L R AS Published on Monday 1 May 2023 - n° 443 - Categories:company results

JinkoSolar in Q1: strong year-on-year growth and sale of N product

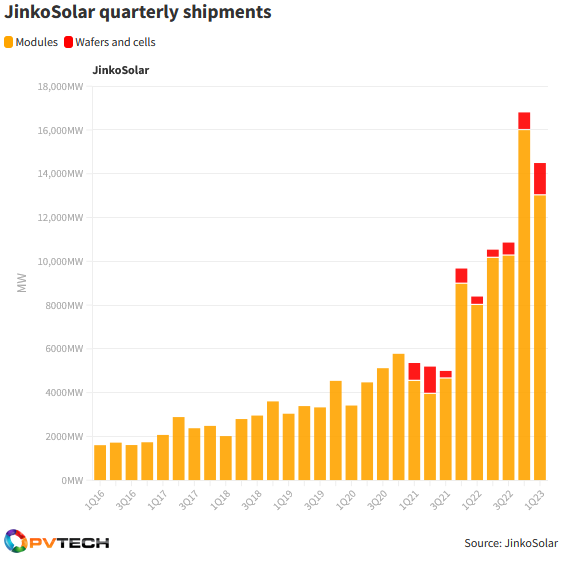

InQ1, JinkoSolar posted sales of RMB 23.3 billion (down 22% on Q4 2022, and up by

58% inQ1 2022). Shipments increased by 60% over the start of 2022. Gross margin in Q1 was 17.3%, compared with 15.1% in Q1 2022. Jinko Solar's profit was RMB789 million ($115 million), up 19% from RMB665 million in Q4 2022.

The rate of N-type products shipped was close to 50% of total shipments.

Growth in photovoltaic demand in the first quarter remained strong despite some seasonal factors. The Chinese market benefited from lower PV prices and delays in PV projects from 2022.

New solar PV installations reached 33.7 GW-ac, an increase of 155% year-on-year. Total overseas shipments of panels and cells reached US$13.1 billion in the first quarter of 2023, an increase of 15% year-on-year.

Panel shipments expected to be between 60 GW and 70 GW in 2023

By the end of 2023, annual production capacity is expected to reach 75 GW of wafers, 75 GW of cells and 90 GW of panels

PV Tech of 28 April 2023

Editor's note: As the trend in shipments and sales is comparable over twelve months, and the gross margin has increased by two points, this means that the company has not had to lower its prices in order to sell. On the contrary, it has raised them by selling N-type products.

In 2023, JinkoSolar will benefit from lower prices for upstream supplies, which will offset the likely fall in prices for N-type panels due to increased competition.