L R AS Published on Monday 7 December 2020 - n° 343 - Categories:Thread of the Week

Le Fil de la Semaine n° 343 of December 7

THIS WEEK'S NEWS HIGHLIGHTS

If there were only five texts to read this week :

THE FILE * The evolution of energy storage in Europe

* The evolution of energy storage in Europe

THE WORLD

* Acceleration of battery installations in Germany

* Acceleration of battery installations in Germany

THE COMPANIES

.

* LONGi, 1st manufacturer to deliver 20 GW per year!

* LONGi, 1st manufacturer to deliver 20 GW per year!

![]() * Meyer Burger's project in the world of teddy bears

* Meyer Burger's project in the world of teddy bears

Other interesting articles :

FRANCE * Bisol Premium obtains the carbon footprint certificate

* Bisol Premium obtains the carbon footprint certificate

.

THE FILE * Investments in RE will result in profits not yet recognised in the accounts.

* Investments in RE will result in profits not yet recognised in the accounts.

* A new project to ship energy from Morocco to the United Kingdom

* A new project to ship energy from Morocco to the United Kingdom

.

THE PRODUCTS * How much hydrogen in natural gas pipelines?

* How much hydrogen in natural gas pipelines?

* What size of wafers should I choose, 166 mm, 182 mm or 210 mm?

* What size of wafers should I choose, 166 mm, 182 mm or 210 mm?

* Floating panels resist storms

* Floating panels resist storms  * The glass shortage and the situation of Chinese manufacturers

* The glass shortage and the situation of Chinese manufacturers

.

THE COMPANIES

* Meyer Burger and SMA call for an industrial strategy

* Meyer Burger and SMA call for an industrial strategy

THE DEVELOPMENT OF THESE TITLES

.

FRANCE * Bisol Premium obtains the carbon footprint certificate

* Bisol Premium obtains the carbon footprint certificate

Bisol Premium panels obtain the carbon balance certificate

from Certisolis for CRE 4 tenders, after obtaining the certificate for CRE 3 tenders.

Tecsol of1 December

.

.

THE FILE

* Investments in RE will result in profits not yet recognised in the accounts.

* Investments in RE will result in profits not yet recognised in the accounts.

According to MacKinsey, investments in new infrastructure and technology to achieve the zero emissions target are likely to be offset by savings in other sectors. The European PV sector could grow to three times its current size over the next decade.

Annual investments in all industrial sectors requiring decarbonisation already amount to €800 billion per year. With €180 billion of additional investment, these sectors would decarbonise at the rate required to reach the net zero emission target. These investments would be offset by savings such as reduced fuel imports.

According to the study, 6 million jobs will be lost in traditional industries. In exchange, an additional 11 million jobs will be created in emerging industrial sectors.

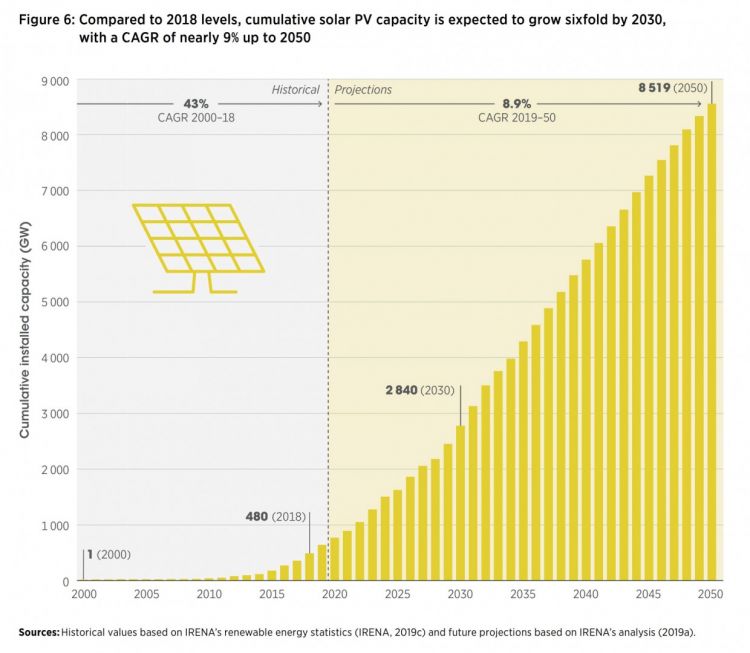

The energy sector will be the first to reach the net reduction target of 55% by the mid-2040s. To achieve this, the photovoltaic and wind energy industries will have to rise to the challenge and multiply their efforts. As demand for electricity is expected to double due to projected hydrogen electrolysis capacity, the annual growth of photovoltaic capacity in the EU will increase from 15 GW today to 44 GW from 2030 onwards. The wind sector will also increase from an additional 10 GW of annual capacity to 24 GW from 2030 onwards.

Thesecond sector is expected to be transport, which could be completely decarbonised by 2045, with electric vehicles and synthetic fuels for aviation and navigation.

Housing, heavy industries and agriculture will be among the most difficult and costly sectors to decarbonise.

The introduction of a decarbonised economy will also lead to price changes for certain products and services. Space heating and cooling and mobility will become cheaper, while the cost of food and air travel will rise.

PV Magazine of 4 December

* What is the growth in deliveries from the three main PV manufacturers in 2021?

* What is the growth in deliveries from the three main PV manufacturers in 2021?

Based on announcements of new capacity expansions by China's three major panel manufacturers, it is estimated that their panel deliveries

in 2021 will be respectively 40 GW at LONGi, 30 GW at JA Solar, 30 GW at JinkoSolar.

https://www.energytrend.com/news/20201125-20074.html

EnergyTrend of 25 November

Editor's note LONGi crossed the threshold of 20 GW delivered at the end of October 2020. If the forecast is correct, deliveries would double in twelve months.

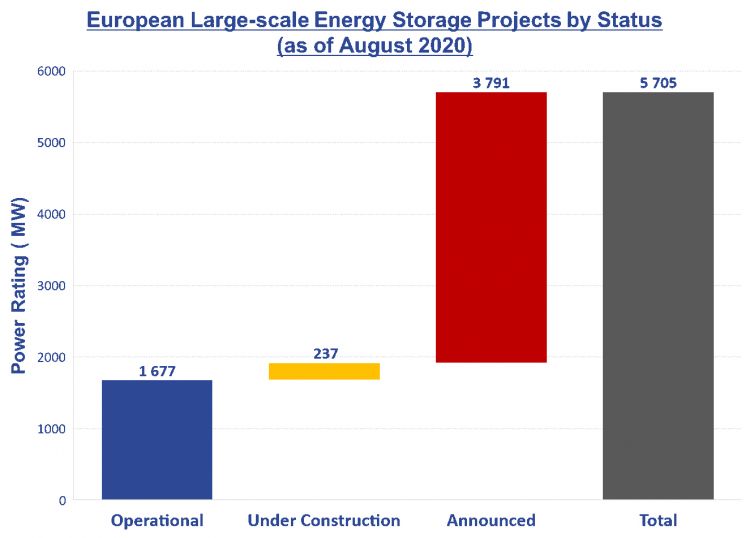

* The evolution of energy storage in Europe

* The evolution of energy storage in Europe

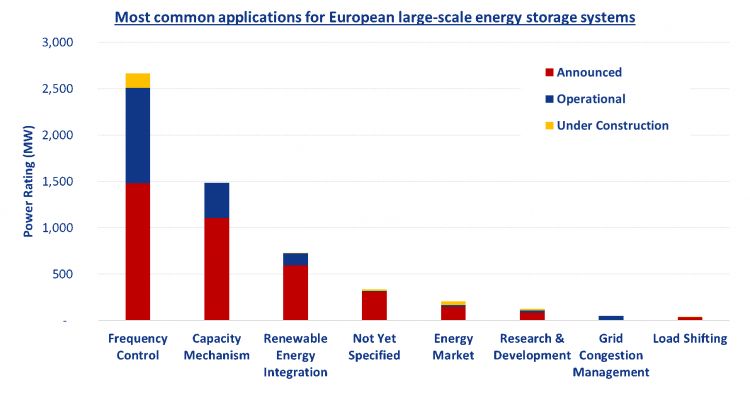

The multiple applications of large-scale energy storage are beginning to be exploited in European countries. The European energy storage industry has experienced remarkable growth over the last decade, from 9 MW of projects announced in 2010 to a total of 5,700 MW in 2020. Of these projects, approximately 1.7 GW are operational, while the remaining 4 GW are either announced or under construction.

The rise and fall of the frequency control windfall Frequency control has provided lucrative revenues by using the capacity of batteries to respond immediately to demand.

In Western Europe, the 3 GW of frequency control reserves (called Frequency Containment Reserves, or FCRs) are purchased jointly by six countries on a common platform. FCRs are auctioned on a daily basis.

For each country, the required frequency reserve is based on the ratio between the annual national generation (in MWh) and the total annual generation in the European synchronous zone. The supply targets vary slightly each week depending on the needs of the transmission system operator (TSO) and the production of previous years. In fact, 30% of each country's reserve must be of national origin and exports to the other members of the FCR cooperation are limited to a maximum of between 100 MW and 30% of each capacity block.

Revenues from this service have only been declining. The megawatt was worth €26 in 2015. It was worth only €5 in 2020), which is no longer profitable.

Energy storage The frequency reserve auctions have been modified several times to keep pace with demand. The most significant event is the sharp decline in market revenues, as prices have fallen from an average of €18/MW/h in 2017 to as low as €5/MW/h in early 2020. This fall in prices makes a new evolution of the market necessary. It is crucial to ensure the sustainability of projects through multiple alternative sources of income.

To read the full article (eight pages): https://solar-media.s3.amazonaws.com/assets/Pubs/PVTP24/Europe%E2%80%99s%20energy%20storage%20transformation.pdf

https://www.pv-tech.org/guest-blog/europes-energy-storage-transformation

PV Tech of 2 December

.

.

THE WORLD * In the third quarter, the United States installed three times as many batteries in the second quarter as in the third quarter.

* In the third quarter, the United States installed three times as many batteries in the second quarter as in the third quarter.

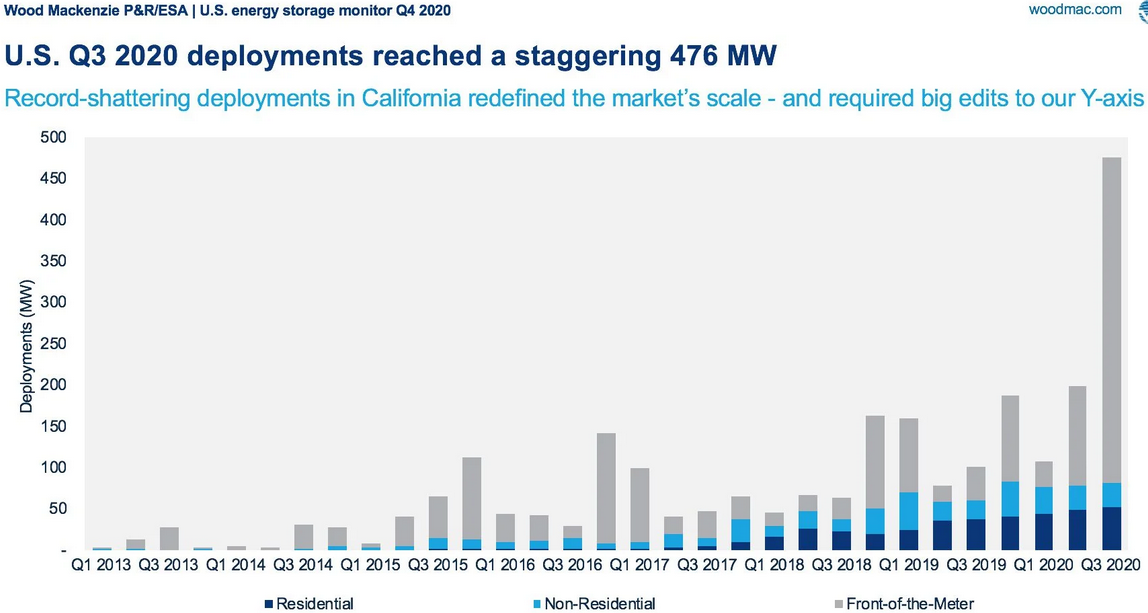

In the third quarter, the United States beat its previous record for battery installation by tripling installations to 476 MW (+240%) in the second quarter. This growth took place despite the coronavirus, which hit the economy in general and conventional energy companies in particular. An increasing number of states decided to store electricity and release it on demand to maintain their networks to absorb the surge in production from renewable power plants.

Annual deployments are expected to more than double by 2020 (exceeding 1 GW) and almost triple by 2021, according to Wood Mackenzie.

https://www.greentechmedia.com/articles/read/woodmac-biggest-battery-buildout-ever-in-q3

GreenTech Media of 3 December

* Acceleration of battery installations in Germany

* Acceleration of battery installations in Germany

The falling cost of storage in Germany is encouraging more and more people to equip themselves with batteries. This is encouraged by the increasing number of PV installations that exceed the ten-year guaranteed buy-back period.

In 2019, around 60,000 residential PV storage systems will be added in Germany. By the end of 2019, some 185,000 systems with a combined capacity of around 750 MW and a storage capacity of 1,420 MWh had been installed. Prices for the most popular storage technology on the market - lithium-ion - fell by a further 6% between 2018 and 2019 to around €1,100/kWh. The reduction mainly concerned medium-sized domestic storage units, from 5 to 10 kWh.

This wave of purchases observed in 2019 will continue in 2020. By the end of May 2020, more than 90,000 home storage units had already been entered in the register of the Federal Network Agency.

For industrial storage facilities (with a capacity of 30 kWh to 1 MWh), around 700 entries were recorded in 2019, for a total capacity of around 27 MW, bringing the total cumulative capacity to more than 57 MWh.

In 2019, there were only nine new large storage facilities (of 1 MWh or more). 54 MW with a storage capacity of 62 MWh were commissioned. At the end of 2019, there were 68 large storage facilities with a combined capacity of 460 MW and a storage capacity of 620 MWh in Germany.

Lithium-ion batteries remain the technology used in all market segments. Other battery technologies were rarely present in the projects.

https://www.pv-magazine.com/2020/12/04/growing-german-storage-market-buoyed-by-falling-prices/

PV Magazine of 4 December

Editor's note Although there are many statistics, it is not clear whether storage has become significant or whether it remains marginal.

* 2 million photovoltaic installations in Germany

* 2 million photovoltaic installations in Germany

At the end of October, there were 2 million photovoltaic installations in Germany, according to the BSW Solar association. They are capable of producing 50 billion kWh per year.

The production capacity could be

reduced by half if the law on renewable energies is amended in 2021. In addition, almost one in four photovoltaic systems is threatened by premature shutdown in the 2020s, as the draft Renewable Energy Act does not yet guarantee the continued operation of photovoltaic systems that have been in operation for more than ten years.

Yet Germany needs a rapid expansion of solar power because the phasing out of nuclear and coal is planned. By 2023, the electricity grid could be in short supply.

https://www.pv-magazine.com/2020/12/04/germany-hits-2-million-pv-system-installations/

PV Magazine of 4 December

* A new project to ship energy from Morocco to the United Kingdom

* A new project to ship energy from Morocco to the United Kingdom

The British company Xlinks launches the idea of producing energy in the Moroccan Sahara and sending it to the United Kingdom via a submarine cable. He is just taking up the idea of Desertec, the industrial initiative Dii in 2009, then Nur Energie.

The project would cost $21.6bn and could provide electricity at $70 per MWh, which compares with the price of nuclear power to be supplied at $125 (£92.50) 2012 prices for Hinkley Point C power.

The proposal comes at a time when the UK is considering how to obtain energy in the future and is advocating offshore wind turbines.

GreenTech Media of 4 December

.

.

THE PRODUCTS

*  * How much hydrogen in natural gas pipelines?

* How much hydrogen in natural gas pipelines?

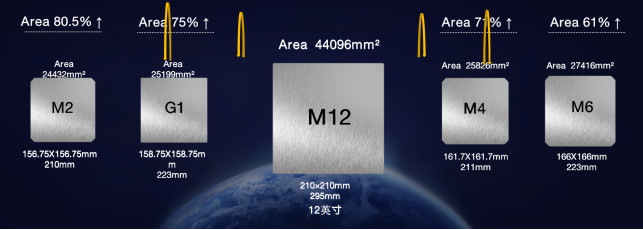

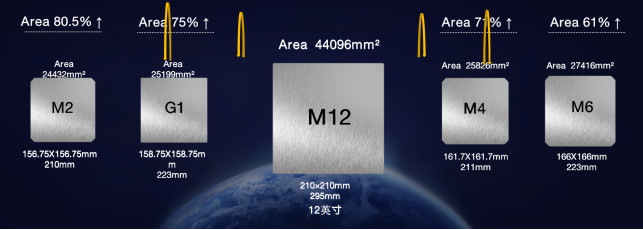

Since the debate is raging between the proponents of the 166 mm, 182 mm and 210 mm wafer sizes, the research organisation DNV GL has been called in by Trina Solar to decide the issue. The analysis revealed an advantage for the panels incorporating the largest wafer, based on the simulation of two-sided systems at two sites in Spain and the USA.

Larger sizes reduce manufacturing costs. Panel manufacturers promise their customers to lower the cost of levelized electricity (LCOE) when generating power. The debate is not neutral because the advantage provided by either format will encourage manufacturers to adopt it.

The study was carried out on two-sided, tracker-mounted panels in southern Spain and Texas (USA). The cost calculations also take into account local project costs and electricity tariffs.

The study showed that the 182 mm and 210 mm formats offered lower electricity costs than the 166 mm format. In Spain, the reduction in initial investment was 2.9% for 182 mm and 3.4% for 210 mm. The average cost of electricity (LCOE) was 2.5% and 2.8% lower. The results at the Texas site were comparable: an investment amount of 2.8% for 182 mm and 3.6% for 210 mm.

Trina Solar attributes this difference to the low-voltage panel design which allows more panels per string: 27 panels per string for 166mm and 182mm products, and 35 for 210mm products.

DNV GL says that its study was carried out with commercially available products, and that technical progress will change the results.

https://www.pv-magazine.com/2020/12/04/largest-wafer-offers-lowest-lcoe-finds-dnv-gl/

PV Magazine of 4 December

Editor's note The fact that the study was commissioned by Trina Solar may lead to a suspicion of bias on the part of DNV GL.

However, this result is partly logical: the larger the wafer used, the more sunlight it can receive and therefore create energy. This explains why the 210 mm format will gradually become the standard.

* Which wafer size should I choose, 166 mm, 182 mm or 210 mm?

* Which wafer size should I choose, 166 mm, 182 mm or 210 mm?

Since there is a fierce debate between the proponents of the 166 mm, 182 mm and 210 mm wafer formats, the research organisation DNV GL was asked by Trina Solar to decide. The analysis revealed an advantage for the panels incorporating the largest wafer, based on the simulation of two-sided systems at two sites in Spain and the USA.

Larger sizes reduce manufacturing costs. Panel manufacturers promise their customers to lower the cost of levelized electricity (LCOE) when generating power. The debate is not neutral because the advantage provided by either format will encourage manufacturers to adopt it.

The study was carried out on two-sided, tracker-mounted panels in southern Spain and Texas (USA). The cost calculations also take into account local project costs and electricity tariffs.

The study showed that the 182 mm and 210 mm formats offered lower electricity costs than the 166 mm format. In Spain, the reduction in initial investment was 2.9% for 182 mm and 3.4% for 210 mm. The average cost of electricity (LCOE) was 2.5% and 2.8% lower. The results at the Texas site were comparable: an investment amount of 2.8% for 182 mm and 3.6% for 210 mm.

Trina Solar attributes this difference to the low-voltage panel design which allows more panels per string: 27 panels per string for 166mm and 182mm products, and 35 for 210mm products.

DNV GL says that its study was carried out with commercially available products, and that technical progress will change the results.

https://www.pv-magazine.com/2020/12/04/largest-wafer-offers-lowest-lcoe-finds-dnv-gl/

PV Magazine of 4 December

Editor's note The fact that the study was commissioned by Trina Solar may lead to a suspicion of bias on the part of DNV GL.

However, this result is partly logical: the larger the wafer used, the more sunlight it can receive and therefore create energy. This explains why the 210 mm format will gradually become the standard.

* Floating panels resist storms

* Floating panels resist storms

The floating PV installations installed in the port of Rotterdam by the Dutch company Floating Solar have withstood four severe storms over the last three years. Further projects are to be launched

PV Magazine of 30 November

Editor's note When talking about "in the port of Rotterdam", one can imagine that the PV installation was sheltered from the biggest waves of the ocean, which does not ensure the strength of PV platforms in the open sea.

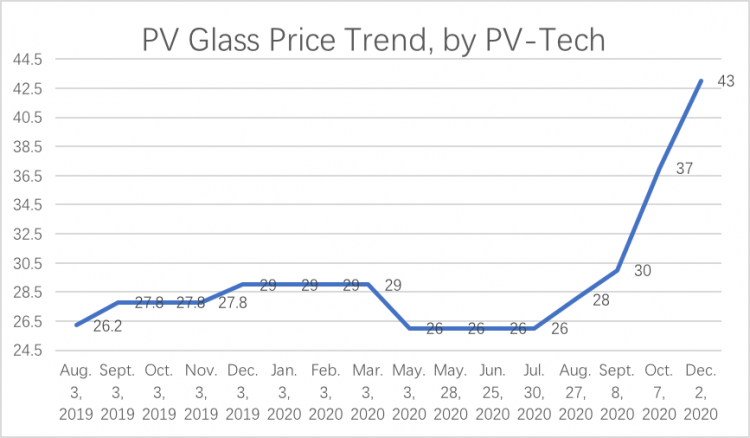

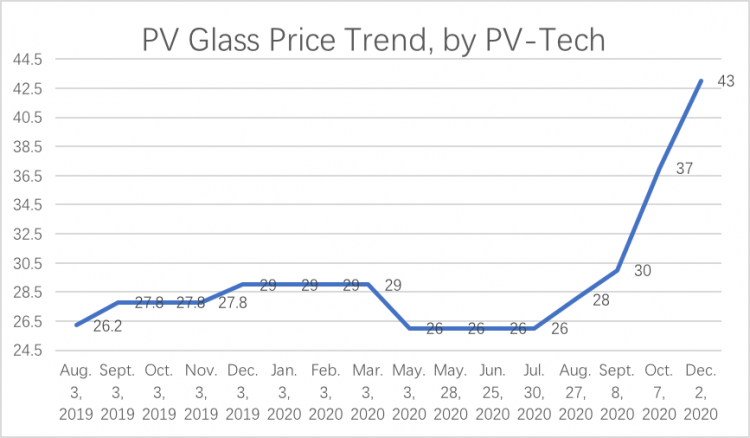

* Glass shortage and the situation of Chinese manufacturers

* Glass shortage and the situation of Chinese manufacturers

The price of solar glass, which cost between 20 and 23 RMB/m² in the years 2013-2019, rose rapidly in the second half of 2020. It reached 43 RMB and even 50 RMB / m² with some small manufacturers.

For the CPIA, packaging represents almost 50% of the total cost of the panels; glass represents 19%. For example, a single-faced panel using 166 mm cells requires an average of 2.2 ? of glass which, based on the current price, costs almost 100 RMB, i.e. a cost of 0.2/W RMB. This doubles the cost of 0.1/W RMB it cost in July. The increasing demand for double-glazed panels and larger panels will keep pressure on production. Leading manufacturers are booking orders in advance

In December 2019, China's solar glass production capacity was 25,360 tonnes/day. 6,900 t/d was to be added in 2020. One of the manufacturers is forecasting a 15% glass shortage in 2021. It estimates that the balance between supply and demand will not be reached before 2022.

| Company | Current Capacity | Investment (RMB billion) | Capacity Planned |

| Xinyi Solar | Unknown | Unknown | One additional thousand-ton level production line planned for each season in 2021-2022 |

| CSG A | Five electronic glass production lines | 0.494 | 2.1 million square meters of insulating glass, 3.5 million square meters of coated glass per year |

| 3.15 | Oven 1,200-ton solar glass production lines in light-weight, high transparency panel manufacturing base at its Anhui Solar Facillity, construction to be finished in 24 months | ||

| Flat | Solar glass 5,290 tons/day | 2.17 | Module cover glass phase 2 project with an annual capacity of 750,000 tons |

| Caihong New Energy | Unknown | 0.5 | 5 deep processing lines for ultra-thin, dual-film, big-size photoelectric glass |

| Unknown | Plans to build a solar glass kiln and supporting facility with pull volume 750 tons/day | ||

| Luoyang Glass | Unknown | 0.186 | Add a 32.4-million-square-meter backsheet glass deep processing production line |

| Almaden | Unknown | 0.877 | Construction of a smart deep-processing line for big-size, high-power, ultra-thin solar glass, technological improvement?construction of a smart deep-processing line for BIPV anti-glare coated glass |

| Unknown | An annual capacity of 100 million square meters of special photoelectric glass to be achieved upon the completion of Fengyang Base Project | ||

| Kibing Glass | Unknown | 1.373 | 1,200t/d high-transparency backsheet material and deep processing in Shaoxing |

| 1.027 | 1,200t/d high-transparency module substrate material production line in Zixing | ||

| Topray Solar | Four glass lines, daily melt volume 900T/D | Unknown | Technological improvement for 2,240-ton solar glass production lines in Chencheng, which produce 18 million square meters of 1.8-2.5 mm glass annually. |

Panel manufacturers are suffering from the rise in the price of glass and are placing orders corresponding to their expected need for glass.

PV Tech of 25 November

.

.

THE COMPANIES * LONGi, 1st manufacturer to deliver 20 GW per year!

* LONGi, 1st manufacturer to deliver 20 GW per year!

The Chinese company LONGi estimates that it is the first manufacturer to deliver more than 20 GW of panels in one year.

Full Sun of December 4th

*  * Meyer Burger's project in the world of teddy bears

* Meyer Burger's project in the world of teddy bears

The Swiss equipment manufacturer Meyer Burger was forced to redeploy because the sale of production machines for photovoltaic plants was being reduced by the emergence of Chinese competition.

The equipment manufacturer, which has long relied on future-oriented technologies,

has decided to put them into practice itself and is launching a 400 MW production that will come on the market in the first half of 2021. The objective is to reach 5 to 6 GW by 2025-2026.

To achieve this, the company increased its capital by €165m last summer, sold assets, bought the buildings of the former Solarworld production site in Freiberg, (Saxony, Germany) covering 33.000 m² and leased 27,000 m² in Bitterfeld-Wolfen (Saxony-Anhalt)

The group will manufacture high-efficiency solar cells using the exclusive SWCT (Smart Wire Connexion Technology) heterojunction technology. The interconnection of the cells contributes to their efficiency. They will be assembled into panels.

The company is very confident in its technological lead. It considers that it will have a very high level of automation to reduce labour costs. It will not have transport costs like products imported from Asia. It intends to acquire one third of the European market by 2025.

In addition, Meyer Burger is strengthening its collaboration with the Swiss research and development centre CSEM to develop new technologies for the production of highly efficient solar cells and panels. It is counting on the translation of research into industrialised cells and panels. Already, Meyer Burger's cells have achieved an efficiency of 25.4 %.

Tecsol of 30 November

Editor's note We naturally wish Meyer Burger every success in his project. Let it be understood that we are in favour of the success of this European attempt.

However, the project is a bit above ground. It is completely focused on itself and without regard for the competition, which is not even mentioned. Can we imagine the Chinese letting Meyer Burger ensure its transformation, settling quietly and without obstacles on the European market? One thinks one is dreaming or being in a world of teddy bears!

Compared to a price per watt that Meyer Burger will offer, the Chinese will offer a price 15 to 20% cheaper. The important thing is not the loss on what they will sell, but the definitive elimination of a potentially dangerous competitor. What will buyers do between their European nationalism (assuming it exists) and their wallets? What support will Meyer Burger have in its attempt? What will there be beyond the applause of the media? What will be beyond the official speeches of personalities who want to be talked about? What will be beyond their pictures in magazines? What will there be beyond the gloss on European renewal? WHAT KIND OF WORLD DO WE LIVE IN? OR IS THERE A BIT OF JUDGEMENT BEHIND THE SPEECHES AND WORDS?

Chinese manufacturers, who achieve net margins of 10% to 20% worldwide, have the capacity to lose part of their profits to Europe in order to maintain their monopoly in the future, since they hold 85% of the world's panel production. They can also supply Meyer Burger with their wafers at a price that is far too high, raising the final price of the panel. What is technology worth if it is too expensive? The Chinese will quickly adopt Meyer Burger's processes and will soon return with technology copied from the Swiss supplier. It will take them two or three years to adopt them. They just have to make it through that time.

In the meantime, with Europe's sieve borders, with the opinion of destructive free trade in Europe dating from another era, and the desire to favour installers to the detriment of producers, we will lose yet another industrial jewel. Let the industrialists prove themselves before condemning them in advance. Let the public authorities know how to anticipate what is obvious today!

We wish Meyer Burger success. Only its failure is inscribed in the current economic and political logic. Will it be changed in time?

* Meyer Burger and SMA call for an industrial strategy

* Meyer Burger and SMA call for an industrial strategy

Meyer Burger and SMA call for a photovoltaic industrial strategy in Germany. They make four proposals. They point out that research and development requires an industrial component. This would create 100,000 jobs in Europe.

1°) It is necessary to create a market for the sustainable production of electricity, in particular financing by banks for research into technologies and to help production. Regional production of solar technology should be supported to ensure the transition to climate neutrality.

2°) The German Renewable Energy Act (EEG) should be used as a "basic element for energy sovereignty". The annual expansion of PV in Germany should be increased to 10 GW per year. Solar self-consumption should be encouraged more strongly.

3°) Concepts and technologies for space-saving photovoltaic installations, i.e. agrivoltaics and floating power plants, should be promoted. The most efficient technology should be used in order to draw as much energy as possible from a minimum surface area, both for rooftop and open space systems".

4°) An installation programme should be set up on 10 million roofs in Germany and 100 million in Europe. New buildings should be equipped with solar systems and intelligent storage systems, a system adapted to the tenants. Separate tenders should be introduced for large PV systems in urban areas.

Leaders call for fair and robust conditions to accelerate the global energy transition. They need a comprehensive industrial strategy that takes into account technology production and electricity generation simultaneously. We need short-term support measures that improve the framework. They add: "Without a strategic industrial policy approach to European solar production, we will be completely dependent on foreign suppliers in the future".

PV Magazine of 4 December

Editor's note The seriousness of these two companies is no longer in doubt. The fact that they are sounding the alarm together should be a wake-up call.

Both companies are trying to revive (or sustain) European industry. They will be a thermometer of the European future:

Or they will succeed and they will restore confidence to other European entrepreneurs. This is the favourable case, but is it certain?

Or they are forced to stop under the pressure of Chinese competition. Europe will then have sealed its destiny for a long time because these companies had a certain size; they had technological knowledge. They had everything they needed to succeed. Their failure will show that they lacked something other than industrial competence, i.e. the political and economic environment. This case may well come up

Or they live. This will depress the other candidates for the launch of global activities both for photovoltaic, and for other sectors subject to international competition such as batteries, hydrogen, ... This situation is very likely with a halt to the expansion of European industries until there is an industrial but above all political awareness.

.