L R AS Published on Monday 11 January 2021 - n° 345 - Categories:Thread of the Week

Le Fil de la Semaine n° 345 of 11 January 2021

THIS WEEK'S NEWS HIGHLIGHTS

If there were only five texts to read this week :

FRANCE

* The reduction of the pre-2011 feed-in tariffs, validated but framed by the Constitutional Council

* The reduction of the pre-2011 feed-in tariffs, validated but framed by the Constitutional Council

* Result of the CRE4 call for tenders for innovation and storage in ZNI

* Result of the CRE4 call for tenders for innovation and storage in ZNI

* Will a 1 GW power plant be built in France?

* Will a 1 GW power plant be built in France?

THE SECTOR * World production capacity reaches 214 GW of cells and 220 GW of panels

* World production capacity reaches 214 GW of cells and 220 GW of panels

THE WORLD

* US federal tax credit extended for two years at 26%.

* US federal tax credit extended for two years at 26%.

PRODUCTS

.  * Agri-Voltaics, the new future of solar?

* Agri-Voltaics, the new future of solar?

Other interesting articles:

FRANCE * Six pages on self-consumption in France

* Six pages on self-consumption in France

* CRE publishes two draft decisions on TURPE 6

* CRE publishes two draft decisions on TURPE 6

* Will a 1 GW power plant be built in France?

* Will a 1 GW power plant be built in France?

![]() * Voltalia has prepared its 2023 target

* Voltalia has prepared its 2023 target

.

.

THE INDUSTRY * Global production capacity reaches 214 GW of cells and 220 GW of panels

* Global production capacity reaches 214 GW of cells and 220 GW of panels

* Four silicon trends in 2021: price expected to remain high

* Four silicon trends in 2021: price expected to remain high

.

.

THE WORLD * The five trends of the European energy transition

* The five trends of the European energy transition

* Belgium has installed 900 MW of solar power in 2020

* Belgium has installed 900 MW of solar power in 2020

* Almost 10 GW installed in Vietnam in 2020! It is the 3rd most installed country

* Almost 10 GW installed in Vietnam in 2020! It is the 3rd most installed country

.

.

THE PRODUCTS * The average price of batteries in 2020 is 137 $/kWh, (- 13% on 2019)

* The average price of batteries in 2020 is 137 $/kWh, (- 13% on 2019)

THE DEVELOPMENT OF THESE STOCKS

FRANCE

* The decrease of the pre-2011 feed-in tariffs, validated but framed by the Constitutional Council

* The decrease of the pre-2011 feed-in tariffs, validated but framed by the Constitutional Council

The Constitutional Council validated on 28 December the draft Finance Law for 2021. It validated the decrease of the feed-in tariffs for the 2006-2010 contracts. This concerns solar power plants of more than 250 kW. This revision of the tariffs is located in article 54 sexies.

+

Lawyer Le Chatelier from Adaltys has analysed Article 225 of the 2021 Finance Law.

He states that it introduces a considerable upheaval in the economic conditions of operation of certain photovoltaic energy production facilities. This article authorises the government to reduce the feed-in tariff for electricity produced by installations with a peak power of more than 250 kilowatts, for contracts concluded before 2011. This reduction will only take place after the publication of an order and a decree by the Council of State.

It is a question of the State making savings while construction prices have fallen sharply in ten years (Editor's note: as well as the interest rates).

The Constitutional Council validated this measure on 28 December 2020, stating that there was a sufficient reason of general interest to justify such an infringement of the right to maintain legally concluded agreements. The Council framed this measure by requiring that this tariff reduction must preserve "the profitability of the installations", allow for a "reasonable return" on the capital tied up in them, taking into account the risks inherent in their operation, and take account of the fact that the tariffs are not to be reduced.The Council framed this measure by imposing that this tariff reduction must preserve "the profitability of the installations", allow for a "reasonable return" on the capital tied up taking into account the risks inherent in their operation, and take into account various criteria (the tariff decree, the technical characteristics of the installation, its location, its date of commissioning and its operating conditions).

The issues that the regulations implementing Article 225 have to address are obviously extremely complex, in particular the notion of "reasonable return on capital employed, taking into account the reasonable return on capital employed, taking into account the risks inherent in their operation", as well as the "safeguard mechanism". The latter, introduced in this context, must remain exceptional. Its use must be reserved for specific situations, unless the exception becomes the rule.

Tecsol of 8 January 2021

* Result of the CRE4 call for tenders for innovation and storage in ZNI

* Result of the CRE4 call for tenders for innovation and storage in ZNI

On 22 December, the Ministry of Ecological Transition published the results of the CRE4 3rd period call for tenders - PV Innovation and that of the call for tenders with storage in ZNI

The 3rd period of the Innovation RFPs: 47 projects

were designated as winners, representing a volume of 142.6 MWp, divided into two families

- Family 1: innovative ground-mounted photovoltaic installations,

- Family 2: innovative photovoltaic installations on buildings, agricultural sheds and car park shades, or innovative agrivoltaic installations.

The winning projects will benefit from an average tariff of 85.1 €/MWh.

31 winning projects are agrivoltaic devices, of which 22 projects (72%) use Sun'Agri technology. Agrivoltaics protects crops from the vagaries of the weather (rain, hail, snow) thanks to mobile solar panels placed above the plants, at a sufficient height to allow for optimal ventilation and the passage of agricultural machinery.

To consult the list : https://tecsol.blogs.com/files/liste-des-laur%C3%A9ats---cre4-3%C3%A8me-p%C3%A9riode---ao-pv-innovation.pdf

*

For the 3rd period of calls for tenders with storage in Corsica and the overseas territories: 47 solar photovoltaic projects with storage were designated winners for a total capacity of 57 MWp, with an average tariff of €98.6/MWh, a decrease of €10/MWh compared to the first tranche in April 2020.

For the 2nd period of the self-consumption AO in ZNI, only one project of 250 kWp was selected in Corsica.

To consult the list : https://tecsol.blogs.com/files/laur%C3%A9ats-de-la-3e-p%C3%A9riode-de-lao-zni-stockage-et-de-la-2e-p%C3%A9riode-de-lao-zni-autoconso.pdf

Tecsol of 3 January 2021

* Six pages on self-consumption in France

* Six pages on self-consumption in France

The daily newspaper Les Echos published six pages on self-consumption in France (to be read on https://fr.calameo.com/read/005635607c25fe5534fc2?page=1)

The French self-consumption market is still "clearly anecdotal". At the end of June, there were almost 78 000 installations connected to the Enedis network. This is low compared to Germany, where there are hundreds of thousands of self-consumers. The French market is clearly making progress. One of the obstacles is the relatively low price of electricity in France, which limits the appeal of the formula. The other brake is the high price of the PV investment (between 7,500 and 9,000 € for a 3 kWp installation). According to the author, the residential self-consumption market is expected to grow by 10% to 15% per year over the next five years.

The collective self-consumption segment has suffered from tenders that have very often been under-subscribed and the volume of tenders reduced. The recent increase of the ceiling to 500 kWp may revive the interest for the formula. The RE 2020 could also have a positive impact in favouring this solution. According to the author, the collective self-consumption market could reach half a GWp by 2025

https://tecsol.blogs.com/mon_weblog/page/4/

Tecsol of 3 January 2021

Editor's note An article often has to show the interest of having written it and therefore present its bright prospects. Hence the forecasts here. Nothing says that they are credible. In the same way that photovoltaic installations are voluntarily or unconsciously limited, the achievements linked to self-consumption (residential and collective) are subject to powerful brakes that hinder its expansion. This is regrettable, but it might as well be said.

* CRE publishes two draft decisions concerning TURPE 6

* CRE publishes two draft decisions concerning TURPE 6

The Commission de Régulation de l'Energie (CRE) has published two draft decisions concerning the tariff for the use of electricity networks (TURPE 6) applicable to energy transport (RTE) and distribution (Enedis). They have been sent to the Conseil Supérieur de l'Energie for its opinion with a view to their application from 1 August 2021, for four years. TURPE is the tariff paid, via their electricity bill, by consumers (both private individuals and small/large companies) for the use of the electricity transmission and distribution networks. For a residential customer, this represents about 30% of their electricity bill including VAT.

The tariffs for the use of public electricity networks cover the costs incurred by the electricity network operators. TURPE 6 takes into account :

Investments estimated at €69 billion at Enedis and €33 billion at RTE over the next 15 years.

* Increased maintenance of the network to guarantee a high quality of supply to all consumers.

Innovation and research (R&D) with an R&D budget of nearly €100 million per year for RTE and Enedis;

The development of electric mobility with the reduction of the cost of inserting electric vehicles into the networks thanks to the control of their charging;

The reduction of the environmental footprint, by promoting innovative flexibility solutions instead of building new infrastructures when possible.

The CRE is assuming average tariff increases of 1.57% per year for RTE and 1.39% per year for Enedis, i.e. an increase of around €15 in the annual bill of a private individual by 2024.

Some key figures for the TURPE 6 period

Enedis

Transmission turnover: €14.5 billion/year on average, including €3.7 billion/year paid to RTE

Investments: €3.9 billion/year on average

Employment: 37,500 employees

Networks: 1.4 million km of power lines

Connected customers: 38 million consumers on average and 465,000 production facilities connected (Q3 2020)

RTE

Turnover: €4.9 billion/year on average, of which €3.7 billion/year is paid by Enedis

Investments: €2.3 billion/year on average

Employment: 9,500 employees

Networks: 106,000 km of power lines

Customers: about 700 customers including 170 producers, 380 industrial consumers, 130 distributors

https://tecsol.blogs.com/files/201217_2020-318_turpe_6_hta_bt.pdf

https://tecsol.blogs.com/files/201217_2020-314_turpe_6_htb.pdf

Tecsol of 22 December 2020

* Will a 1 GW power plant be built in France?

* Will a 1 GW power plant be built in France?

A 1,000-hectare solar project in Gironde (near the Cestas power station), called Horizéo, is being studied by Engie and Neoen. With a size of about 1 GW, it would be installed on a forest that would have to be cleared. It would be accompanied by a data centre for storing digital data. It could also house a green hydrogen production unit, a battery storage centre to smooth out supply, and agricultural production.

The elimination of such a large area of forest has moved local residents, who have set up the environmental protection association Sepanso, reports France-Bleue Gironde.

Tecsol of 23 December

The 74% subsidiary of Casino, GreenYellow, developed through PV shading and roofing, then expanded its activity in France, but also a lot internationally, which allowed it to achieve a turnover of €295m in 2019.

As a result of its multiple installations in Africa, the Indian Ocean, the West Indies and French Guiana, the company has installed more than 300 MW, including 120 MW in France, many of which are self-consumption plants. Today, GreenYellow operates around 100 MW on its own behalf.

At the end of 2018, GreenYellow carried out a €150m capital increase reserved for Tikehau Capital and BPI France (which hold a total of 24% of the capital).

The group has diversified:

1°) in energy efficiency; it has 2,500 energy performance contracts;

2°) in the distribution of green electricity, with CDiscount Energie. It has 140,000 subscribers;

3°) it is starting to install 240 electric vehicle charging stations under its car park shades with the Dutch company Allego. It has signed an agreement in 2020 with Jedlix to monetise the volume of energy supplied intelligently;

4°) it is examining the interest of developing a green hydrogen business.

GreenYellow is no longer just a panel installer, but a set of technological applications to reduce its customers' energy bills and CO2 emissions.

The company wants to expand its activity in France by carrying out tests in agri-voltaics in partnership with the French Wine Institute and the industrialist Exosun (ArcelorMittal group). It is studying the interest of launching into collective self-consumption.

Tecsol of 6 January 2021

* Voltalia has prepared its 2023 target

* Voltalia has prepared its 2023 target

Voltalia has reached its objective set in 2016 to exceed the GW installed (1,015 MW) by the end of 2020. This has been accompanied by geographical diversification: four years ago, Brazil accounted for 84% of its installed capacity, Europe (mainly France) 16%. Now, Brazil accounts for 67% of installed capacity, Europe 24% and Egypt 9%.

In 2020, the group has secured 1,028 MW of new long-term power sales contracts to generate growth in the coming years. This is 2.6 times the level of power secured in 2019 which was 389 MW (in 2018: 241 MW). A quarter of the new contracts were concluded with energy users through PPAs (Power Purchase Agreements).

https://voltalia.com/uploads/08_Not%C3%ADcias/Press_Releases/2020/20201215_Voltalia_1GW_FR.pdf

Voltalia of 4 January 2021

Editor's note: More important than the installations that reflect past activities is the accumulation of contracts to be built obtained in 2020. They herald the forthcoming increase in installed capacity. The company has set itself the target of reaching 2.6 GW in production or operation by 2023. With these contracts signed, this objective is credible.

.

.

THE FIELD * Global production capacity reaches 214 GW of cells and 220 GW of panels

* Global production capacity reaches 214 GW of cells and 220 GW of panels

More and more companies are investing and building new products in the solar industry. In the second half of 2020, global cell production capacity reaches 214 GW, of which 35 GW are heterojunction cells. Cell expansion projects are concentrated in Jiangsu, Zhejiang, Anhui and Sichuan. Aikosolar plans to build a new production line to form a cumulative production capacity of about 50 GW of high efficiency solar cells in Yiwu. CECEP will put 20 GW into production by the end of 2021.

Global panel production capacity reaches 220 GW in the second half of 2020. Most of the projects are located in Jiangsu and Zhejiang, while Vietnam and Indonesia are also an important production base. It is possible for most of the new production lines to continue to upgrade and produce high power panels using the 182/210 mm formats.

https://www.energytrend.com/news/20201230-20480.html

EnergyTrend of 30 December

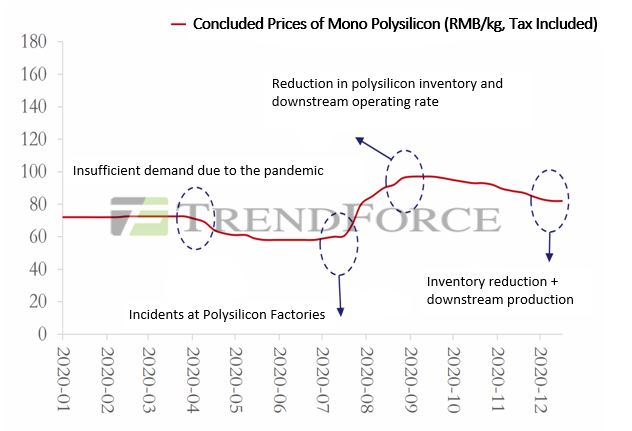

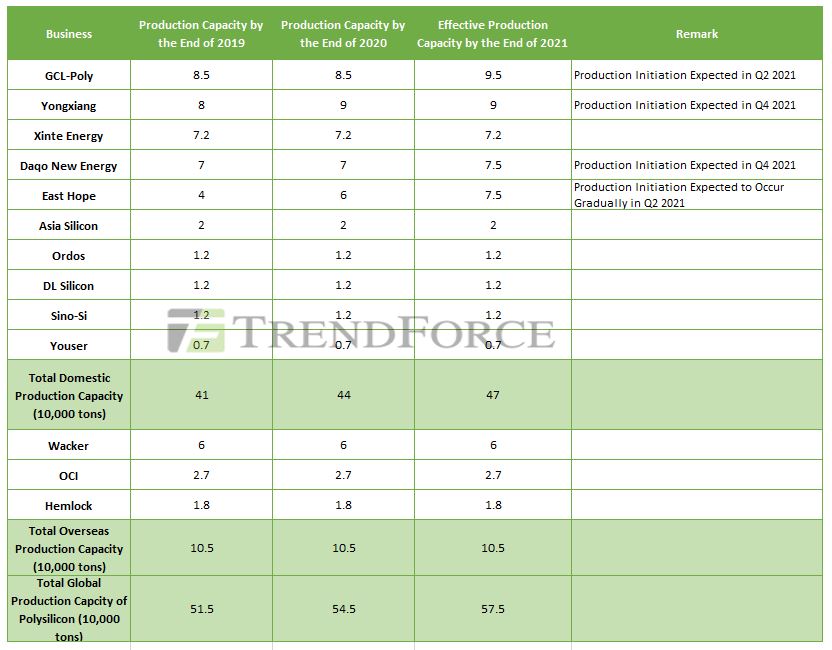

* Four silicon trends for 2021: price expected to remain high

* Four silicon trends for 2021: price expected to remain high

In 2020, silicon manufacturers have managed to reduce consumption and further reduce the cost of PV through management and technology optimisation. The increase in demand should be met by manufacturers. Those located in areas with low electricity prices will be favoured. There will be development of granular silicon and N

The price of mono-silicon will remain above 80 RMB /kg

The incidents of mid-2020 exacerbated prices. The capacity rebuild in Q4 pushed prices down a little until mid-December, when strong demand boosted them.

Production costs are different for silicon produced in the west (Xinjiang, Inner Mongolia and Sichuan), and in regions with low electricity prices (Yunnan and Qinghai). Manufacturers operating in regions with high energy prices or from abroad have higher costs and lower profit.

Delayed commissioning of silicon and wafer production facilities has led to an expectation of higher prices. Price fluctuations (between RMB 80 and 90/kg) will occur in 2021 depending on off-peak periods and high demand.

Global silicon production capacity is 575,000 tonnes.

Final demand for panels is expected to be 145-160 GW in 2021. Demand for wafers is increasing. Major producers are adapting in 2021: they are increasing their production capacity of mono-Si wafers. Price development will depend on demand, but also on silicon price increases.

The pandemic has slowed down the increase in silicon production capacity. New capacity of 35,000 tonnes per East Hope is starting production. GCL granular silicon production increases. Tongwei will start producing 40,000 tonnes in Q4 2021.

Production is concentrated. The top five silicon producers will supply 70.8% of the world in 2021. Their weight allows them to hold prices in 2021. Buyers have long-term purchase agreements that represent 80% of the production capacity of the major silicon producers. This is a result of wafer producers' desire for raw material.

The market will pay more attention to granular silicon and N

The alternative process to the Siemens system, the one that makes granular silicon , has fewer processing steps and therefore saves time. Therefore, the granular silicon process could be the key to increasing the purity of polysilicon while reducing its cost. Its manufacturing process can still be improved. Currently, the total operational production capacity of granular silicon in China is less than 30,000 tonnes. The process technology has not yet reached the stage of mass production. Granular silicon has great long-term potential.

Demand for N-type silicon will increase as downstream manufacturers move their N-type offerings to the verification and mass production stages. Chinese polysilicon suppliers are launching projects to increase N-type polysilicon production capacity. Production could start in 2022.

Hence the four main trends for 2021

1°) A slowdown in supply growth. Capacity increases will be seen at the end of the year. Buyers have placed long-term orders that correspond to 80% of the production capacity of the main silicon manufacturers.

2°) Panel demand is expected to be between 145 and 160 GW in 2021. New wafer production capacity will need more silicon supply.

3°) The price development of the different types of polysilicon will be differentiated in 2021. It will depend on the evolution of demand and supply, while remaining in the range of 80-90 RMB per kg.

4°) Granular silicon is starting to enter mass production. Customers will need time to verify the quality of the output from this technology.

https://www.energytrend.com/research/20210107-20605.html

EnergyTrend of 7 January 2021

.

.

THE WORLD

* The five trends of the European energy transition

* The five trends of the European energy transition

2020 was a pivotal year for Europe's energy transition. Even covid 19 has not managed to slow down the momentum. The new group of EU Commissioners has created a green hope alongside the pandemic.

1°) The former German Defence Minister found herself at the head of the Commission without having campaigned

to get the job. The lack of agreement among EU leaders on the candidates who ran, allowed her to impose her vision. She presented her Green Plan on 2 December 2019, which included a fund designed to drive change for economies and communities that rely on carbon-intensive industries. More ambitious climate targets for 2030 were also set out, with a 55% emissions reduction target for 2030, up from 40%, as well as a net zero target for 2050.

The emergence of the pandemic has required huge stimulus packages to be put in place. The 2021-2027 budget is €1,800 billion, of which €750 billion is for post-pandemic recovery. 550 billion will be used for 'green' projects.

Climate action and energy transition are now seen as partners in overcoming the coronavirus.

2°) The major oil companies have joined the transition energy: by the end of 2020, all major European oil companies had made long-term climate commitments.

BP has announced that it will invest $5 billion a year in low-carbon projects. Equinor plans to invest $11.6 billion in renewables alone by 2030. Iberdrola has committed to increasing its annual investment in renewables to $11.8 billion.

BP and EDF have set themselves the same target for 2030, to reach 50 GW of RE. However, the pandemic has delayed the launch of this investment process

3°) Green hydrogen has gone from being a dream to a likely future. The many objections (too expensive, little demand, difficult to store because not very dense, renewable capacity would overwhelm the grid) were swept aside. A bit like solar in 2007. Major European companies are committed to hydrogen.

There are still many problems to be solved, such as finding an odorant that makes the hydrogen smell bad without destroying the delivery infrastructure.

4°) Offshore wind is just getting started4°): Some major deployment targets for 2030 have been extended in the EU (60 gigawatts), as well as in the UK (40 gigawatts) and Germany (20 GW). The EU and the UK are now aiming for 100 GW by 2030 and 300 GW by 2050. Floating offshore wind promises more in the future. The world's largest such project, the 88 MW Hywind Tampen, has been approved by the Norwegian government.

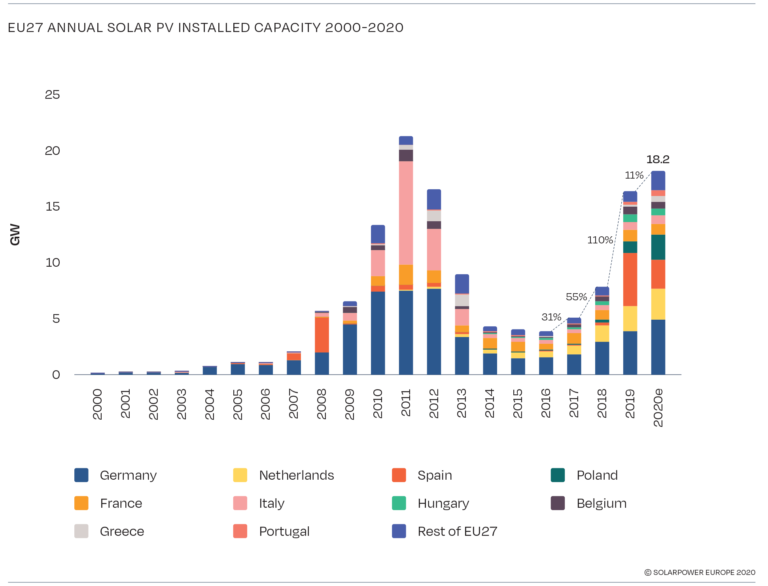

5°) Solar power has become the cheapest electricity in the world... The European solar renaissance continued. Poland has joined Germany, the Netherlands, Spain and France among the top five end markets for 2020. Solar Power Europe forecasts an installation range of between 14.9 and 28.8 GW for 2021, and growth of over 20% for 2021 and 2022.

https://www.greentechmedia.com/articles/read/2020-europes-energy-transition-in-five-trends

GreenTech Media of 30 December 2020

* Growth of PV installations in Europe in 2020: +11% to 18.7

* Growth of PV installations in Europe in 2020: +11% to 18.7

The turbulence that shook most sectors in 2020 hardly affected solar in Europe. The sector is growing by 11%, making it the fastest growing year for solar power since 2011 with 18.7 GW installed, according to SolarPower Europe. Germany, the Netherlands, Spain, Poland and France are now the largest solar markets in Europe.

Germany, the country with the largest population in the EU, also has the highest ratio of solar capacity per capita with 650 W per capita, and an addition of 4.8 GW in 2020. The Netherlands added 2.8 GW of capacity to its fleet, while Spain, the market leader last year, grew by 2.6 GW, of which almost 1.5 GW came from the Netherlands.Spain, the market leader last year, grew by 2.6 GW, of which almost 1.5 GW came from systems based on power purchase agreements (PPAs), making Spain the world's largest market for solar power without subsidies. Poland, generally considered a laggard in clean energy, soared, adding 2.2 GW, more than double the capacity it added last year. At the same time, France has passed the 10 GW installed capacity threshold, although it has only installed just under 1 GW in 2020.

A key tool to accelerate the growth of the sector in Europe is the EU's new generation recovery plan, with its €672.5 billion recovery and resilience facility, 37% of which is exclusively for climate spending. »

90% of Europe's roofs are unused and ready to be installed with solar energy. Member States must also deploy one million charging points for electric vehicles, which can be powered by solar energy.

A recent study by Finland's LUT University shows that solar energy has the potential to create up to four million green jobs in Europe by 2050. After the health crisis, renewable energy is a unique opportunity to revive the European economy, and to stimulate the clean energy transition, creating green growth and jobs around the world.

This trend is expected to continue in 2021, with the EU solar market forecast to grow by 23%, taking new installations to 22.4 GW. This would represent an all-time high for the EU, beating the 2011 record of 21.3 GW, when generous feed-in tariffs massively boosted the sector. Over the next four years, the EU will experience double-digit growth. Installations worldwide are expected to reach the terawatt scale (1,000 GW) by 2022.

Tecsol of 16 December 2020

+

According to SolarPower Europe, PV installations in Europe (137 GW at the end of 2020) are expected to double between 2020 (18.7 GW) and 2024 (35 GW), bringing installations to 252 GW.

SolarPower Europe of 15 December 2020

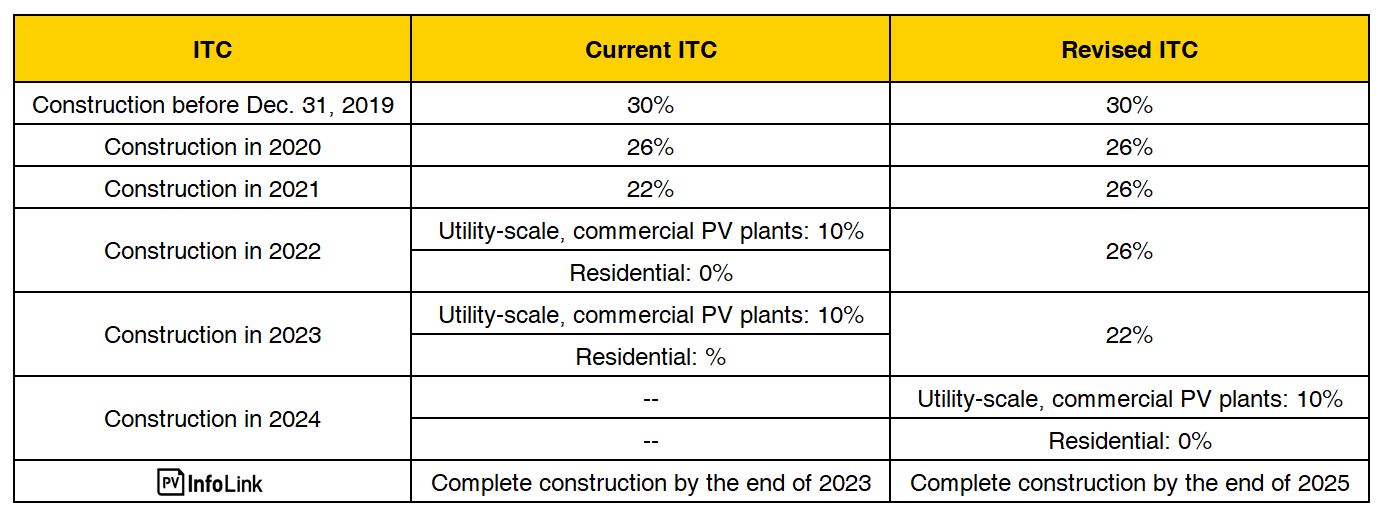

* Two-year extension of the US federal tax credit to 26%.

* Two-year extension of the US federal tax credit to 26%.

On 22 December, the US Congress passed a $90 billion Covid 19 stimulus package and a two-year extension of the solar investment tax credit (ITC) to 26% for projects starting construction in 2021 and 2022. The tax credit will be reduced to 22% in 2023 and then to 10% in 2024 for commercial projects. Residential projects will no longer be eligible for the credit. Projects must be commissioned by the end of 2025 to qualify.

US demand looks promising with tax credit extension

The tax credit is one of the main drivers of solar growth in the US market. Eligibility for the tax credit is based on the "early construction" principle. Projects that are not commissioned within a certain time frame are not eligible for the credit. This mechanism has supported the growth of solar energy in the US in recent years.

The commissioning of projects will run from late 2023 to late 2025. It is expected to encourage developers to invest in the US market, thereby supporting the growth of solar in the long term.

The US market was expected to enter a transition period in 2024 after the end of the 2023 commissioning deadline under the old regime. With the tax credit extended for two more years, PV InfoLink expects demand to increase in 2024 and 2025, meaning that the US market will grow from 2021 to 2025. In addition, as each state strives to achieve carbon neutrality, demand for panels in the US could exceed 30 GW in 2024 and peak in 2025.

PV InfoLink of 24 December

* Belgium installed 900 MW of solar in 2020

* Belgium installed 900 MW of solar in 2020

Belgium installed 900 MW of solar in 2020 (equivalent to the French 2020 installations estimated at 945 MW), bringing the operating capacity to 4,788 MW (half of the French installations which reach 10 GW).

Wind and solar production increased by 31% to 15.1 TWh. It now represents 18.6% of the electricity mix in 2020. Nuclear power will contribute 39% and gas 34%.

https://www.pv-magazine.fr/2021/01/08/la-belgique-a-installe-900-mw-de-capacite-solaire-en-2020/

PV Magazine of 8 January

Editor's note: The fact that a small country like Belgium is installing as much as France in 2020 indicates that there is a problem in France. Where does it come from? Because of what?

It is worth noting that SolarPower Europe estimates the 2020 installations in the Netherlands at 2.8 GW. Here again, an ambitious and determined policy has made it possible to install three times as many solar power plants as in France. When will our political and trade union leaders be self-critical of this unenviable situation?

* Nearly 10 GW installed in Vietnam by 2020! It is the 3rdème most installed country

* Nearly 10 GW installed in Vietnam by 2020! It is the 3rdème most installed country

A very favourable feed-in tariff for solar energy in Vietnam has led to a large number of installations in 2020: the volume of installations has risen from 0.4 GW in 2019 to 9.5 GW in 2020, spread over almost 102,000 systems. In December alone (the deadline for the favourable solar tariff), 6.7 GW were installed!

Cumulative PV capacity reached 16.4 GWp (13.2 GW-ac) at the end of the year, which implies that an additional 1.5 GWp of ground-mounted and floating solar projects were also commissioned under this feed-in tariff in 2020.

PV Tech of 6 January

.

.

PRODUCTS

* Agrivoltaics, the new future of solar?

* Agrivoltaics, the new future of solar?

The combination of photovoltaic installations and agriculture could provide 20% of the total electricity production in the United States, according to the University of Oregon. This combination would have little negative impact on crop yields. PV offers a "rare chance to create a real synergy: more food, more energy, lower water demand, lower carbon emissions and more prosperous rural communities."

The cost of the PV installations would be $1.12 trillion over a 35-year lifetime. The private sector would cover most of the construction costs; the federal government would contribute through rebates and other incentives. It would take about 17 years to pay back the $1.12 trillion.

Already in September 2019, studies in Arizona had shown that crops shaded by photovoltaic panels can offer multiple benefits, including increased food production, reduced plant drought and reduced heat stress from solar panels.

SolarPower Europe launched an agrivoltaics study group in early 2020. The aim is to stimulate the deployment of agrivoltaics in Europe by shaping the EU's agricultural and energy policy programmes.

In Oregon, the project promoter believes that the large-scale installation of agrivoltaic systems opens the door to other technologies. For example, excess energy from solar panels could be used to power electric tractors or to produce fertiliser on a farm. Inexpensive sensors could be installed on the solar panels to guide artificial intelligence-based decisions and improve agricultural productivity.

https://www.pv-magazine.com/2021/01/07/could-agrivoltaics-feed-demand-for-clean-energy/

PV Magazine, 7 January 2021

Editor's note: The 17-year payback period mentioned above will scare off any private investor. As a result, it is necessary to industrialise the installation of high-altitude panels to reduce costs. Unless other ways are found to combine the two activities. Could it also be that we made a mistake in the calculations?

* Average battery price in 2020 is $137/kWh, (-13% on 2019)

* Average battery price in 2020 is $137/kWh, (-13% on 2019)

The average battery price in 2020 is $137/kWh. This is 13% lower than the average for 2019. In the market, prices below $100/kWh were seen for the first time in China for electric buses. The average price of $100/kWh will not be reached until 2023, according to BloombergNEF.

Battery prices for electric vehicles have averaged $126/kWh based on volume. The average price of battery cells has been $100/kWh.

It is estimated that when the average battery price is $100/kWh, the price of electric vehicles will be at the same level as internal combustion automobiles.

Price reductions in 2020 are due to increased order size, growth in EV sales and the introduction of new battery designs. New cathode chemistries and lower manufacturing costs will drive prices down. Component prices have fallen since peaking in spring 2018. They have stabilised in 2020. Even if raw material prices were to return to the peaks reached in 2018, this would only delay average prices reaching $100 per kWh by two years.

Major battery manufacturers now enjoy gross margins of up to 20%. Their factories are operating at production rates of over 85%.

BloombergNEF, 16 December

.

*

*

.JPG)