L R AS Published on Sunday 6 February 2022 - n° 392 - Categories:forecasts;, evolution-stat

Global photovoltaics in 2021 and 2022 in price and volume

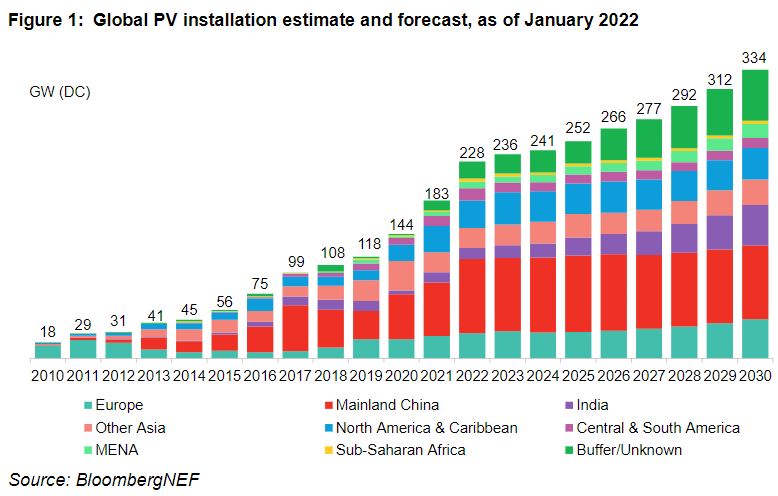

BloombergNEF estimates that global installations in 2021 have reached 183 GW (+27% of the 144 GW installed in 2020). It cites silicon shortages as the cause of limited growth

in the past year. The consultancy sees the volume of installations in 2022 at between 204 and 252 GW (+11% to +38%), with an average level of 228 GW, an increase of 25% in the year. Silicon production will increase by 39% this year. This would be sufficient to achieve a production of 300 GW. This would allow panels to fall from 27.8 US cents per watt in 2021, to 25 cents in the first half of 2022, and then to 24 or 23 cents per watt in the second half of 2022

The focus on residential and commercial rooftop installations in China could push Chinese demand to between 81 and 92 GW

The other source of demand growth worldwide is from power purchase agreements (PPAs) in Northern and Southern Europe: in the Iberian market, for example, BNEF recorded PPAs totalling 1.4 GW last year, or 72% of all agreements signed in Europe. Across Europe, BNEF estimates that this segment will reach 13.1 GW by 2025.

The firm estimates that production will start to rise outside of China, with India the most ambitious producer

Photon of1 February 2022

Editor's note: If there was a 27% increase in panel purchases in 2021, why was there talk of a silicon shortage last year, since it is in line with other years and even 2022?

BloombergNEF's analysis is too "Western" and too "economic". It looks at production volumes as having an effect on the market. This ignores the fact that the five or six silicon producers account for almost all of China's silicon production, and indeed the world's, as China has protected itself from silicon imports through tariffs. Sheltered by its borders, and given that panel production is concentrated in China, that country sets the prices it wants. Buyers only have to go through the manufacturers' wishes

It is not certain that the price of silicon and panels will fall in 2022