L R AS Published on Monday 11 January 2021 - n° 345 - Categories:silicon mono/multi

The four trends for silicon in 2021: its price should remain high

In 2020, silicon manufacturers have succeeded in increasing productivity and further reducing the cost of PV by optimising management and technology. Increasing demand

should be satisfied by the manufacturers. Those located in areas where electricity prices are low will be favoured. We will see the development of granular silicon and type N

The price of mono-silicon will remain above 80 RMB/kg.

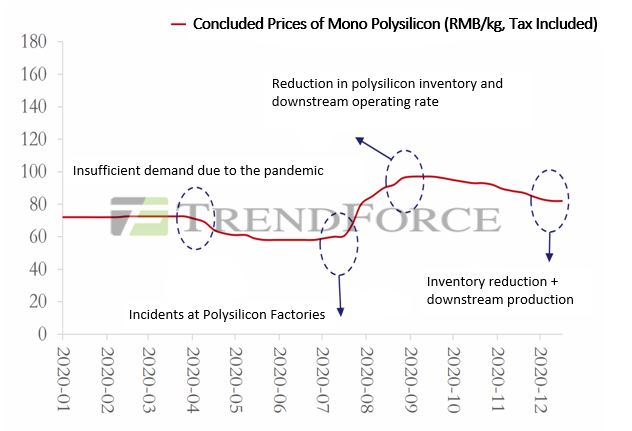

The incidents of the mid-2020s exacerbated prices. The rise in production capacity in the fourth quarter caused prices to fall slightly until mid-December, when strong demand boosted them.

Production costs are different depending on whether silicon is produced in the west (Xinjiang, Inner Mongolia and Sichuan), or in regions where electricity prices are low (Yunnan and Qinghai). Manufacturers operating in high energy-price regions or abroad have higher costs and lower profits.

The delay in the commissioning of silicon and wafer production facilities has led to an anticipation of higher prices. Price fluctuations (between 80 and 90 RMB/kg) will occur in 2021 depending on off-peak periods and high demand.

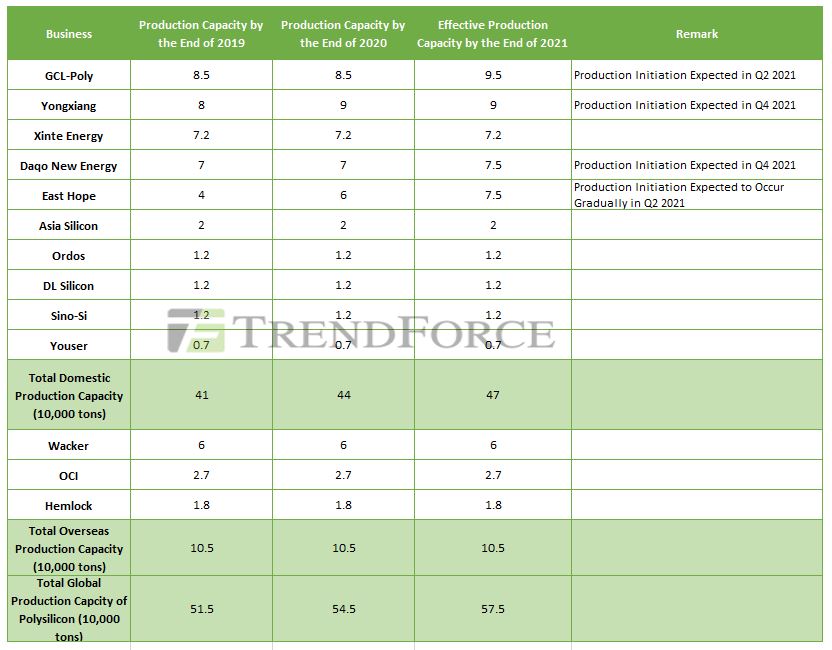

World silicon production capacity is 575,000 tonnes.

The final demand for panels should be 145 to 160 GW in 2021. The demand for wafers is increasing. The main producers are adapting in 2021: they are increasing their production capacities of mono-Si wafers. The evolution of prices will depend on demand, but also on silicon price increases.

The pandemic has slowed down the increase in silicon production capacity. A new capacity of 35,000 tonnes by East Hope is starting to produce. Production of GCL granular silicon is increasing. Tongwei will begin production of 40,000 tonnes in the fourth quarter of 2021.

Production is being concentrated. The top five silicon producers will supply 70.8% of the world's silicon in 2021. Their weight enables them to hold prices in 2021. The buyers have entered into long-term purchase agreements which represent 80% of the production capacity of the main silicon producers. This situation stems from the wafer producers' desire to have raw material at their disposal.

The market will pay more attention to granular and N

The granular silicon process , an alternative to the Siemens system, involves fewer processing steps and therefore saves time. As a result, the granular silicon manufacturing process could be the key to increasing the purity of polysilicon while reducing its cost. Its manufacturing process can be further improved. Currently, the total operational production capacity of granular silicon in China is less than 30,000 tonnes. The process technology has not yet reached the mass production stage. Granular silicon has great long-term potential.

Demand for N-type silicon will increase as downstream manufacturers move their N-type offerings to the verification and mass production stages. Chinese polysilicon suppliers are launching projects to increase N-type polysilicon production capacity. Production could begin in 2022.

Hence the four main trends 2021

1°) A slowdown in the growth of supply. The increases in capacity will become apparent at the end of the year. Buyers have placed long-term orders for 80% of the production capacity of the major silicon manufacturers.

2°) Demand for panels is expected to be between 145 and 160 GW in 2021. New wafer production capacity will require more silicon supply.

3°) The evolution of the prices of the different types of polysilicon will be differentiated in 2021. It will depend on the evolution of demand and supply, while remaining within a range of 80 to 90 RMB per kg.

4°) Granular silicon is starting to enter mass production. Customers will need time to check the quality of the production resulting from this technology.

https://www.energytrend.com/research/20210107-20605.html

EnergyTrend of 7 January 2021