L R AS Published on Tuesday 31 May 2022 - n° 406 - Categories:the manufacturers, China

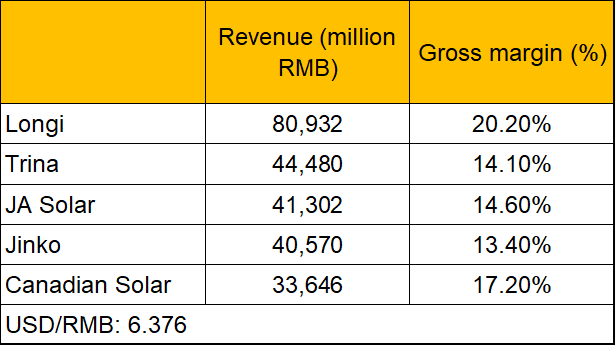

The five main panel suppliers in 2021: economic and financial analysis

Data compiled by InfoLink shows that five large vertically integrated companies shipped 121 GW of panels last year,

thus securing 69% of the market. This reflects greater concentration, as a year earlier (2020), the top five panel suppliers had shipped 82 GW, representing 59% market share.

Gross margin and other indicators have fallen from 2020 levels. This indicates that price increases and disproportionate production capacity in the supply chain have affected companies' operating performance in 2021.

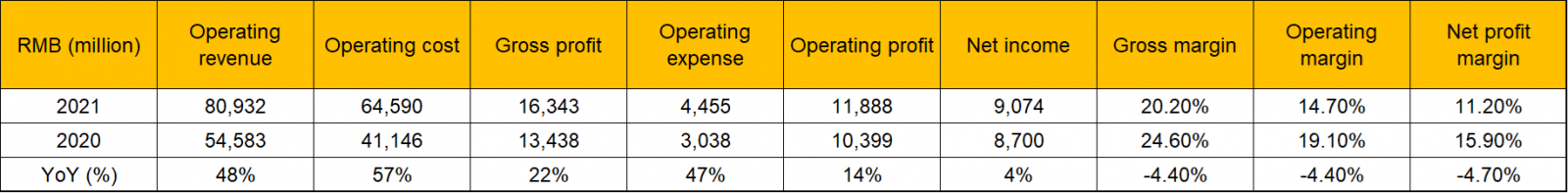

LONGi

In 2021, Longi shipped 38.5 GW of panels, with 37.2 GW of sales volume, a 55% year-on-year increase, and 70 GW of wafer shipments, 33.9 GW of sales volume, a 7% year-on-year increase.

Longi recorded sales of RMB 80.9 billion in 2021, up 48% from RMB 54.6 billion in 2020. The overall gross margin was 20.2%, down 4.4% on 2020, but still higher than other companies, thanks to wafer production, which has a higher margin. The cell and panel segments contributed RMB 58.5 billion, together accounting for 72% of total revenue, with 17.1% of gross margin. The panel segment grew by 61% year-on-year, but the gross margin fell from 20.5% to 17.1% due to production costs. The wafer segment generated revenues of 17 billion euros, or 21% of the total. Despite its strong negotiating position with downstream players, the gross margin on wafers slipped from 30.3% to 27.5% against a backdrop of rapidly rising silicon prices.

Longi plans to have wafer, cell and panel production capacity of 150 GW, 60 GW and 85 GW by the end of 2022. Annual wafer and panel delivery volumes are estimated at 90-100 GW and 50-60 GW, respectively.

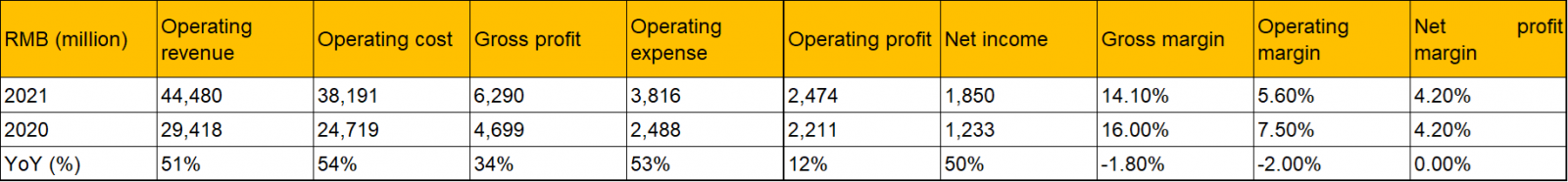

TRINA SOLAR

Trina shipped 24.8 GW of panels in 2021, an increase of 58.7% year-on-year, with a sales volume of 21.1 GW. The volume of shipments of panels assembled with 210 mm cells reached 16 GW.

In 2021, Trina recorded revenues of RMB 44.5 billion, an increase of 51.2% year-on-year. Gross margin fell from 16.4% last year to 13.8%. The panel business contributed the most, accounting for 77% of total revenue. Subject to higher production costs, the gross margin for panels fell from 14.9% in 2020 to 12.4% in 2021.

By the end of 2022, Trina expects cell production capacity of 50 GW, panel production capacity of 65 GW and panel shipments of 43 GW.

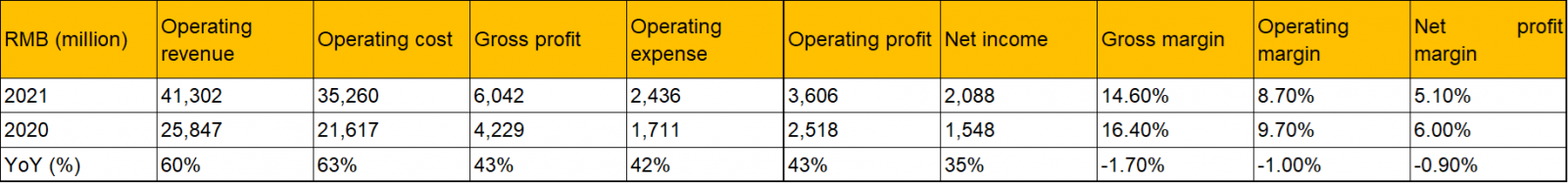

JA SOLAR

JA Solar shipped 25.5 GW of cells and panels, including 24.5 GW of panels, with 24.1 GW of sales volume, an increase of 63% year-on-year.

JA Solar recorded sales of RMB41.3 billion in 2021, an increase of 60% year-on-year. Sales of panels accounted for 96% of total sales. With production costs rising faster than revenues, the gross margin on panels fell from 16.1% to 14.1%.

JA Solar aims to increase panel production capacity from 40 GW to over 50 GW by the end of the year, while maintaining wafer and cell production at 80% of panel capacity. Annual shipments are estimated at 35-40 GW.

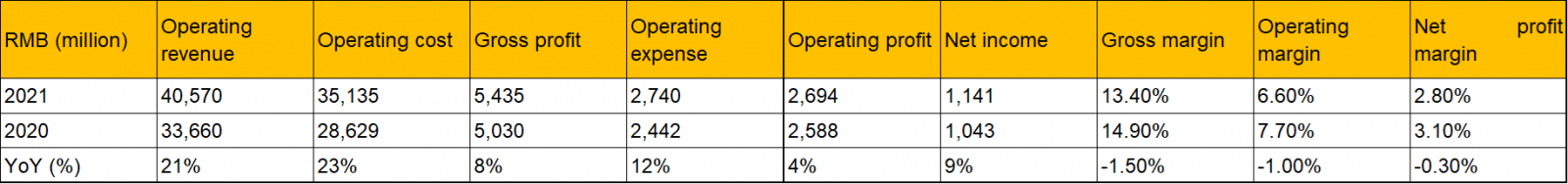

JINKOSOLAR

Jinko sold 22.2 GW, 0.9 GW and 2.2 GW of panels, cells and wafers in 2021, an increase of 18.5%, 27.9% and 29.9% year-on-year, respectively.

In 2021, Jinko's revenue reached RMB 40.6 billion, up 20% year-on-year. The panel business remained the most profitable, accounting for 93% of total revenue. Gross margins for panels, cells and wafers were 13.4%, 2.6% and 20.8% respectively. Compared to 15.1%, 3.0% and 10.7% in the same period last year, the gross margin for wafers increased, while that for cells and panels decreased.

Jinko plans to increase wafer, cell and panel production capacity to 50 GW, 40 GW and 60 GW, respectively, by the end of 2022. The company is aiming for a shipment target of 35-40 GW.

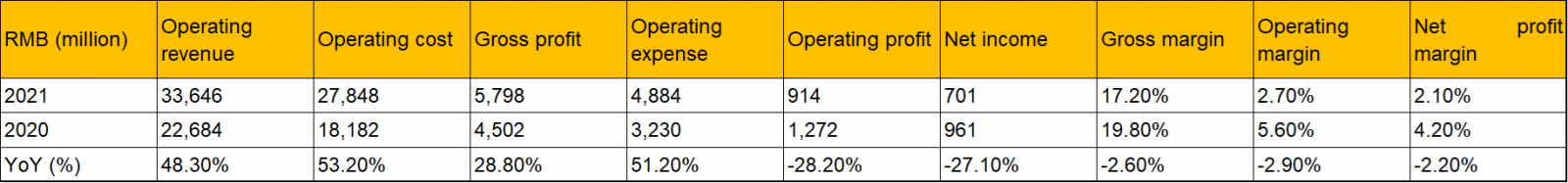

CANADIAN SOLAR

Canadian Solar shipped 14.5 GW of panels in 2021, an increase of 28.3% year-on-year, including 870 MW of in-house capacity.

Annual sales amounted to 33.6 billion euros, representing year-on-year growth of 48.3%. Gross margin rose from 19.8% in 2020 to 17.2% in 2021. The panels business accounted for 63% of total revenue. CSI Solar, with its activities in photovoltaics, ESS and with China Energy, saw its gross margin fall to 15.6% in 2021 from 19.6% in 2020.

For 2022, Canadian Solar forecasts ingot production capacity of 10.4 GW, wafer slicing capacity of 14.5 GW, cell production capacity of 14.5 GW and panel production capacity of 32 GW, with an annual panel shipment target of 20-22 GW.

Supply chain comparisons

The major manufacturers have achieved significantly higher revenues in 2021 and have gained more market share. However, gross margin, operating margin and other indicators appear to be down on 2020 levels. The main reasons for this are price increases resulting from disproportionate production capacity in the supply chain and the energy intensity controls imposed by China in 2021, which have caused operating costs to rise faster than revenues.

The financial statements reveal disparities between their operating performances. Silicon price rises never stopped in 2021, due to the one-year lag in supply. It jumped by almost 200%, leading to a significant fall in gross margin.

The wafer sector, which has better bargaining power than the downstream sector, increased its prices by more than 50% in response to rising silicon costs. The overall gross margin for wafers was between 20% and 30%.

The cell and panel sectors were the hardest hit by supply chain price increases in 2021. The rapid and large-scale expansion of cell and panel production has clearly outstripped demand. Cell and panel manufacturers have not been able to raise prices at the same rate as the upstream sectors, showing only 20% price increases in 2021, much less than the upstream. In addition, bill of materials prices and logistics costs have risen, leading to a decline in operating performance. Vertically integrated companies have managed to maintain a gross margin in excess of 10%.

In 2021, the operating performance of a photovoltaic system manufacturer depended on its production method. Companies involved in upstream activities or with vertical integration were less affected by supply chain price rises, while those focusing solely on downstream activities were more affected, as they suffered greater increases in production costs.

Outlook for 2022

InfoLink forecasts that global demand for panels will be between 223 GW and 248 GW this year.

At present, disproportionate production capacity along the supply chain is driving up silicon and wafer prices, which remain high with a high gross margin against a backdrop of slow production expansion and robust downstream demand.

Downstream, cell and panel manufacturers have faced increased production costs and limited price increases. At the same time, BOM price rises resulting from the conflict between Russia and Ukraine, logistical bottlenecks caused by the pandemic and other uncertainties pose significant challenges throughout the year.

PV InfoLink of 16 May 2022