L R AS Published on Tuesday 8 March 2022 - n° 396 - Categories:various sectors

What can a buyer do when there's a shortage of panels?

Best practice according to PVEL.

When demand for panels is high and supply is limited, buyers feel they are at the mercy of their suppliers. They often accept what is available instead of the equipment they want.

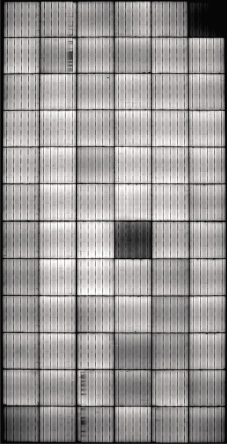

In the example on the left, the image shows numerous inactive cells. The buyer was able to obtain additional spare parts from the supplier at no extra cost.

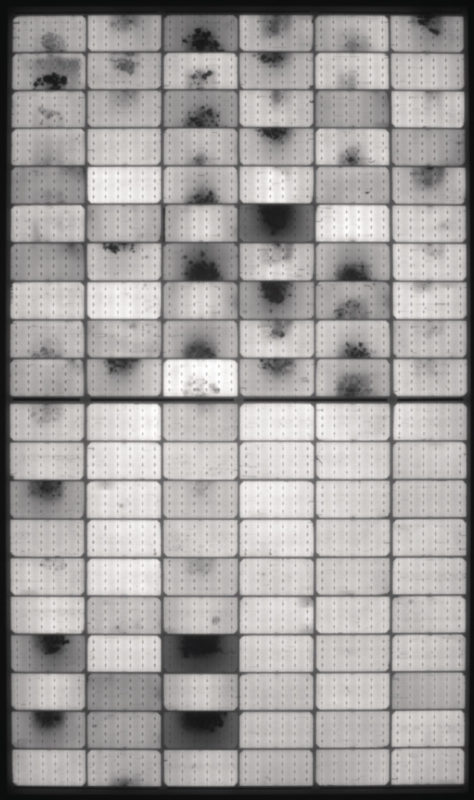

The image on the right was taken during a batch test. It revealed major problems with some cells, probably caused by poor quality wafers made from silicon with a high concentration of impurities, and errors in the processing of the cells. The buyer was able to negotiate revised warranty terms.

PVEL expects supply chain difficulties to continue into 2022 for three main reasons:

Raw materials:

Raw material shortages and cost increases are reducing product availability and increasing prices. Prices are expected to remain above 2019-2020 levels. High silver prices mean that manufacturers will look to use less silver for cell solder plating than is needed for reliability. A limited supply of cost-effective silver could also hold back production of high-efficiency cell architectures such as TOPCon and heterojunctions.

Trade policy:

Forced labour issues and import tariffs will dampen availability in the US. US buyers will look for non-Chinese suppliers. Manufacturers will go to India, Vietnam and Cambodia, perhaps with new factories if Congress passes the climate legislation currently under consideration. However, products are likely to have quality problems as production increases

Shipping rates:

Ports remain congested. New Covid variants have tempered expectations of a significant fall in rates in the short term.

Buyers will begin to bear the cost of shipping when manufacturers refuse carriage-paid (DDP) contracts that guarantee all-inclusive prices for panels delivered to the project site. In 2022, buyers of large-scale photovoltaic panels are increasing their purchases from so-called "second-tier" manufacturers, sourcing from new factories and accepting bills of materials containing unknown components. These are compromises on quality for the sake of project execution.

Good news

Panel buyers can always take steps to preserve quality. Instead of waiting for panel problems to become revenue-cutting operational issues, they can act to prevent and isolate quality issues while the cost of resolving them is relatively low. Provided they carry out five quality checks.

a°) PVEL carries out product qualification programmes (PQP). Many lesser-known manufacturers produce high-quality PV panels, but not all. Buyers should contractually require that the factory and nomenclature of the PV panels match the products tested in PVEL's PQP.

b°) Carry out production monitoring, and ask a third party to supervise the production of their projects. When there is an on-site controller, quality problems are less likely to occur.

c°) Independently testing PV panels in the field when they are removed from the containers helps buyers determine if damage has occurred during manufacturing or shipping.

d°) Test panels in the laboratory on delivery: batch testing, or laboratory testing of a random sample of panels for a project, allows buyers to retrospectively assess product quality before problems occur in the field.

e°) Demand contractual remedies: limited product availability does not prevent buyers from demanding commercial remedies for quality problems in supply agreements. These solutions can include discounts, the supply of additional spare parts, extended warranty conditions and even the replacement of products on the basis of test results.

Today, buyers have less power than sellers, but this dynamic will soon be reversed. There are always advantages to monitoring PV panels. It is particularly important when supply constraints make certain risks unavoidable. By monitoring, developers can limit bad products that will reduce future revenues.

https://www.pv-magazine.com/2022/02/26/the-weekend-read-buyer-power-in-a-tight-pv-module-market/

PV Magazine 26 February 2022