L R AS Published on Saturday 2 February 2019 - n° 262 - Categories:IBC. heterojunction

Which of the heterojunction or the TOPCon will prevail in 2019?

So far, the manufacturers of N-type cells (SunPower, Panasonic, LG) have taken the leading positions in interdigitated back contacts (IBC), heterojunction (HJT) and tunnel oxidation passivated contacts (TOPCon). But Chinese manufacturers are coming in with low costs and high efficiency.

They have been stimulated

by the "Best" programmes whose volume has increased over the years: the 1 GW programme to be installed in 2015 has stimulated single crystal, the 5.5 GW in 2016 has brought PERC to the forefront, the 8 GW in 2017 has pushed panels to 310 W / 315 W, with a conversion rate of 23%. These programmes have stimulated technology and the localization of material and equipment supply.

Production capacity in PERC technology jumped from 34 GW at the end of 2017 to 63 GW at the end of 2018, and probably 93 GW at the end of 2019. This technology is gradually being replaced by selective emitter PERC (SE-PERC) which has a rapidly growing market share.

The type n Products using this technology have high production costs, which prevent manufacturers from being competitive in the market, resulting in a market share of only 4-6%. At the same time, the yield of mono-PERC reached 21.5 % / 21.8 %, which slowed down the switch to type N.

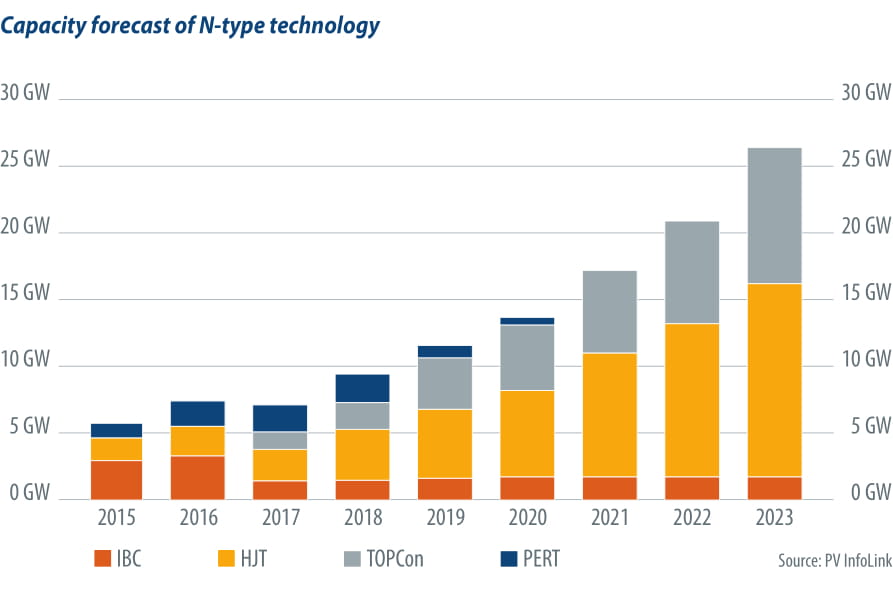

Among the N-type technologies, there are four main branches: PERT, heterojunction (HJT), IBC and TOPCon by PERT.

The effectiveness of the front face of n-PERT is almost identical to that of PERC. In addition, bifacial PERC is also available, which has left n-PERT, with higher costs, in a more difficult position in terms of profitability.

IBC requires many production processes. The difficulties and costs are therefore much higher than with other technologies.

As a result, Heterojunction (HJT) and TOPCon are expected to be the two main N-type technologies in the next two years.

Mass production efficiency is very close between TOPCon and HJT technologies, reaching 22.5 - 23% for China, and 23 - 24% for non-Chinese manufacturers. However, there is compatibility of N-type TOPCon cells with significant production capacity. Manufacturers can adopt it by modifying three to five production processes. Jolywood is currently the only manufacturer that has successfully produced TOPCon cells in China in quantity. The technology is therefore not as mature as that of HJT. It still takes some time for TOPCon to emerge.

The heterojunction is almost entirely incompatible with existing production lines, but has only four to five production processes. Its manufacturing process is not as complicated as TOPCon. In addition, more than eight manufacturers worldwide can already mass produce HJT panels. Its potential for future growth in efficiency is also expected to be higher. As a result, many manufacturers will continue to switch to HJT technology.

The difficulty for the producer of N-type panels is to reduce costs in order to be competitive.

2019 will be a year in which TOPCon and HJT Type N will compete. The maturity of the equipment and the cost reduction potential of the two technologies will probably become clearer during this year. It is likely that HJT will be adopted by new entrants or by manufacturers considering capacity expansion, while existing LRPT manufacturers and vertically integrated manufacturers will likely prefer to adopt TOPCon.

https://www.pv-magazine.com/2019/01/30/outlook-for-n-type/

PV Magazine of 30 January

Editor's note The multiplicity of technological choices shows how difficult it can be for a manufacturer to stay in the race by remaining competitive: a bad choice and the company suffers either higher costs than its colleagues, a lower rate of return, or even disaffection from customers because it offers a product that is not popular. To avoid making too many mistakes, manufacturers have an interest in copying each other, so that if a choice turns out to be wrong, it is the whole profession that suffers the consequences, and not just one producer.