L R AS Published on Sunday 4 November 2018 - n° 253 - Categories:company results

SunPower faces liquidity crisis

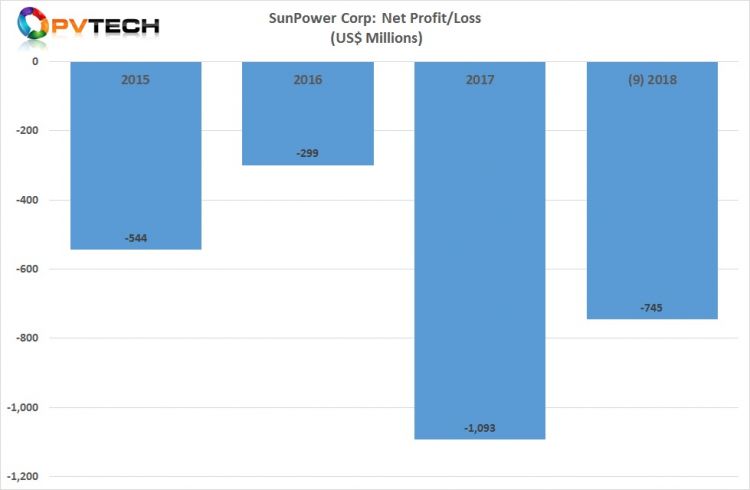

SunPower's cash crisis will require the company to sell additional assets and borrow to finance its operations in 2019. This is what management announced in the third quarter financial statements after a net loss of

745 million was incurred in the first nine months of the year.

The company has defined its structure: upstream includes research, production and "oddly" global sales and marketing; downstream includes North American residential and commercial activities. Solar power plants are not yet included in this breakdown.

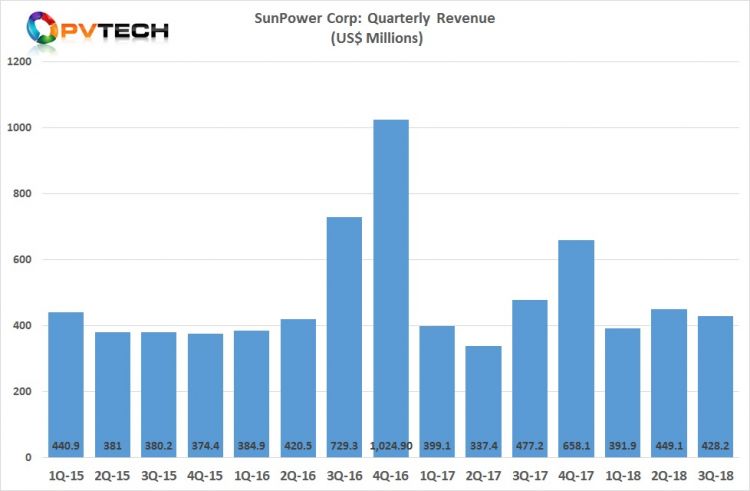

Third quarter sales ($428 million) are split between solar power plants ($104 million compared to $109 million in the second quarter), with a negative gross margin of 2% of sales due to delays in various international projects; the commercial sector ($145 million compared to $133 million in the second quarter) with a gross margin that became negative at 3.6%. The residential sector is the only sector that is profitable with sales of $195 million and a gross margin of 14.4% ($205 million and a gross margin of 21.8% in the second quarter). The group's gross margin for the quarter was 2.3%. Deliveries amounted to 346 MW (385 MW in the second quarter).

This poor performance was exacerbated by customs duties on panel imports.

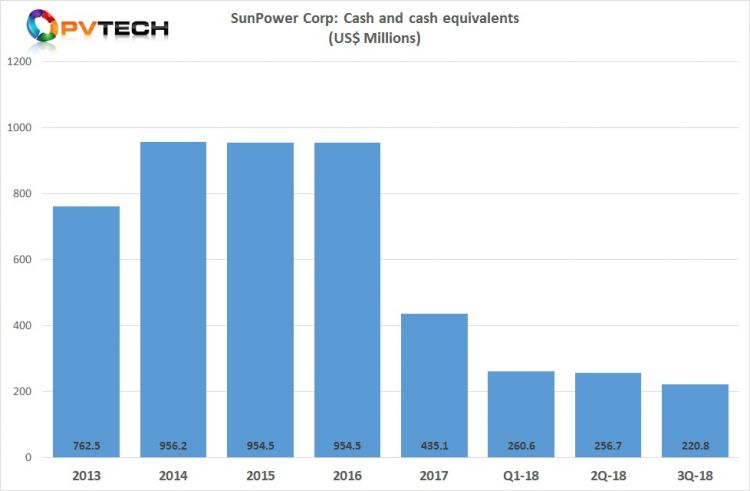

Cash and cash equivalents continued to decline to $221 million.

For the full year, the company is revising its sales forecast downwards to $1.7 - $1.8 billion (from $1.6 - $2.0 billion), with deliveries of 1.4 - 1.5 GW (from 1.5 - 1.9 GW). Losses for the year are expected to exceed $880 million (versus $1.01 billion in 2017).

PV Tech of October 31

+

In the third quarter, Sunpower generated revenues of $428 million (-12% for the third quarter 2017). EBITDA returned to $6.7 million compared to 67 MW a year ago! Net loss doubled from $46 million to $90 million.

Despite these poor figures, the CEO believes he "has implemented strategic initiatives" and "positioned the company for sustainable profitability.By the first quarter of 2019, the company's objective is to finalize the strategic decision to segment its upstream and downstream activities in order to focus downstream efforts on the "power generation" business.By the first quarter of 2019, the company aims to finalise the strategic decision to segment its upstream and downstream activities in order to focus downstream efforts on the business to enhance its role as a residential installer in the United States, while increasing worldwide sales of the upstream solar panel business by the Sunpower Solutions division.

For the fourth quarter, the company expects revenues of $460 to $510 million due to the deployment of 425 to 475 MW, and a net loss of $135 to $160 million.

Photon of October 31