June 2019 may receive grant payments in 2018.

PV Magazine of 8 June

Uncertainties about China's subsidy policy in thefirst quarter prompted most Chinese players to wait for clarification and to shut down the facilities. As a result, Chinese demand collapsed after the completion of the Best Around Lunar New Year programme.

This weak activity was offset by the traditional high season in India and Japan. Foreign markets (the United States, Vietnam, Spain, Australia, Mexico, Brazil and Ukraine, etc.) recorded strong demand. This brought Chinese exports to a record high: 16 GW in the 1st quarter. At the beginning of the second quarter, demand in Japan and India did not weaken. The strong demand was for mono-PERC panels.

The reason for the buyers' choice is simple: a multisilicon panel has a power of 275 W. Mono-PERC panels can reach 310 W. If they use half cells, the output power reaches 315-320 W. Thus, a difference of 40 W exists between the two types of panels for a price difference of $0.05 / W: the choice is quickly made in favour of the mono-PERC. The various manufacturers have therefore converted their production lines. In 2019, the global capacity of mono-PERC will double, reaching 100 GW.

However, China's priority for grid parity projects and the absence of a Best of the Best programme will encourage installers to return to multi-crystalline (for cost reasons).

The Chinese government has just confirmed a series of projects without subsidies. Consequently, demand will resume in June-July, with a peak season between the third quarter of 2019 and the first quarter of 2020.

In the sector, prices have decreased from February to April. Since the Chinese government's announcement, prices have stabilised. The shortage of multi-crystalline cells led to a rise in prices in May, restoring the margins that had been badly hit in the first few months. Demand for monosilicon provided comfortable profit margins at the beginning of the year. This will persist in the second half of the year due to the expected strong demand, but there will be no significant rebound in prices.

PV Magazine of 5 June

Editor's note If we take the export figure of 16 GW, to which we add the 5.2 GW facilities in China in the first quarter, the producers have therefore used their production capacity on an annual basis of 85 GW, or half of the total. (or with the commissioning, less than half) of the Chinese production capacity which was specified by the National Energy Administration at 175 GW at the end of 2018. As some manufacturers have worked harder than others, the announcement of difficulties in the sector is not an invention. Producers are used to these accordion blows in their work plan. They will increase their rhythms of activity in the second half of the year, but some of them, having favoured the Chinese market, are in difficulty.

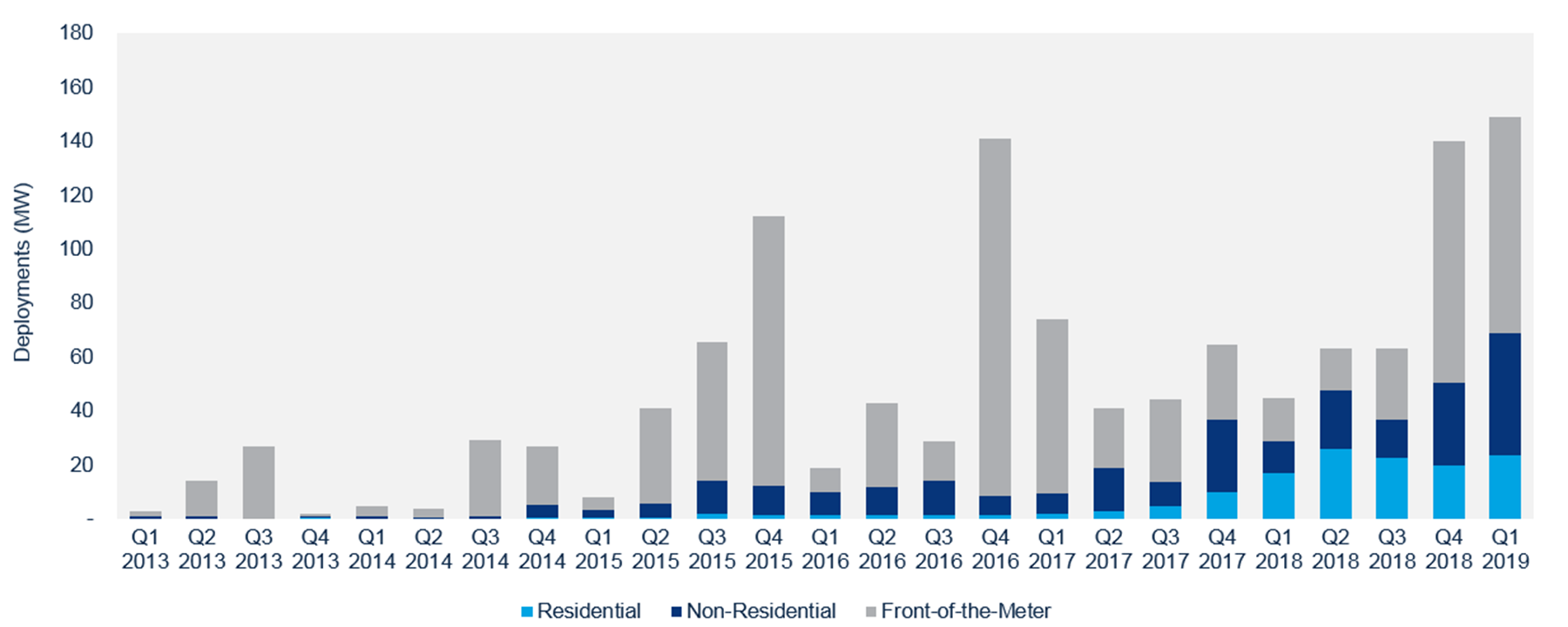

* Doubling of storage facilities in the first quarter in the United States

The storage market is still small, but more and more American states are getting into the business. The US market set a record for deployments in the first quarter. In the first three months of the year, 149 MW of storage for the network were commissioned (+ 232% over the first quarter 2018),according to Wood Mackenzie. This paves the way for a doubling of facilities in 2019 compared to 2018. Deployments in 2020 will triple compared to 2019. The forecast has been raised from last quarter.

US storage revenues are expected to reach $1 billion.

Residential storage accounts for nearly half of the megawatts deployed in the quarter and more than half of the megawatt-hours.

Commercial and industrial storage behind the meter set a personal record: 45 megawatts and 108.7 megawatt hours in the first quarter.

Overall energy capacity, measured in megawatt hours, decreased 23% from the previous quarter, even as the number of megawatts deployed increased.

Battery supply constraints hit the industry hard in the second half of 2018, largely due to a sudden increase in demand for capacity in the South Korean market, which reduced the volume of cells available for export. This shortage caused some projects to be postponed to 2019, contributing to high activity in the traditionally slow first quarter.

Demand from electric utilities accounted for 60% of the megawatt hours. New Jersey built two 20 MW / 20 MWh projects to regulate the PJM frequency. New York has also set up a 20 megawatt frequency regulation system. Arizona's power company, Salt River Project, built a 10 megawatt / 40 megawatt hour stand-alone storage project, making it the second largest in terms of energy capacity.

GreenTech Media of June 4

Editor's note This expansion of storage shows that the needs are still far from being met both by the electricity companies and by private individuals who are making increasing use of storage. While it is understandable that the companies want to regulate the electricity network, the demand from private individuals indicates a profound change in behaviour, in favour of an individualisation of their attitude.

* National preferences in India and US retaliation

India's requirement for local content in some roofing, water pump or public control systems serves the interests of local industry, particularly photovoltaics. D. Trump reacted by denying India the privilege of duty-free export to the United States. This will affect Indian exports of photovoltaic products, but local content programmes could absorb lost sales abroad.

Thus, on 5 June, D. Trump revoked India's special status and removed its exemption from the application of the US safeguard measures. He justified this decision because India does not ensure fair access to its markets in the US.

The decision will have an effect, since in 2018, 47% of India's solar exports went to the US. Cost is a major criterion for US PV buyers. India had a price advantage. The 30% tax will reduce the price advantage that Indian manufacturers had over other foreign suppliers. It will be difficult to be competitive. Indian manufacturers will find it difficult to find other markets as they will be competing with Chinese products. Europe, by abolishing the minimum import price, favours Chinese products: a sharp drop in Indian exports is to be expected. Not all Indian manufacturers share this negative outlook: Vikram Solar focuses on systems installed on industrial and commercial roofs in the United States or Europe.

Indian manufacturers will sell on their domestic market, especially for rooftop systems, solar pumps and products for the public sector. This is a big challenge

PV Tech of 4 June

Editor's note India has no choice. If it wants to develop a photovoltaic industry, it must give priority to its national production. This attitude cannot please foreign suppliers who see customers disappear. The United States is very wary of this because they are used to imposing their will on other countries. D. Trump makes this his policy.

The American retaliation measure will probably not have much effect, given the size of the Indian market and the government's desire to strongly develop photovoltaic installations on its territory, which is a natural outlet for local production.

.

.

THE PRODUCTS

* Tendency to increase platelet size

While the usual wafer and cell size is M2, some Chinese monosilicon wafer manufacturers have switched to M3, which is only slightly larger. This is because the larger the surface area of the wafer, the greater the power output. The more exposure there is, the greater the energy production. We will have to see if the current material allows the use of slightly larger cells. Already, the M3 size is widely adopted on existing monosilicon cell production lines.

LONGi offers monosilicon wafers of size M3 and also M6, the largest size currently available. The use of M6 will require an adjustment of the cell production equipment.

Digitimes of 4 June

* Examination of panel reliability by PVEL

PV Evolution Labs (PVEL) has published the 5th edition of its PV module reliability dashboard in partnership with DNV GL. It is the most comprehensive comparison of PV panel reliability test results available on the market. Compared to previous years, some of the tests have been tightened up, making it more difficult to achieve a "superior performance" rating. In some areas, more than 30% of the panel types failed one or more test criteria.

PVEL has observed high degradation rates of some panels using PERC technology, particularly in wet heat tests. PVEL emphasises that its studies are the only ones that provide information on the quality of the panels. For manufacturers, they are the only ones to detect the potential risks of certain technologies, designs or materials.

The thermal cycle The panels are placed in a chamber where the temperature is lowered to - 40° C, stopped, then raised to + 85° C. The maximum electric current is applied to the panels while the temperature is raised or lowered. This is repeated 800 times for PVEL's Product Quality Programme (PQV) (IEC 61215 cycles only perform 200 cycles). Thermal cycle performance had improved by 42% in the 2019 dashboard. Panels from nine manufacturers were the best performing: 2 panels at Boviet Solar, 4 at GCL-SI, 2 at Q CELLS, 3 at JinkoSolar, 3 at LONGi Solar, 2 at REC Group, 2 at Silfab and 4 at Trina Solar.

Damp heat The panels are placed in a room at 85°C and 85% relative humidity for 2,000 hours (84 days). At IEC, the duration is 1,000 hours. Panels from five manufacturers are the most efficient: four panels at Adani, two at GCL-SI, one at JinkoSolar, three at LONGi Solar, two at Phono Solar and four at Vikram Solar. The results of the 2019 tests showed a deterioration of the results compared to those of 2018, which were worse than those of 2017. In 2019, a significant number of the panels tested showed a degradation of more than 4%. Most of the panels showing abnormal degradation would have been manufactured with PERC cells (normal or cut). Not all PERC panels fail, some of the better performing panels use this technology. More generally, 30% of the panels failed on one or more test criteria.

Dynamic mechanical loading the panels are subjected to a thousand cycles of alternating loading at 1,000 Pa. Then the panel is subjected to 50 thermal cycles (at - 40° C) to cause microcracks. Then three series of ten humidity freezing cycles (at 85°C and 85% humidity for 20 hours followed by a rapid decrease to - 40°c to stimulate corrosion. The panel is then visually inspected. PVEL notes a 37% decrease in the best performing results, and adds that this is the first time it has practised freezing 30 times compared to 10 cycles in previous years, which increases the number of failures compared to 2018. Panels from nine manufacturers were the most efficient: two from Adani, two from Boviet Solar, two from GCL-SI, one from Q CELLS, one from JA Solar, two from LONGi Solar, one from REC Group, two from Silfab and two from Vikram Solar.

Potential Induced Degradation (PID) The panels are placed in a chamber with maximum tension, applied at 85° C and 85% relative humidity for two cycles of 96 hours. The best performers were three panels from Adani, two from Boviet Solar, four from GCL-SI, two from Q CELLS, three from JinkoSolar, two from LONGi Solar, two from Phono Solar, two from REC Group, two from Seraphim Solar, two from Silfab, two from Wuxi Suntech, two from Trina Solar, two from Vikram Solar and two from ZNShine.

Several companies, such as Q CELLS, GCL-SI, REC, Suntech and Trina Solar, have been awarded Top Performer status in PID tests.

GCL-SI appears to have been the leading manufacturer of photovoltaic systems, the only company to achieve "Best in Class" status for two panels (GCL-P6 / 60Hxxx and GCL-P6 / 72Hxxx /) in each of the four test regimes.

Vietnamese Boviet Solar also distinguished itself by achieving "Best Executioner" status for its BVM6612M-xxx-H / and BVM6610M-xxx-H series panels in three of the four test regimes.

The PV 2019 module reliability dashboard is available as a free download from www.pvel.com/pv-scorecard.

PV Tech of 3 June

NDLR These tests are very important in order to improve the quality of the panels and to have a benchmark on the attractiveness of this or that model. We imagine that the manufacturer is notified of the test results so that any defects can be corrected.

For distribution reasons, the names of the models are not provided, which deprives the buyer of the knowledge of what he is buying. But then what is the point of these tests if they are only intended for manufacturers and not for those who use them?

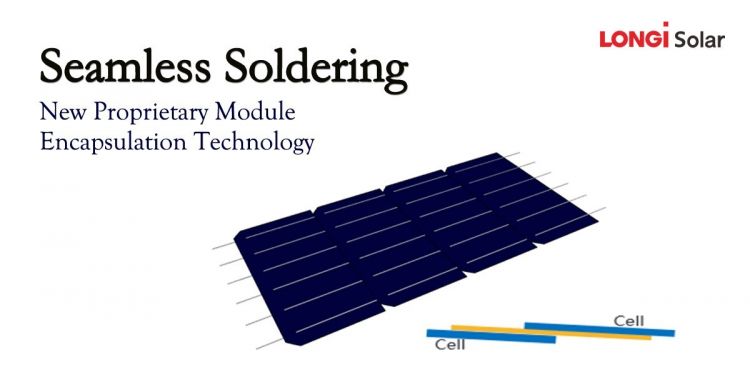

* LONGi launches stacked cells

In the second half of the year, LONGi Solar will begin mass production of its newly developed technology for interconnecting fixed, solderless cells. This technology is expected to significantly reduce panel cell losses. Combined with high-efficiency PERC cells, the panels could reach 500 Wp according to tests carried out by TÜV SÜD on 30 May.

This technology uses a welding tape to create a mosaic-like interconnection of the cell, completely eliminating the typical 2mm wide gap architecture between cells. It is compatible with existing panel encapsulation processes and equipment. It can be upgraded to mass production.

This technology would also be usable with large-area M6 size cells, its welding wire and reflective tape technology.

PV Tech of 2 June

NDLR Here again, we adapt, we evolve, we grasp a few tenths of the conversion rate, while remaining within the same technology.

.

.

MISCELLANEOUS

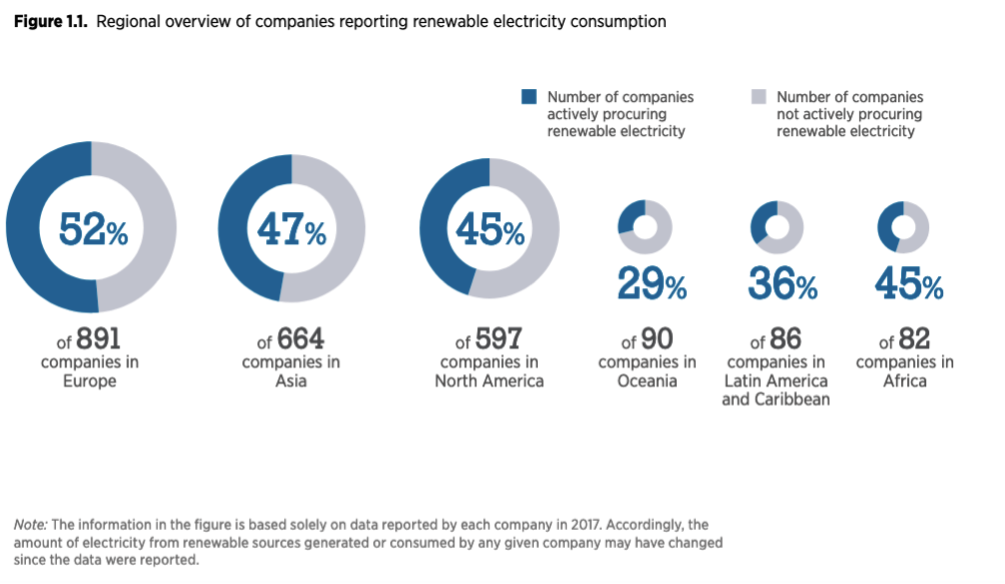

* Businesses are driving the energy transition

The transition to 100% renewable energy is already underway. It is being organised by companies. They are turning to renewable energies because of the volatility of fossil fuel prices and to reduce their risks. In 2019, more than 170 companies have committed to switching to 100% renewable energy, with 37 of them already 95% close to reaching their target. These are often the most influential companies in the world (Ikea, Unilever, Anheuser-Busch, ...) notes the CEO of Solarcentury.

Companies are really moving forward with Power Purchase Agreements (PPAs) in particular. This renewable electricity supply is not only positive for CO2 reduction, but also has a significant impact on the global economy.

According to IRENA, more than 10 million people now work in the global renewable energy sector. Corporate commitments to renewable energy are increasing this number and providing significant new capital injections. According to Bloomberg NEF, RE100 members alone invest more than $94 billion.

Bloomberg NEF calculates that RE100 signatories will need to purchase an additional 197 TWh of renewable energy in 2030 to meet their 100% target - which will have to be achieved with 100 GW of new renewable power plants. This demand will generate an investment of about $90 billion in renewable energy over the next decade.

These leading companies have a zerocarbon philosophy embedded in their culture and are now communicating their change: Anheuser-Busch, has set a target of sourcing electricity from renewable sources by 2025 and has even launched a 100% renewable electricity label for Budweiser.

Unilever's management is convinced that sustainable practices are the only way forward for companies. In 2017, their sustainable brands generated 70% of its growth.

Ikea is committed to producing as much renewable energy as it consumes by 2020. Ikea now sells turnkey solar systems to customers in the Netherlands, Belgium, Germany, Switzerland, Poland and most recently Italy. Ikea is committed to renewable energy. It sees it as a fantastic opportunity to make rapid progress. The company has therefore placed sustainable development at the forefront of its 2020 strategy.

Ikea is already independent of energy in the Nordic countries and produces more energy than it consumes. The same will be true in the United States. Globally, the company has deployed more than €1.5 billion in renewable energy projects. It owns and operates more than 400 wind turbines and has installed nearly 900,000 solar panels in its shops and distribution centres, including its UK shop Greenwich. Ikea goes further by helping its customers to use solar panels in different European countries.

Instead of arguing, companies are leading the way. In particular, many are aiming for the goal of 100% within a decade, which shows that a rapid transition is not only essential, but possible.

Governments must therefore not only accept this change, but organise it by removing obstacles to change in companies.

PV Magazine of 5 June

Editor's note The CEO of Solarcentury emphasises a phenomenon that emerged quietly, the conversion of large companies, initially American, to renewable energy. They may have a certain notoriety about it, but it certainly has an economic advantage: instead of having a fuel price that fluctuates according to political factors, they get a fixed price in the long term, probably lower than the grid price. The economic advantage of this fixed price, which is lower than the cost of the network, leads to an increase in competitiveness compared to companies that have not taken the step. This gap can only increase over time as large energy producers have to increase their prices as large customers use less energy ...

* We would have found out why there is light-induced degradation (LID)

Light-induced degradation (LID) has existed for decades and is increasing with PERC cells. Performance loss can be as high as 10% in the first month after installation.

Researchers at the University of Manchester claim to have identified the origin of the process (LID) in silicon solar cells. It results from a defect in the mass of the silicon that slumbers until exposure to the sun, creating an obstacle to the flow of electrons.

The researchers also found that the defect is reversible and that the service life of the material's substrate is increased again by heating in the dark.

https://www.pv-magazine.fr/2019/06/04/des-scientifiques-britanniques-observent-le-lid-en-action/

PV Magazine of 4 June

* Protecting Europe through carbon footprinting is not a good idea

Representatives of the European Photovoltaic Industry (ESMC) are focusing on climate protection with carbon footprinting in order to level the playing field between the European industry and the Chinese industry. The introduction of carbon footprint measurement would compensate for the cost disadvantages compared to imports from high-emitting countries and would encourage new investment in Europe.

Five elements should be taken into account:

- A border-adjusted carbon price that is revenue-neutral

- Wider application of the EU framework for sustainable procurement

- Taking the carbon footprint into account in policy support programmes and state aid

- Wider application of ecolabelling and ecodesign

- Better access to funding and support for R&D in the sector

But, they recognise that Europe's proactive policies are needed to revive the industry.

Full Sun on 10 June

Editor's note Make no mistake. Focusing on the carbon footprint provides a trompe l'oeil advantage. It allows competitors to be ruled out when there is a decision-maker (the State, for example) who takes this factor into account. On the other hand, an investor who calculates its cost price and production will not care about the carbon footprint criterion, preferring to have the highest possible rate of return on investment.

What needs to be done is to make European companies competitive against imports. This often requires tariff protection such as D. Trump understood this well, until the structures of the various European companies are consolidated and they have initiated technological progress. It is surprising that no European manufacturer of PV panels or products has presented Intersolar or SNEC with innovations that are valid worldwide. Only the Chinese have shown inventiveness. European companies are too small to be able to afford research and development worthy of the name. They are therefore condemned to live in the shadow of tailor-made calls for tenders.

.

le Fil de la Semaine n°280 of 11 June