L R AS Published on Monday 28 May 2018 - n° 235 - Categories:Thread of the Week

le Fil de l'Actu n°235 of May 28th

THE IMPORTANT POINTS OF THIS WEEK'S NEWS (le Fil de l'Actu n°235 du 28 mai)

Items marked with a star are free of charge.

* If there were only five texts to read this week * .

FRANCE

* Installations in France in the 1st quarter : relaunch of connections *

* EDF has published its position on the multiannual energy programming **

Increase in the ceiling for the collection of participativefinancing *

* The ambitions of BHC Energy (Total group) in the aggregation *

*Voltalia to build 50 MW in Kenya *

* Analysis of the CRE innovationcall for tenders by Sia Partners *

.

THE SUBSIDIARY

* Isthe installation of micro-grids in emerging countries a decoy? *

*Soon, a 60 cell panel at 500 watts **

Chinese manufacturers are switching to PERC cells ** How to

make photovoltaics reach the mass market? *

* The duckcurve, the Nessie curve, the shark curve *

.

THE WORLD

* What may be the price per kWh in 2022 in the USA? *

* The EPFL has evaluated the economic impact of renewable energies * * 35

German organisations areasking for protection against Chinese imports *

.

THE PRODUCTS

* Inverters that are too easy to hack *

* Is it better to choose storage or pumped heat? *

.

THE COMPANIES

* LONGi buys 55,000 tonnes of polysilicon! *

* Sunpower short of cash *

THE DEVELOPMENT OF THESE TITLES

* If there were only five texts to read this week :

Installations in France in the first quarter: connections are back ontrack

Soon, a 60-cell panel at 500 watts

How can photovoltaics reach the mass market?

The EPFL has evaluated the economic impact of renewable energies

Sunpower is short of cash.

.

FRANCE

* Installations in France in the first quarter: relaunch of connections

New PV installations in France in the first quarter amounted to 246 MW, three times the amount at the beginning of 2017. The country has 8.3 GW of solar power installed (7.91 GW on the French mainland and 386 MW in overseas territories and Corsica).

In the fourth quarter of 2017, installations have just reached 401 MW: the last two quarters indicate that the series of calls for tenders launched by the French government in the second half of 2016 is beginning to bear fruit.

Projects awaiting connection at the end of March totalled 3.1 GW compared with 2.9 GW at the end of December.

The French continental regions with the largest amount of installed solar energy are: New Aquitaine (with 2.12 GW), Occitania (1.66 GW), Provence-Alpes-Côte d'Azur (1.14 GW);

PV Magazine of 25 May.

.

* EDF has published its position on the multiannual programming of the Energy

EDF has published its position on the multiannual programming of Energy. It does not believe that electricity consumption will fall before twenty years and envisages an annual increase in demand of between 0% and +0.5%. The company confirms that it does not want to close other nuclear power stations than Fessenheim before 2029. EDF's management, which has just obtained the renewal of the licence to operate the plants for up to 40 years, considers that a certain number of plants could last up to 50 years and is very confident in its ability to operate all or part of its nuclear fleet safely for up to 60 years. This is a reaffirmation of EDF's official position.

Batirama of May 23rd.

.

* Raising the ceiling for the collection of equity financing

The ceiling for the collection of participatory financing will rise from €2.5 million to €8 million. This concerns renewable energies and share, bond and mini-bond issues.

Green Univers of 25 May.

.

* The ambitions of BHC Energy (Total group) in the aggregation

BHC Energy, Total's energy management subsidiary, which has been active in the field of erasure for three years, wants to make a place for itself on the French market for the aggregation of renewable energies. It is targeting 15% of the market.

BHC Energy has been authorised since April 2017 to purchase electricity produced by renewable installations with a purchase obligation contract. It is therefore authorised to replace the incumbent operators.

Green Univers of 22 May

Editor's note The Total Group has more and more ambitions in renewable energies. It is trying to be present in the different categories of activity. Beyond these acquisitions, it would be interesting to know the growth of activity and especially the profitability of these acquisitions, even if the group is in an accelerated investment phase. Indeed, the financial situation of Sunpower (see elsewhere) raises questions about the quality of the management of these very specialised subsidiaries, which carry out their activity far from hydrocarbons. It is not enough to have money to know how to use it well....

.

*Voltalia to build 50 MW in Kenya

French company Voltalia has signed a 20-year contract to sell electricity to Kenya from a 50 MWp solar power plant in western Kenya

The company, which is mainly focused on wind power in Brazil, aims to reach the installed solar and wind gigawatt by 2020.

PV Magazine of 25 May.

.

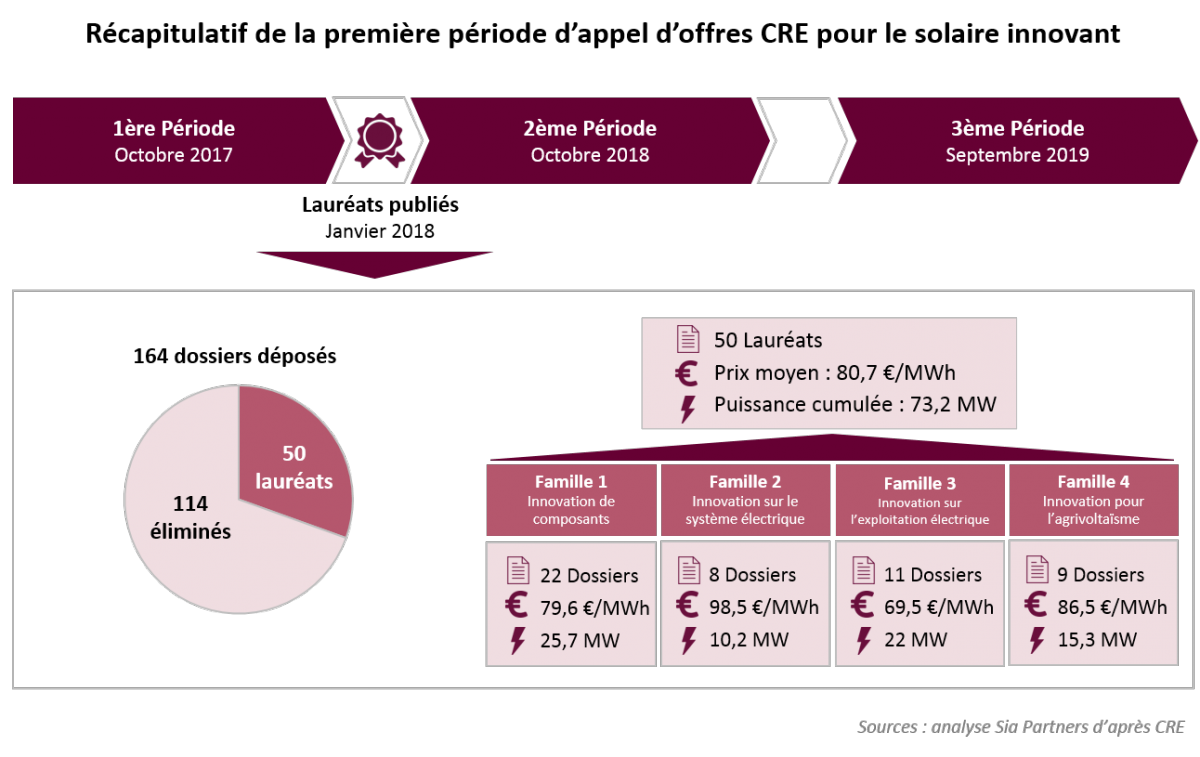

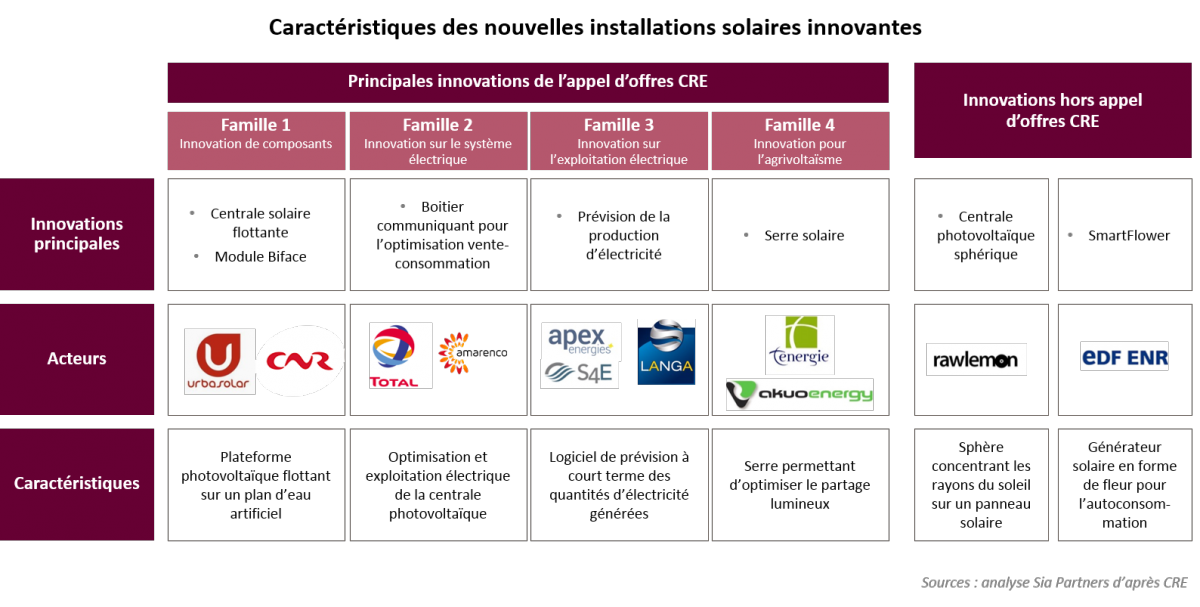

* Analysis of the CRE innovation tender by Sia Partners

At the end of 2017, CRE launched a call for tenders for innovative solar installations. Lhe projects were selected on the basis of their economic competitiveness and their contribution to innovation.

Four families of innovation were proposed,

in order to ensure fair competitiveness for each type of innovation:

component innovations (such as the solar road, innovative panels, new cell technologies, ...),

electrical system innovations (high-voltage architecture, innovative energy distribution systems, etc.),

innovations related to the optimisation and electrical operation of photovoltaic power plants (monitoring software coupled with sensors, preventive maintenance tools, etc.),

solar energy coupling secondary photovoltaic production to main agricultural production.

The rating system is linked to the degree of innovation, synergy with agricultural use, or market positioning.

The average price of the bids selected by CRE is €116.70 per MWh, compared with €89.00 per MWh for the conventional call for tenders. This is 31% higher. This can be explained by the innovations proposed, such as production optimisation boxes, integrated interruption forecasting software, etc. For installations in greenhouses and agricultural sheds, the price supplement is 14%. The same applies to ground-based installations, where the weighted average price of the bids selected (€70.40/MWh) is 5% higher than for ground-based solar power plants (€67.00/MWh).

Fifteen developers share 77 MW spread over 50 projects for an average price of €80.70/MWh. The main winning players in this first wave include Urbasolar, Langa, Tenergie, Total Solar allied with Amarenco and Luxel. The winners of this first wave of innovation tenders are distinguished by their technical and usage specificities.

Five applications for floating solar power plants were selected. Other innovations stand out, such as communicating boxes for optimising sales and consumption of solar energy, or production forecasting software to improve short and long-term projections. Finally, a significant part of the selected projects focus on the contribution of solar energy to agriculture.

Solar innovation is a sector at the cutting edge of research. The barrier to entry is high. Nevertheless, many players who could not compete in traditional calls for tenders - either because the size of their installation is too small or because the criteria set by CRE are too restrictive - have the opportunity here to present their innovation and receive financial support.

This type of call for tenders will give a new dimension to French solar energy.

http://www.energie.sia-partners.com/20180517/en-france-les-installations-solaires-innovantes-ont-le-vent-en-poupe-0

SIA Partners of 17 May

Editor's note A contradiction has been detected on the price of the classic call for tenders, which is indicated at €89 per MWh, and the average price offered to the winners of €80.70 per MWh.

.

THE FILE

* Is the installation of micro-networks in emerging countries a decoy?

Mini-grids seem to be the solution to bring electricity to the 1.1 billion people who have no access to it. The International Energy Agency estimates that they will bring electricity to a third of this population. The purchase of equipment that can generate income for rural villagers is seen as one of the most important ways to improve the bankability of rural mini-grids.

Rural mini-grid companies are now working with communities to understand what income-generating equipment (called productive uses of electricity) can make businesses viable.

A virtuous cycle is created when developers of rural mini-grids allow the purchase of equipment that will increase a customer's income. In an ideal situation, the increase in the customer's income covers more than the cost of operating the equipment. The resulting profit allows the customer to afford additional services powered by the mini-network.

This scenario is idealized.

The challenge is to develop productive uses. There may be many barriers to the adoption of equipment for productive uses. One such challenge is the limited ability of the customer to pay for the initial cost of the equipment. In some wealthy villages, the electricity generated by the mini-grid has reduced the cost of operating the equipment by a factor of four, and the acquisition of equipment has progressed very rapidly. In the poorest villages, however, it took several years of savings before customers were able to purchase appliances.

The financing itself will not lead to the adoption of equipment, as villagers are risk averse. Market access for new products or increased production must be provided. The biggest challenge in using electricity is the lack of commercial links or efficient supply or delivery chains. Enterprises that provide micro-grids often have to take over micro-businesses in order to start them up. These micro-grid providers seek partnerships with non-governmental organisations or private companies to provide expertise to initiate growth in production and demand.

Often electricity providers need to identify micro-enterprises that can generate value. They need to know the market in the local community.

Another aspect to be analysed is the uses: sometimes the electrical voltage is too low for the use of machines; sometimes the wells are too far from the village centre for pumps to be used; other times the water pipes to the fields have to be built or installed; sometimes the demand is for drinking water for food and there is no water left to water the fields.

The problem of electrification of areas that are not connected is diverse, varies according to the village communities, and is also linked to the local economic potential. Thus, it is not enough to provide micro-grids; the supply must be extended to many other factors that are unforeseen but which condition the use of energy.

PV Magazine of May 26th

Editor's note Our personal experience of several decades in Africa makes us fully subscribe to this analysis. And to go even further: Europeans are taking their knowledge to regions that have known nothing else for hundreds of years. Why would they want to change? How could they when they don't have the technical culture or the knowledge to set up machines or to repair a simple breakdown. Finally, the desire for economic development is often external to their conception. As an African told me this summer in the capital of Benin: "Africans are bon vivants. They don't want anything else" There is no desire for enrichment that we find in Asia...

.

*Soon, a 60 cell panel at 500 watts

Soon, a 60 cell panel at 500 watts: China's Tongwei Solar plans to set up the production of bifacial heterojunction silicon cells with the help of the Shanghai Institute of Microsystem and Information Technology and Three Gorges Capital Holdings. Production capacity is expected to reach 10 GW within five years. The conversion rate of a 60 cell panel should exceed 23% and have a power of 500 watts.

The company, which will increase production capacity to 10.5 GW by the end of 2018, is expected to reach 30 GW in five years.

Tongwei has entered into an agreement with LONGi to purchase 55,000 tonnes of high-purity polysilicon over the period 2018 to 2020. This contract is valued at $1.1 billion.

Digitimes of 24 May.

.

* Chinese manufacturers switch to PERC cells

Chinese manufacturers of monosilicon solar cells are switching their production to PERC. This technology offers a higher panel conversion rate. Manufacturers of multicrystalline should strive to follow suit. This shift has been made possible by Chinese OEMs offering machines that are much cheaper than imported ones, which speeds up the process.

Canadian Solar as well as GCL Poly in China and Solartec Energy in Taiwan are the leading manufacturers of polysilicon PERC cells. Canadian Solar produces polycrystalline black silicon cells, having developed a special texturing process that increases the conversion rate of the cells.

PERC cell production capacity in China will increase from 50 GW in early 2018 to 60 GW by the end of the year. Strong competition among manufacturers is likely to develop in 2019 in the PERC segment.

Digitimes of25 May.

.

* How can photovoltaics reach the mass market?

Until now, customers of solar systems have been more curious about novelty and overlooking the initial difficulties of a new system. Now, the market will be more of a user-customer market that wants a fully finished product that is easy to buy, easy to use and worry-free. This transition between the two categories of customers is difficult to achieve, as many technologies have failed to take this step.

The solar energy market has evolved so rapidly that one could forget that mass distribution has not yet occurred. Dissemination among those curious about the novelty is between 2.5% and 13.5%. The next step is mass diffusion, but solar energy is a complex product to sell. This explains why the cost of acquiring a customer is around $4,000 according to GTM (in the United States). This means that solar energy is not ready to be adopted by Mr. Toutlemonde.

He wants a product that is economical, easy to buy, low-risk, and offers the assurance that homeowners will not be left with broken equipment. The market, too, has changed. Until now, the owner of the system was the roof rental company (in the United States). Now it is the homeowner. However, the owner has no insurance to guarantee production, which is usually included in the electricity rental and purchase contracts.

However, breakdowns or anomalies occur on the inverters, panels, and the wiring of mechanical and electrical connections. Over a period of twenty years, it is likely that something unexpected will happen to the systems. However, customers do not appreciate this because they do not know how PV systems work. It is up to them to detect a failure or an anomaly... Traditional customers want to buy solar energy without fear. This is a challenge for the industry. However, a customer who has had a bad experience has a bad memory of the installer and the brand of the faulty equipment. It is therefore necessary to develop a new relationship with the customer. The customer must be able to call a telephone number and, before the call is made, there must be monitoring of the installation, with an alert service in the event of an anomaly. Customers are not solar energy practitioners. They want it to work. It is on this condition that PV will develop.

GreenTech Media of 24 May.

.

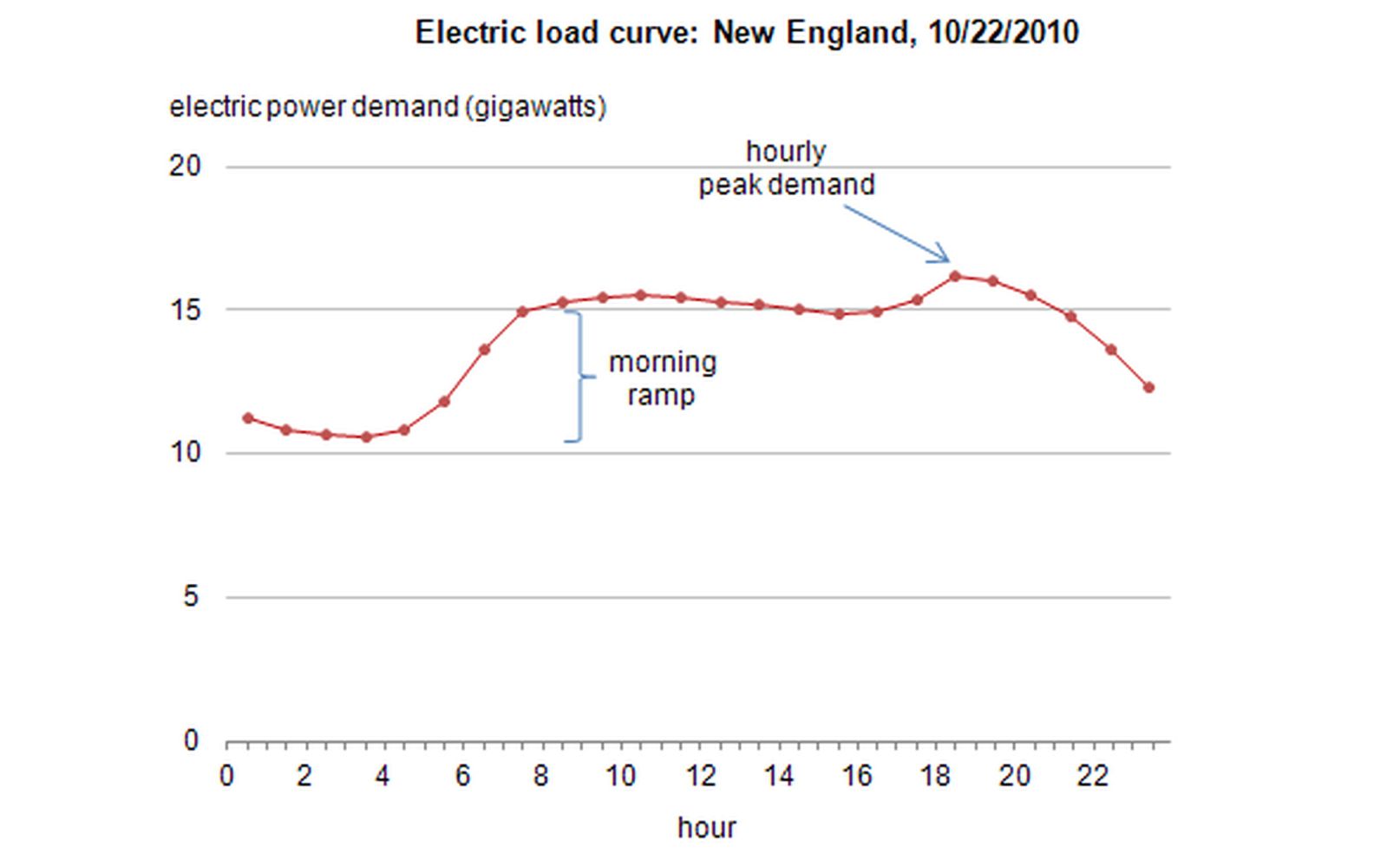

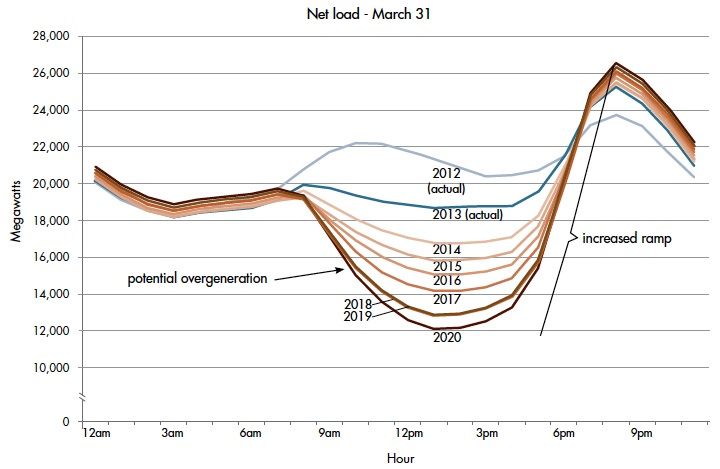

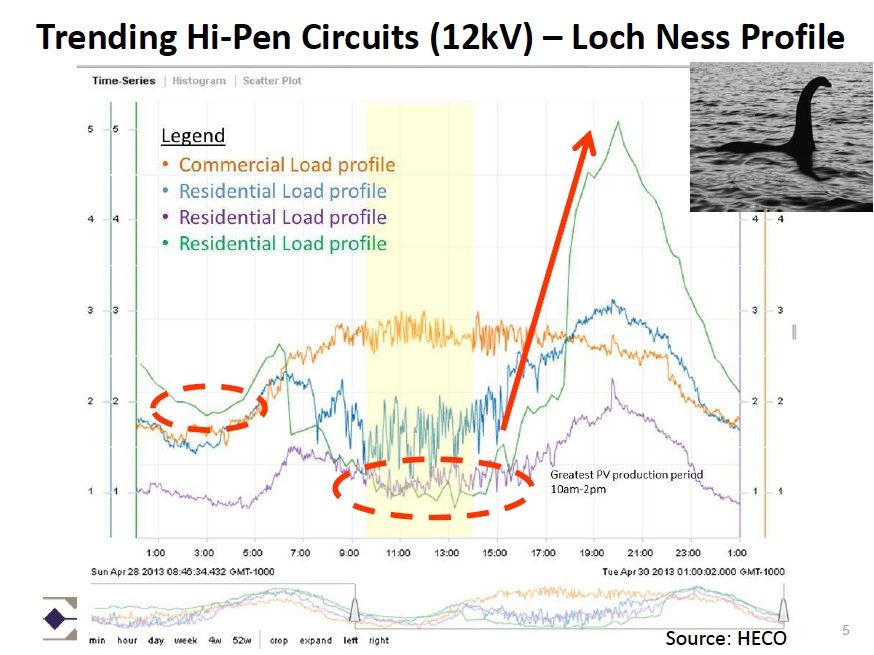

*The duck curve, the Nessie curve, the shark curve

There is the duck curve, the Nessie curve, and now the shark curve in developing countries. The latter differs from the daily evolution of electricity demand that we usually see

The curve of the duck

The demand for energy increases early in the day as people wake up and businesses begin to open. In the late afternoon, demand for electricity peaks, often exacerbated by the use of air conditioning (and previously by millions of inefficient light bulbs).

However, as solar power generation increases, the demand for energy from the grid during the day decreases, resulting in a trough. This trough results in a rapid rise in demand in the early evening as soon as the sun goes down. Increased energy demands are costly and difficult to supply without compromising the reliability of the grid.

The Nessie curve. :

Electricity demand in some Hawaiian islands is characterised in the evening by an even faster rise in demand than in California (partly because residential demand accounts for a larger share of overall energy demand).

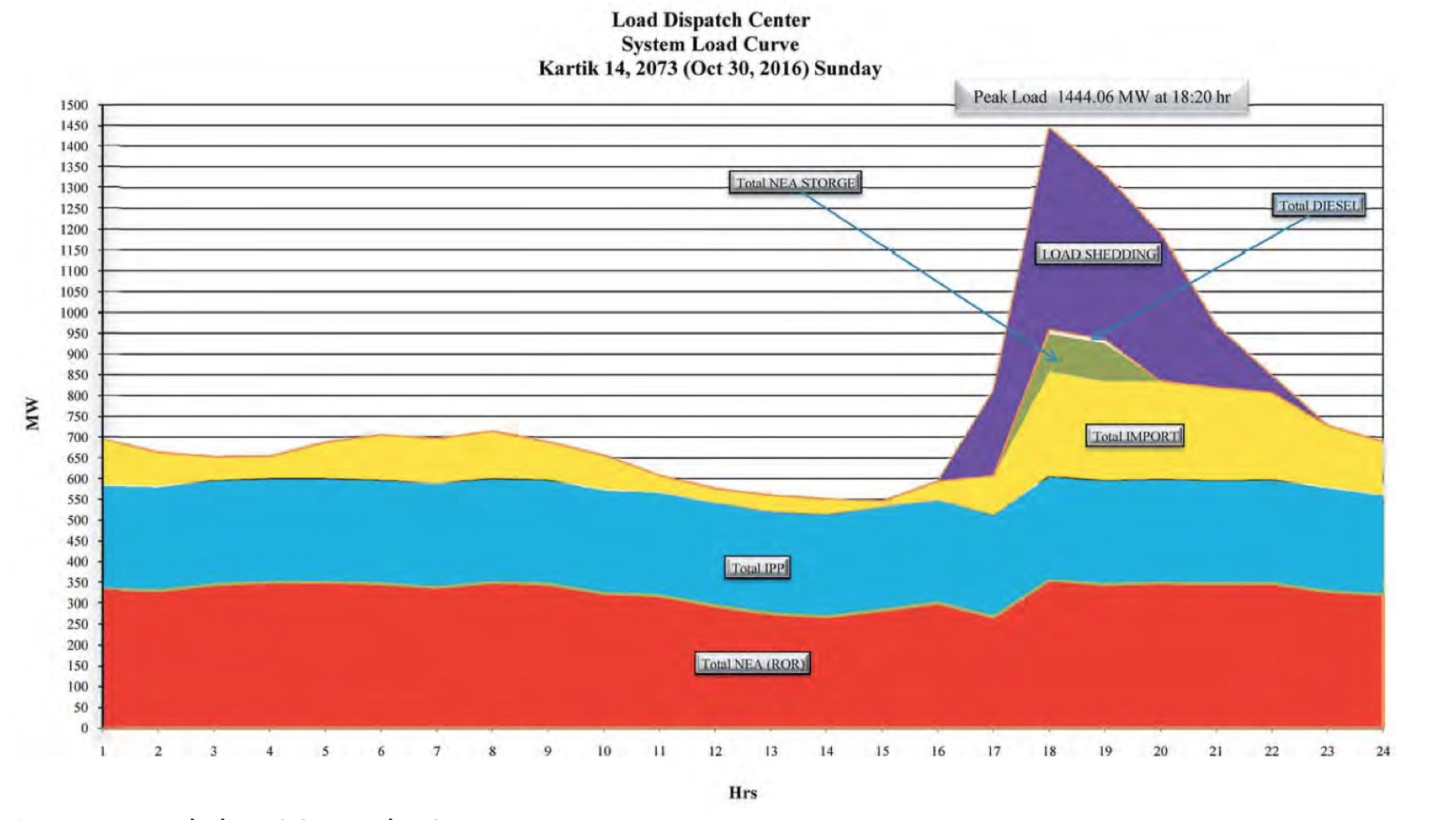

The shark curve :

In emerging countries, the rise in evening consumption is sharper, due to the much lower industrial demand during the day and the much lower number of household appliances. This night-time peak is often invisible because it remains largely unsatisfied, mainly due to a lack of sufficient production resources and poor demand management. This peak is the cause of countless power outages and billions of dollars in economic losses around the world.

Load shedding is greatest in the early evening; however, this unmet demand for electricity is often not represented in daily demand graphs, in part because utilities do not like to talk about the large latent demand for electricity that cannot be met.

The shark curve is a feature of most developing countries in the world, before the spread of more efficient appliances, demand management, demand response, and greater use of batteries.

GreenTech Media of 22 May

.

THE WORLD

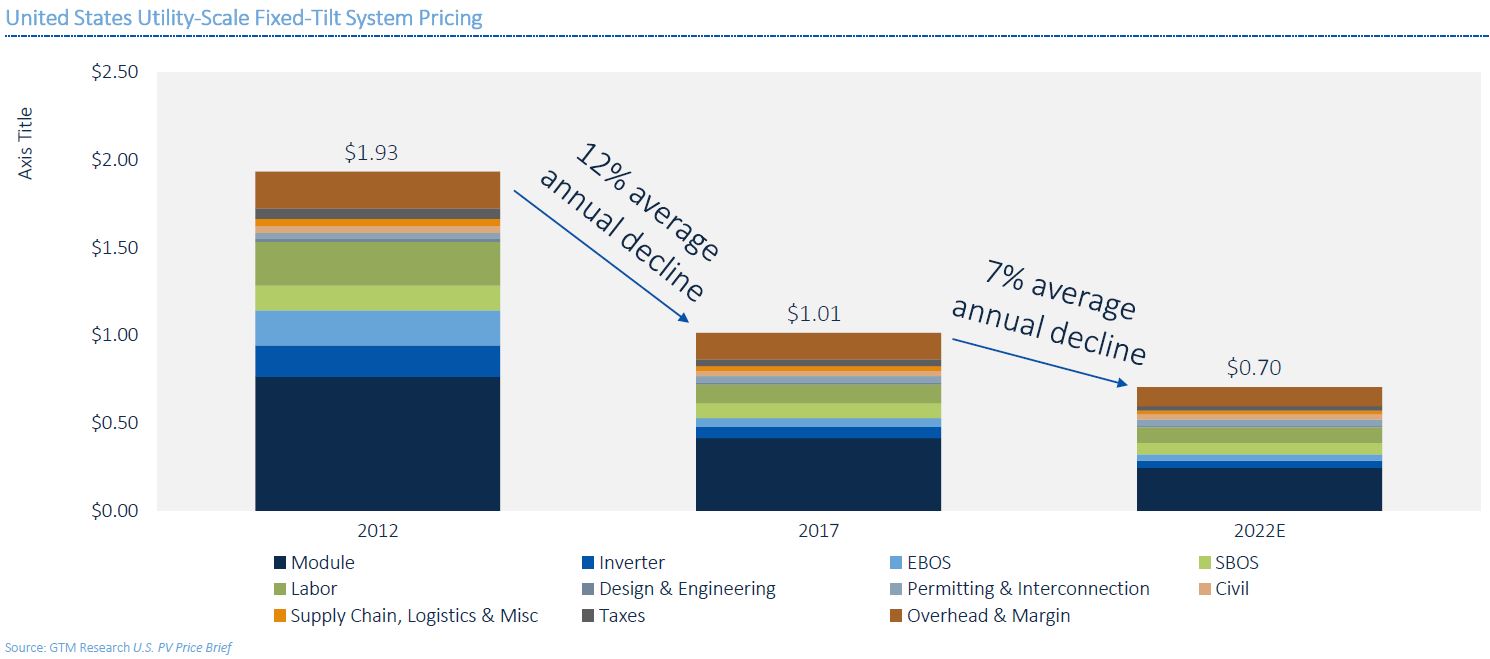

* What might the price of the kWh be in 2022 in the United States?

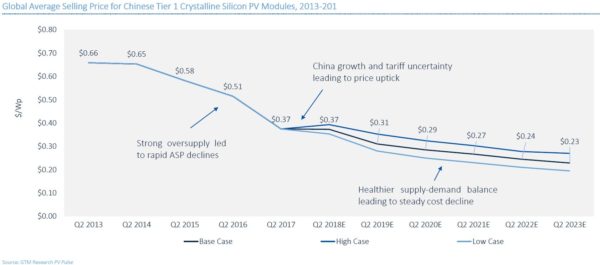

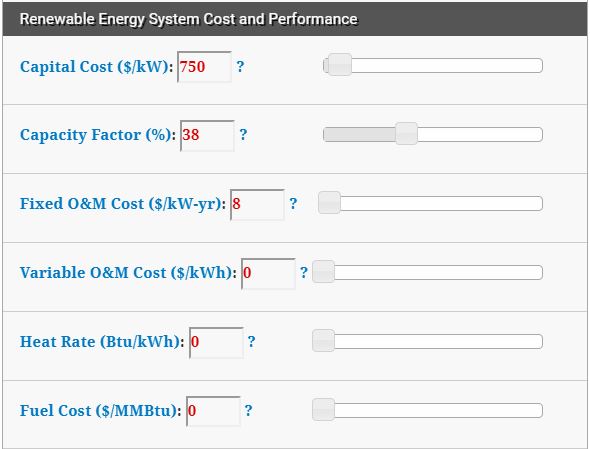

GTM Research estimates that within four years, solar panels will cost only $0.24 per watt, and trackers $0.70 per watt. This opens up new prospects for solar energy. The cost of $1 per watt has been observed in 2016-early 2017 in the United States. These costs could be temporarily increased by the introduction of tariffs.

The date of 2022 is important because the tariffs should disappear by that date and the investment tax credit could be used, if work started in 2021 and the project is completed in 2023.

GTM estimates that the price of panels should drop from $0.37/W currently to $0.24/W in 2022 (-35%). Much of this decline in prices could come solely from the increase in the efficiency of the panels, as they are expected to increase their efficiency to 20%, a 17% to 25% increase from the current 16% to 17%. Other installation costs, such as the price of inverters, which in the near past has decreased by 10% to 20%, would only decrease by 5% to 10%. Other installation costs may not decline in the near future.

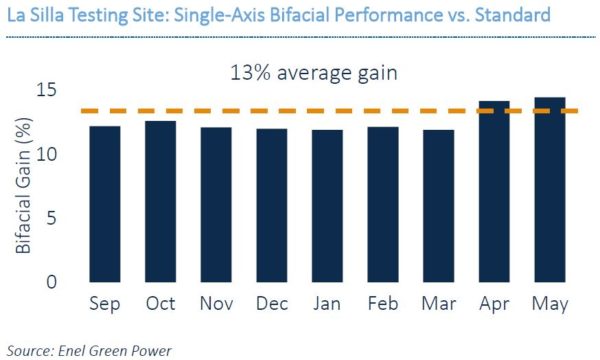

The efficiency gap (+13%) obtained with two-sided panels installed on trackers compared to single-sided panels could increase by 12.5% this year.

It is also noted that high-yield panels on single-sided trackers exceed 30% yield in the south-western United States. If we optimise double-sided panels with single-axis trackers and adapt the terrain to the reflection (albedo), we obtain an efficiency rate of almost 34%, i.e. 20% more on the same m² where a standard solar panel mounted on fixed installations is installed.

As a result, the price of solar electricity falls. GTM estimates that solar and wind power will bring wholesale electricity prices down by 50% by the end of the 2020s.

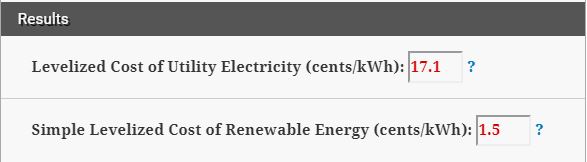

GTM has sought to determine the price trend for a panel lifetime of 25 years (the current manufacturer's guaranteed lifetime): the panel yield offered by trackers is 30.2% plus the 12.5% of the bifacial. In another comparison, the yield is 38%, which is 12% higher because 20% of the bifacial panels increase production by 17-25%. Operating and maintenance costs were also taken into account, estimated at $7.50/kWh (there are current contracts between $8 and $10/W, some of which are influenced by the tax credit and others by the very dense installation area). Solar power plants have no variable O&M costs (PDF).

This results in an average cost of renewable solar energy of 1.5¢/kWh. This price includes the benefits for developers of power plants for electricity companies.

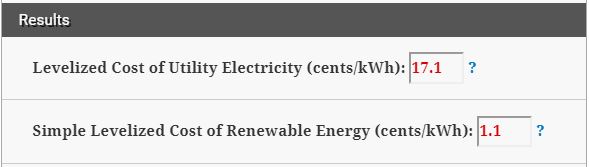

If the developer partners with an investor who benefits from the tax credit and the 25% depreciation, which reduces the investment cost by $0.52 / W, the price of electricity in the United States is 1.1¢ / kWh.

Although this price seems unreal, we are already seeing bids in auctions that are recent: 1.78 ¢ / kWh in Saudi Arabia, 1.97 ¢ / kWh in Mexico using clean energy certificates, 2.15 ¢ / kWh in Chile.

PV Magazine of 25 May.

.

* The EPFL has evaluated the economic impact of renewable energies

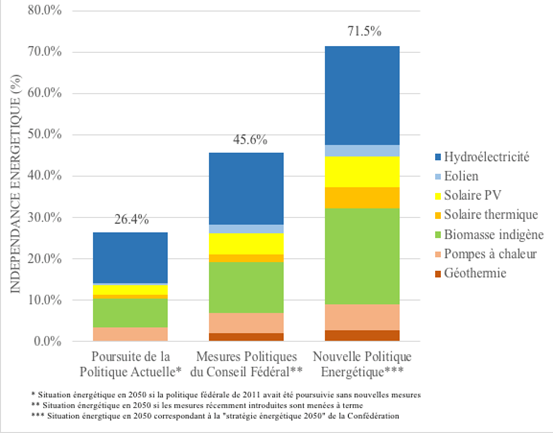

The Ecole Polytechnique de Lausanne has assessed the economic impact of renewable energies and energy efficiency measures in Switzerland up to 2050. If current policy were to continue, Switzerland's energy independence would reach 26%.

The deployment of locally available renewable energies (solar, wind, hydraulic, wood, etc.), combined with the improved performance of vehicles and buildings, is leading to a sharp drop in imports of fossil fuels (fuel oil, petrol, diesel, natural gas). The level of energy independence would thus fall from 26% today to around 72% in 2050.

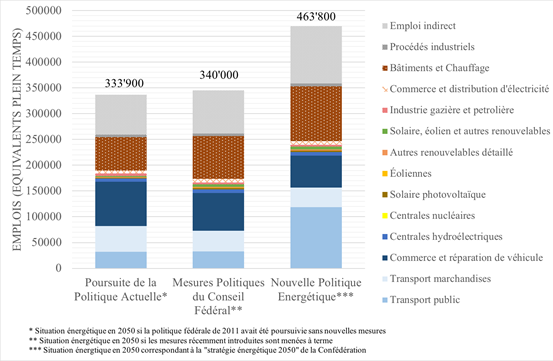

Another consequence is that energy efficiency creates jobs: the number of jobs in energy-related sectors in Switzerland would be about 35% higher in the "new energy policy" scenario than in the other two scenarios. The transport sector benefits from an increase in jobs, thanks to a modal shift in favour of public transport. On the other hand, a decrease in employment in the automotive sector is expected in connection with the deployment of electric vehicles, which require significantly less maintenance than petrol cars.

These results are based on a sectoral approach for activities directly related to energy production and distribution. The estimate of jobs induced by the energy transition is based on an "input-output matrix" approach and takes into account the structural impacts on the economy at current energy prices.

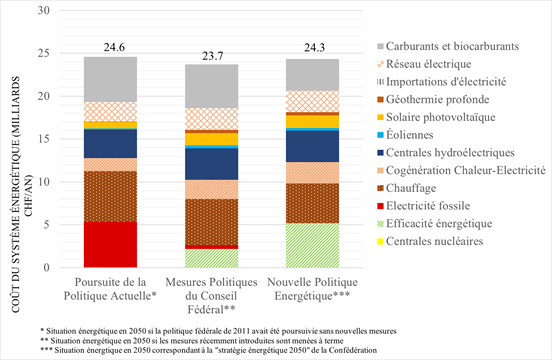

The annual costs of the future energy system are estimated at around CHF 24 billion per year (excluding taxes), irrespective of the scenario chosen. These figures include the cost of infrastructure (networks, production units, etc.), the costs of energy efficiency measures, as well as the cost of imports of fossil fuels (petroleum products, natural gas, electricity).

The differences in costs between the scenarios studied are less than 10% (see Figure 3), which, given the margin of uncertainty, does not make it possible to state that one option is more expensive than the other. However, the scenarios that depend on fossil resources present greater uncertainty about their future cost, as they are subject to oil and gas prices, whose long-term evolution is more difficult to predict than that of technologies.

This result is not really surprising," says Professor François Maréchal of the IPESE laboratory. Renewable energies coupled with energy efficiency certainly generate additional investment costs, but these are offset by a drop in the import bill for fuels and combustibles. In addition, renewable energies (notably photovoltaic solar energy) and energy efficiency solutions (electric vehicles, etc.) will be less and less expensive. »

EPFL of 24 May.

.

* 35 German organisations call for protection against Chinese imports

Nearly 35 German industrialists and research institutes are asking their government for an industrial strategy to maintain a domestic solar industry. They are asking the government to conserve and develop solar technology to contribute to Germany's future energy. Fraunhofer is behind this request.

They ask that a°) the criteria of sustainability of solar equipment and carbon footprint should be better considered in tenders; b°) a national technology exchange platform should be organised; c°) the government should develop an industrial strategy to maintain a domestic solar industry.e which implies a closer collaboration between research institutes, mechanical engineering organisations and PV system manufacturers; c°) that the government should organise the obtaining of patents and strategic know-how; d°) that the government should organise a national platform for technology exchange; d°) that a national platform for technology exchange should be set up. establishing multi-gigawatt production capacities so that European technologies can be established in Europe.

PV Magazine of 25 May

.

THE PRODUCTS

* Inverters that are too easy to hack

The standardisation body TÜV Rheinland has expressed doubts about the cybersecurity measures of inverter manufacturers after hacking commercially available photovoltaic inverters "within minutes". This is all the more alarming as the storage systems communicate with the inverter. By hacking into inverters, cybercriminals could gain access to battery management systems and control them to operate in a dangerous manner. On a larger scale, it may be possible to attack the entire power grid, causing massive power fluctuations.

TÜV Rheinland was able to parameterise commercially available inverters without any problems. This indicates that inverter manufacturers are not addressing cyber security concerns.

Last October, GTM raised cyber security concerns when a Dutch researcher discovered 17 vulnerabilities in solar inverters that hackers could use to remotely monitor the plant's output.

GreenTechMedia of 24 May.

.

* Is it better to choose storage or pumped heat?

There are two techniques for absorbing and regulating renewable energy: electrical storage using pumped heat, and battery storage. These two technologies are very different. Each has its limits.

The cost of storage by lithium battery is decreasing at a rapid rate. The kWh cost $1,200 in 2012 and only $700 in 2016, it will reach $300 in 2030. This price reduction will lead to the development of battery storage.

Heat pump storage is very cheap: the kWh costs about $350.

The investment costs for the two technologies are very different. Heat pump storage costs between $1.5 and $2.5 million per megawatt hour of installed capacity. Grid-wide battery solutions are estimated to cost approximately $3.5 million. In exchange, the energy density is high, with minimal maintenance costs. This alternative is highly dependent on charge and discharge cycles and is considered to be an immature technology.

Heat pump storage has a high reversibility: the machine works both as a motor and as a heat pump, so if it transforms electricity into a temperature difference, it can regenerate most of the electricity. Therefore, this technology has the ability to reduce the mismatch between demand and supply. On the other hand, the drawbacks are the decrease in stored energy over time due to heat losses.

PV Magazine of 24 May

.

THE COMPANIES

* LONGi buys 55,000 tons of polysilicon!

China's Tongwei will deliver 55,000 tonnes of polycrystalline silicon to LONGi by 2020. Tongwei estimates that this contract will provide it with a net profit of RMB 132m ($20.6m) in 2018, RMB 694m ($108m) in 2019 and RMB 992m ($155m) in 2020.

This follows LONGi's intention to triple its monosilicon wafer production in 2020. LONGi has signed a supply contract with Daqo New Energy for 39,600 tons of silicon wafers for a total amount of $787 million.

LONGi's expansion policy should enable it to become the world's leading manufacturer of monosilicon wafers in 2018 with 28 GW, whereas GCL Poly is only aiming for a capacity of 23 GW of monocrystalline wafers.

PV Magazine of 24 May.

.

* Sunpower short of cash

Sunpower obtained a $300 million loan from Crédit Agricole to repay a loan maturing on June 1. The company is in financial difficulty as its cash position decreased by $200 million in the first quarter of 2018 alone. At that date, it only held $261 million in cash and cash equivalents. Official documents indicate that the company is not expected to have sufficient cash to repay a loan maturing in 2018 (2/3 of which is owed to Total, its parent company) and to pay operating expenses.

It is difficult to determine the company's medium-term financing plan: Sunpower is expected to obtain $380 million from the sale of 8point3 and $200 million from the sale of leases. However, the price that will be paid for the acquisition of SolarWorld Americas is not known.

PV Magazine, May 25

.

le Fil de l'Actu n°235 du 28 mai