L R AS Published on Saturday 19 November 2016 - n° 169 - Categories:the manufacturers, thin layers

First Solar moves to much larger panels and reorganises its commercial offer

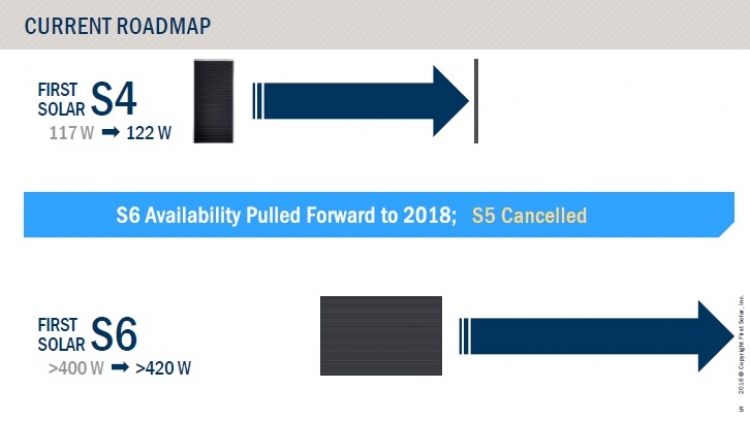

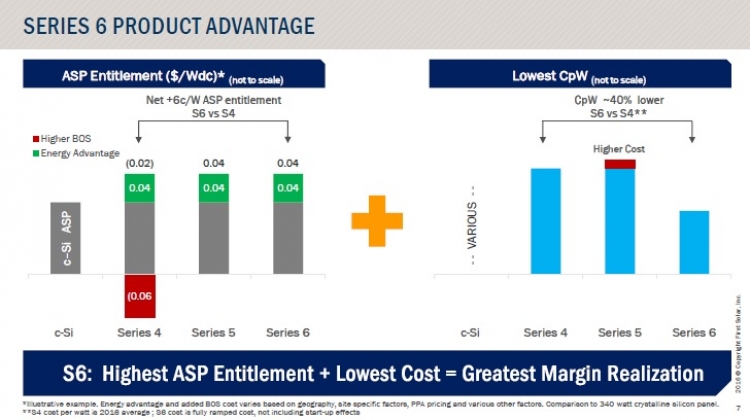

The drop in panel prices, which reached 25% in the third quarter of 2016 alone, prompted First Solar to jump from Series 4 to Series 6. Series 6 panels are large, which not only reduces installation costs, but also manufacturing costs:

The number of employees will decrease by 27%, or 1,600 people, and the Ohio plant will be closed. The factory in Vietnam, which had never been put into production, will be used for the production of series 6. Investments will be between $525 million and $625 million, more than the 2016 amount.

Production capacity for Series 6 will reach 3 GW in 2019, indicating that Series 4 will no longer be produced by that date.

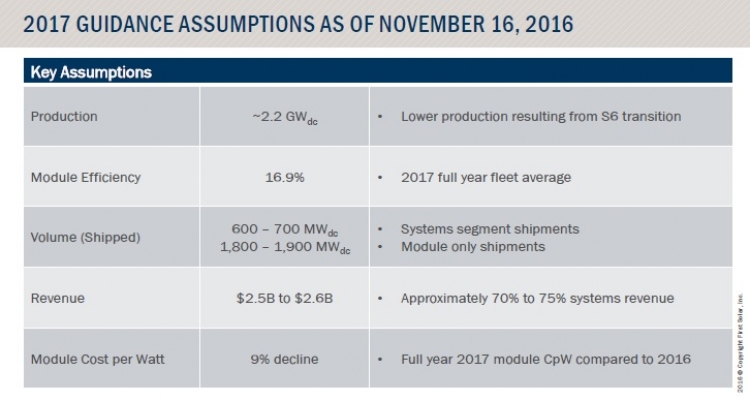

The group anticipates restructuring and asset impairment charges (equipment for Series 5) of $500 million to $700 million, of which $70 million to $100 million will impact cash. The bulk of these charges will be recorded over 2016. For 2017, revenues are expected to reach $2.5 to $2.6 billion, of which 70% / 75% will come from the sale of solar power plants and the remainder from the sale of panels to third parties. Panel production is expected to be around 2.2 GW compared to 2.8 GW to 2.9 GW in 2016. This decrease is due to the shutdown of production lines for Series 4 and the delay in the installation of machines for Series 6.

R&D spending will fall to $95 million, the lowest level since 2010.

| Turnover 3rd quarter 2016 | change / 2015 | gross margin 2016 | gross margin 2015 | operating result 2016 | operating margin 2016 | operating margin 2015 | net income 2016 | net margin 2016 | net margin 2015 |

| 688 M$ | -46% | 27,1% | 38,1% | 89 M$ | 12,9% | 31,3% | 154 M$ | 22,4% | 27,5% |

PV Tech of 16 November 2016