L R AS Published on Monday 28 September 2020 - n° 333 - Categories:Thread of the Week

Le Fil de la Semaine n° 333 of September 28th

A computer problem at the server blocked the finishing of the article, preventing the placement of the graphics.

THIS WEEK'S NEWS HIGHLIGHTS

If there were only five texts to read this week :

FRANCE

* French nuclear power. EDF minimises its production costs

* French nuclear power. EDF minimises its production costs

THE FILE * Nuclear power at the end of the cycle: little construction, rising costs, aging

* Nuclear power at the end of the cycle: little construction, rising costs, aging

THE WORLD

* Cobalt supply to the European Union

PRODUCTS

* Comparison between panels with cells of different formats

* Trackers, a high-growth, high-margin PV niche market

Other interesting articles :

FRANCE

* Almost official announcement of the increase in the feed-in tariff from 100 kWp to 500 kWp

* Total buys a 3.3 GW portfolio in Spain

* Neoen in the first half of the year; the company maintains its 2020 and 2023 objectives.

* Voltalia in the first half of the year and revised outlook.

.

THE WORLD

* China's photovoltaic industry could reach grid parity by the end of 2020

* China's 14th Five-Year Plan to be announced within a year

* U.S. utilities keep their coal or gas-fired power plants

* Study recommends installing PV on all German roofs

.

THE PRODUCTS

* Vanadium redox flux batteries will only work well with a future membrane.

* Air-bridge thermo-photovoltaic cell with 30% efficiency.

.

THE COMPANIES

* Jinko Solar in the 2nd quarter: sales and profit growth

.

MISCELLANEOUS

* Airbus is working on clean aircraft but warns of its cost and constraints

THE DEVELOPMENT OF THESE TITLES

.

FRANCE

*

Almost official announcement of the increase in the feed-in tariff from 100 kWp to 500 kWp

Professionals in the photovoltaic and building sector were given a preview of the main elements of the next tariff decree at the 2nd "Rencontres PVBAT". This provides for a feed-in tariff for photovoltaic installations of 100 to 500 kWp (corresponding to approximately 600 to 3,000 m²), with a proposed tariff of 9.8 c€/kWh, reduced to 4 c€ once the threshold of 1,150 hours of annual production has been exceeded. Self-consumption will be possible. The text will go to the High Energy Council on 29 September and should be published in early 2021.

This tariff will facilitate the implementation of projects for professional buildings subject to an obligation to produce renewable energy, and will encourage project owners in their efforts to obtain a label.

GMPV press release of 24 September

* French nuclear power. EDF minimises its production costs

* French nuclear power. EDF minimises its production costs

In its French version, the article Nuclear power at the end of the cycle: little construction, rising costs, aging evokes the French nuclear industry

At the beginning of 2018, EDF stated that the cost of generating electricity with its existing reactors was €32 per MWh (of which €17 was for operation and maintenance costs and €5 for fuel). A further €10 of modernisation costs are expected to be incurred to extend the life of the plants to 50 years.

Michèle Pappalardo, former High Representative of the Court of Auditors, pointed out at the hearings of the National Assembly's Committee of Inquiry that the calculation of the EDF stopped halfway to 2025. She recalled that the Court had calculated a total cost of 100 billion euros (117 billion dollars) for the period 2014-2030.

These early 2018 estimates do not take into account the unprecedented extensions of judgments in a low cost and low consumption market environment. Operating costs have increased significantly in recent years". Unit outage timeframes are significantly exceeded and particularly costly. As a result, EDF's net financial debt increased by €8 billion in 2019 and rose by a further €1 billion in the first half of 2020, mainly due to the Covid-19 effect, to reach a total of €42 billion.

The health crisis has led to a further deterioration in the situation that will manifest itself in 2021-2022. The effects related to the health crisis could "add a total of €5-10 billion to the company's debt burden by 2022".

PV Magazine of 25 September

Editor's note Who are we kidding? In 2010, EDF set its cost price at €42 per MWh (Arenh tariff). Some time later, the Court of Auditors estimated it at 60 €. And today, EDF is announcing €32 per MWh! But since then, there has been inflation, refurbishments, breakdowns, requests to reinforce nuclear safety, delays in the construction of new power stations...

In reality, EDF wants to assert, despite common sense, that its electricity remains the cheapest on the market compared to solar power, and is ready to launch any figure because nobody can check !

With this pertinent example, what credit can be given to the National Assembly's commission of enquiry?

Don't we have the example of the British power station that EDF is building and which will sell its electricity on the basis of £92.50 per MWh, i.e. more than €100 per MWh? Don't we have this study (Lenucléaire en fin de cycle: peu de construction, coût en hausse, vieillissement) on the productioncost of nuclear power plants in the world (but how could France deviate so much from this average?) with an average price of $155 per MWh?

* Total buys a 3.3 GW portfolio in Spain

Total integrates production, trading and sales in the electricity chain

The oil company Total has purchased a portfolio of 3.3 GW in Spain which will come into operation between 2022 and 2025. This portfolio will provide it with 6 terawatt-hours to supply all its industrial operations in Europe by 2025: it has signed the largest power purchase contract in the world...with itself...

By February, Total had acquired nearly 2 GW of solar power, 850 MW of power plants in Spain and 2.5 million customers from the Portuguese company EDP.

In Spain, Total's portfolio of 5 GW of solar power compares favourably with that of its competitors: electricity giant Iberdrola has 6 GW of operational onshore wind turbines, 600 MW of operational solar power and a 14 GW renewable energy pipeline in the start-up phase.

It also exceeds the project portfolio of the Portuguese oil company Galp Energia, which acquired 900 MW of operational solar and 2 GW for development last January.

Worldwide, Total becomes the No. 1 in the field of renewable energies (Editor's note: the n°1 remains EDF with its wind power plants in the United States in particular).. It will achieve a significant revenue stream in solar in the mid 2020s. It owns half of Adani's 2.1 GW solar portfolio in India and has acquired 51% of the 1.1 GW Seagreen offshore wind project in Scotland. The project could be expanded by 340 MW. It won an auction in Qatar for 800 MW of solar power in conjunction with Marubeni. In early September, Total joined forces with Macquarie Bank to develop 2 GW of floating wind turbines off the coast of South Korea. It has just acquired a portfolio of 1 GW of wind turbines with the acquisition of the developer Global Wind Power.

GreenTech Media of 25 September

NDLR Buying is good. Knowing how to manage and maintain power plants is better. That's why Total has joined forces with various partners to date. With this purchase, Total is embarking on the management of power plants.

* Neoen in the first half of the year; the company maintains its objectives for 2020 and 2023.

In the first half of the year, Neoen generated revenue of €157 million (up 33% over 2019). EBITDA increased by 58%, with a margin of 94%. Operating profit was €95 million (up 67%). Group net profit was €22m (+32%). The company has 2.1 GW in operation (up 13% over 31 December 2019) and 1.5 GW under construction (up 26% in six months).

The solar business generated sales of €74m (47% of consolidated sales). It is up 34% compared with the first half of 2019, thanks to the contribution of power plants commissioned in 2019 and early 2020. The increase in EBITDA (up 75% to €88 million) was due to the commissioning of power plants and revenues from the Mexican plant.

The company invested €205 million in the first half. Cash and cash equivalents amounted to €589 million at 30 June. Net debt amounted to €2.0 billion (compared with €1.8 billion at the end of December).

For 2020, the company estimates that it will achieve EBITDA of €270 to €285 million (the previous range was €270 to €300 million). This is because the company is experiencing delays in the commissioning of certain projects. Neoen also confirms its target of more than 5 GW of capacity in operation or under construction by the end of 2021, capacity that will be fully operational by the end of 2022. Neoen also reiterates its EBITDA target of more than 400 million euros in 2022.

https://www.neoen.com/var/fichiers/cp-ry-sultats-s1-2020-neoen.pdf

Neoen of September 23rd

* Voltalia in the first half of the year and revised outlook

In the first half of the year, Voltalia announces a 55% increase in sales to €88m. EBITDA increased by 71% to €24 million, bringing the margin to 27% (compared with 24% in 2019). Operating profit was €1 million (compared with €4 million in 2019). However, the net loss increased from €9m to €16m due to the seasonality of the winds in Brazil and the depreciation of the Brazilian currency.

Energy sales increased by 36% to €62 million, for production of 915 GWh, up 21%. The EBITDA margin fell from 60% to 53%. Installed capacity increased by 54% to 820 MW. These results come from Brazil, where 54% of energy sales were made, compared with 73% a year ago due to unfavourable weather conditions. There was also the depreciation of the Brazilian currency against the euro, which reduced US performance.

Revenues from service activities fell by 32% year-on-year to €50m, some of which was from internal services. EBITDA was a loss of €1.9m compared with a profit of €1.2m.

Cash and cash equivalents amounted to €161m, compared with €270m at 30 June 2019.

Voltalia raises new risks

The health and economic crisis is generating new risks: they stem from (i) currency fluctuations (mainly the Brazilian real), (ii) the ability to carry out without delay the major ongoing and future construction sites of Voltalia-owned power plants, and (iii) the ability of Voltalia's service customers (mainly development and project construction sales) to make progress in their decision-making processes.

While Voltalia-owned sites under construction experienced only minor delays in the first half of 2020, Covid-19 is now affecting construction schedules. Initially delayed by a few weeks, projects are now delayed by 4 to 6 months or more.

Voltalia revises its forecasts

The weakness of the Brazilian currency is expected to reduce the 2020 EBITDA by - €25m. Delays related to covid-19 on Construction and Services is estimated at - €27 million. As a result, Voltalia now anticipates a 2020 EBITDA of around €100 million, i.e. +50% over 2019, but below the envisaged range of €160 to €180 million. In 2021, Voltalia's EBITDA is expected to reach around €170 million. In 2023, a range of €275 to €300 million in EBITDA should be achieved.

By the end of 2020, the power in operation will have reached 1 GW. In 2023, the target power will increase to 2.6 GW in operation and under construction. The company has won 867 MW of new contracts since the beginning of 2020 (compared with 389 MW in 2019 and 241 MW in 2018). Thus, Voltalia has already secured 92% (or 2.4 GW) of its 2023 ambition.

Solar power now accounts for 50% of the total power under contract (at the end of June 2020, solar power accounted for 19% of the company's installed capacity). Europe + Africa represents 34% of the total power under contract.

Voltalia

.

.

THE SUBSIDIARY * Nuclear power at the end of the cycle: little construction, rising costs, ageing

* Nuclear power at the end of the cycle: little construction, rising costs, ageing

The latest edition of the study on the situation of the World Nuclear Industry, published by French nuclear consultant Mycle Schneider, underlines that the stagnation of the sector continues with only 2.4 GW of new nuclear production capacity commissioned last year, compared to 98 GW for solar. Global operational nuclear capacity decreased by 2.1% to 362 GW at the end of June. "The number of reactors in operation in the world fell to 408 in mid-2020, which is lower than the level already reached in 1988 and 30 units below the historical peak of 438 in 2002".

The average cost of energy from nuclear power rose from $117 per MWh in 2015 to $155 by the end of 2019, while the average cost of solar power rose from $65/MWh to about $49 and that of wind power from $55 to $41. "What is remarkable about these trends is that the costs of renewable energy continue to fall due to incremental improvements in manufacturing and installation, while nuclear, despite the fact that it is the most expensive energy source in the world, is still the most expensive in the world. nuclear, despite more than half a century of industry experience, continues to see its costs rise," says the report, citing a recent study by Lazard, a financial advisory and asset management firm. "Nuclear power is now the most expensive form of generation, with the exception of advanced gas-fired plants.

This cost differential explains the small number of new facilities that have been built.

Six nuclear reactors will be connected to the network in 2019: three in Russia, two in China and one in South Korea. At the same time, five nuclear power plants were shut down last year and three others were shut down in the first half of this year; no nuclear facilities were commissioned from January to June 2020.

70% of all nuclear electricity in the world in 2019 was generated by five countries (in order of importance), the United States, France, China, Russia and South Korea. The United States and France accounted for 45 per cent of global nuclear power generation in 2019, two percentage points less than the previous year. France's share decreased by 3.5 per cent".

The average age of the world's nuclear reactor fleet is 30.7 years, with two-thirds of reactors operating for more than 31 years.

The number of reactors under construction has risen from 46 to 52 - 15 of which with a total production capacity of 14 GW are in China. Most of these projects have suffered delays of several years. Last year construction began on four plants in China and one each in Russia and the United Kingdom. Work on a nuclear power plant in Turkey began in the first half of 2020.

PV Magazine of September 24th

NDLR This information is particularly important and, above all, not well known. In particular, the cost of operating nuclear power, which has become the most expensive form of electricity production, is completely ignored. One might have suspected this with the price concluded by EDF for the construction of the British power station at 11 ct € per kWh, which could only increase with the delays and other construction disappointments.

It should be noted that the construction period for nuclear power stations is particularly long (about ten years when all goes well). This means that the 52 power stations under construction were decided ten or fifteen years ago. It is very likely that the figure for investment decisions taken over the last three years is marginal, outside China.

.

.

THE WORLD

* Cobalt supply to the European Union

British researchers are looking at European cobalt supply in the medium and long term:

European demand for cobalt (Editor's note for automobiles. Without this clarification, it does not fit in with the following paragraph) currently stands at two kilotonnes (kt) or 2,000 tonnes per year. It should increase to 15 kt by 2030 and 31 kt by the middle of the century. In 2017, nearly 219,000 electric vehicles were registered in the European Union, representing 1.4% of total vehicle sales. This fleet required 1.2 kt of cobalt, i.e. 1% of world production.

Four years ago, the European Union used 34.6 kt, of which 14.8 kt was used for portable electronics, nearly 8 kt for the production of hard metals and 7.1 kt for the manufacture of superalloys. However, the growing demand for electric vehicles and fixed energy storage is shifting the demand for cobalt mainly to the production of batteries.

The problem is similar with nickel: the current demand is 11 kt of nickel in the EU. It is expected to reach 172 kt by 2030 and 540 kt in 20 years time, thanks to the introduction of high-nickel cathodes to reduce the use of cobalt.

In view of this expansion in demand for cobalt and nickel, researchers are advocating circular economy (recycling) to reduce the demand for primary ore.

Even if legislators in Brussels introduced stricter recycling regimes, no significant amount of cobalt would return to the market before 2032; supply through recycling would only become a reliable resource in 2040. This distant date stems from the time it takes for batteries to go through their first and then second life cycle.

"In the economic model, 35 kt of cobalt could be recovered through recycling by 2050, compared to 18 kt in the baseline scenario. This commercial approach would also make it possible to directly reuse 3 kt of batteries by the middle of the century, which is not the case with other models. Depending on the political decision-makers, it would rather allow the recycling of 32 kt of cobalt and the technological approach would yield only 10 kt", according to the study.

The situation needs to be corrected by the relatively low collection rate of electric vehicle batteries for reuse and recycling in the EU. 39% of all vehicles sold in the EU are not reintroduced to the European market after their end of life, because they "disappear". This figure is increased by the fact that around 10% of vehicles that have spent their time on EU roads are exported outside the EU and its recycling regime.

The study points out that the volatility of raw materials markets will also have to be corrected to ensure reuse and recycling is possible - if it is cheaper to mine raw nickel and cobalt than to recycle it, mining will continue.

Four countries consume 94% of the world's cobalt: China, with 57 kt per year, Japan (10 kt), South Korea (8 kt) and the United States (6 kt). It is therefore important to encourage recycling and minimise the negative environmental impacts or depletion of critical materials associated with the improper treatment of end-of-life electric vehicle batteries.

China boasts most of the 300 kt of annual lithium-ion battery recycling facilities in the world, and Europe only 30 kt. It has been estimated that Europe would need to increase its capacity fivefold by 2035 to reduce its exposure to cobalt supply. To recycle all the lithium-ion batteries that would need to be recycled in Europe by 2050, this capacity would need to be increased by a factor of 45.

https://www.pv-magazine.com/2020/09/22/european-cobalt-supply-hinges-on-circular-economy/

PV Magazine of September 23rd

Editor's note Betting on the recycling of lithium batteries would require a change of habit on the part of the population, and the creation of a dedicated sector. It can be promoted, but nothing says that it will be established.

What is impressive is the soaring demand for raw materials that are rather rare on the planet, and the absence of an alternative to nickel and cobalt to put in place these famous electric vehicles. One could almost say that electric vehicles will be the luxury of tomorrow!

* China's photovoltaic industry could reach grid parity by the end of 2020

The health crisis brought the Chinese solar industry to a halt in the first half of the year. It triggered a short-term rise in production costs, with an immediate one-quarter delay, according to a study by Environmental Geochemistry and Health. The Chinese government claims that the plants have been brought back into operation.

Delays in the roll-out of projects have been the main consequence of the pandemic. These delays affected installation rates in the second and third quarters of this year. Delays in projects mean that PV equipment manufacturers are less competitive on price and quality, as buyers focus more on those who can deliver on time. Price competition is also becoming less important due to fluctuating global demand. The pandemic had increased investment costs by 3%.

https://www.pv-magazine.com/2020/09/24/chinese-pv-industry-headed-toward-grid-parity/

PV Magazine of September 24th

* China's 14th five-year plan will be announced within a year.

China's 14th Five-Year Plan is expected to come into effect in the second half of 2021. The authorities do not plan to set targets for the deployment of solar and wind power

In 2019, renewable sources accounted for 15.3% of China's electricity production. For the 14th plan, an overall renewable energy target could be raised to between 18 and 20% of the energy mix. PV InfoLink estimates that solar installations will remain at 45 GW per year.

This rather conservative target is explained by the abolition of guaranteed tariffs. The absence of subsidies will make developers more cautious: the cost of materials has fallen, but non-technical expenses such as solar energy reduction, property tax, financing costs and pre-development costs account for 20% of the total costs of a project. With the abolition of payments by the government, new projects will find it difficult to achieve grid parity.

Added to this is the low availability of the network to absorb new production if the infrastructures are not adapted.

Schedule for the 14th plan: end of November, collection of comments and suggestions. End of March 2021, presentation of the official project. Second half of 2021, official announcement of the policy and related measures.

PV InfoLink of 24 September

Editor's note The lack of subsidies and guaranteed tariffs will dampen the developers' ardour for one or perhaps two years. Then, having controlled costs and the management of construction sites, the developers will find, as elsewhere, energy supply contracts with user companies. Although Chinese installations will still be weak in 2021, they will multiply from 2022 onwards.

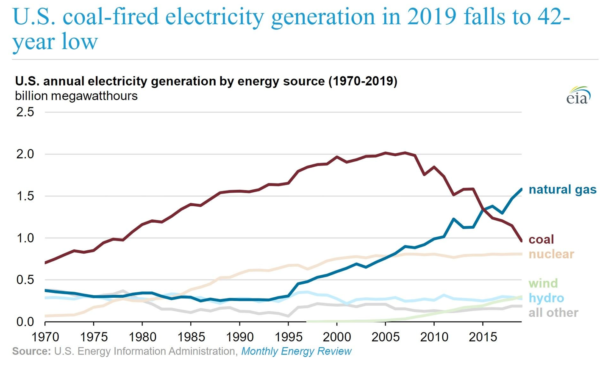

* American power companies are keeping their coal or gas-fired power plants

How will the United States remove 236 GW of coal-fired and 1,000 advanced gas-fired power plants currently in operation?

It is well known that the price of RE electricity is now cheaper than that from coal or advanced gas plants, but the latter are in operation, and to get rid of them you need good reasons.

85 GW of coal-fired plants have been shut down since 2007. The pace of closures appears to be accelerating as 31 GW have been retired since the beginning of 2018. This has led to a 30% drop in US coal-fired power generation in the first six months of 2020. Electricity from renewables increased by 5% in the first half of 2020. Thus, the real beneficiary of the decline in coal was natural gas production, which increased by 9% in the Americas in the first half of the year, according to the IEA.

The IEA says coal-fired power plants are simply "uneconomic in most regions" because of the low cost of renewables and falling spot prices for natural gas. Yet 236 GW of coal capacity is still operating in the United States.

Yet there is a trend to favour solar + storage over gas-fired power plants.

According to Rocky Mountain, retiring unprofitable units among the 236 GW in operation would save $10 billion. Closing the 236 GW would save an additional $9 billion. But power companies cannot abandon the assets of more than 1,000 peak units and 236 GW of coal capacity without a different regulatory and financial structure. That's why the study recommends that the government fund this transition so that the savings go to the consumer. Only many power companies prefer to keep their coal-fired or gas-fired plants.

The reasons for the status quo are said to be related to prejudices about oversupply of capacity and the advantage of self-generation. In addition, there is the corporate culture of the companies and the design of tariffs that favour gas-fired generation. However, some companies are ready to bet on new energies and on storage, as in California.

PV Magazine of 21 September

Editor's note Cultural resistance is well described in this article. We prefer to keep what we know rather than move on to something we don't know.

* Study recommends installing PV on all German roofs

The German government is banking on 100 GW of photovoltaic power being installed by 2030. A study commissioned by the electricity company Elektrizitätswerke Schönau indicates that installing panels on the roofs of homes with an average output of 100 kW should achieve most (140 GW) of the 170 GW needed to avoid electricity shortages and meet climate targets.

This would require the installation of 6 GW per year to 12 GW by 2024, rising to 14 GW per year from 2024 to 2030. This ambition depends on certain conditions: smart meters, market premiums, direct marketing by private individuals with an installation of more than 100 kW, development of large power plants without subsidies.

The study recommends making the installation of a solar system compulsory for all new buildings.

https://www.pv-magazine.com/2020/09/21/germany-could-add-140-gw-of-small-solar-by-2030/

PV Magazine of 21 September

Editor's note If you don't want to install power plants everywhere in the fields, you will have to place them on rooftops (or on water). Only a few kW can be collected on each roof. This means the multiplication of very small installations, which implies a different electrical and social organisation.

The mentioned volume of 6 GW per year is double the annual commissioning in Germany. This is still reasonable and feasible. Going to 12 GW in four years' time already seems more problematic because it requires installers and, above all, acceptance by the inhabitants of these installations in a very short space of time.

Such a study certainly starts from a good preconception, but there is no proof of its feasibility. Above all, it makes people believe that installing 6 GW, 12 GW, 14 GW every year is feasible if there is a government decision. Activists can seize on such a study to demand its application. This creates an ideological conflict between potential and reality.

.

.

THE PRODUCTS

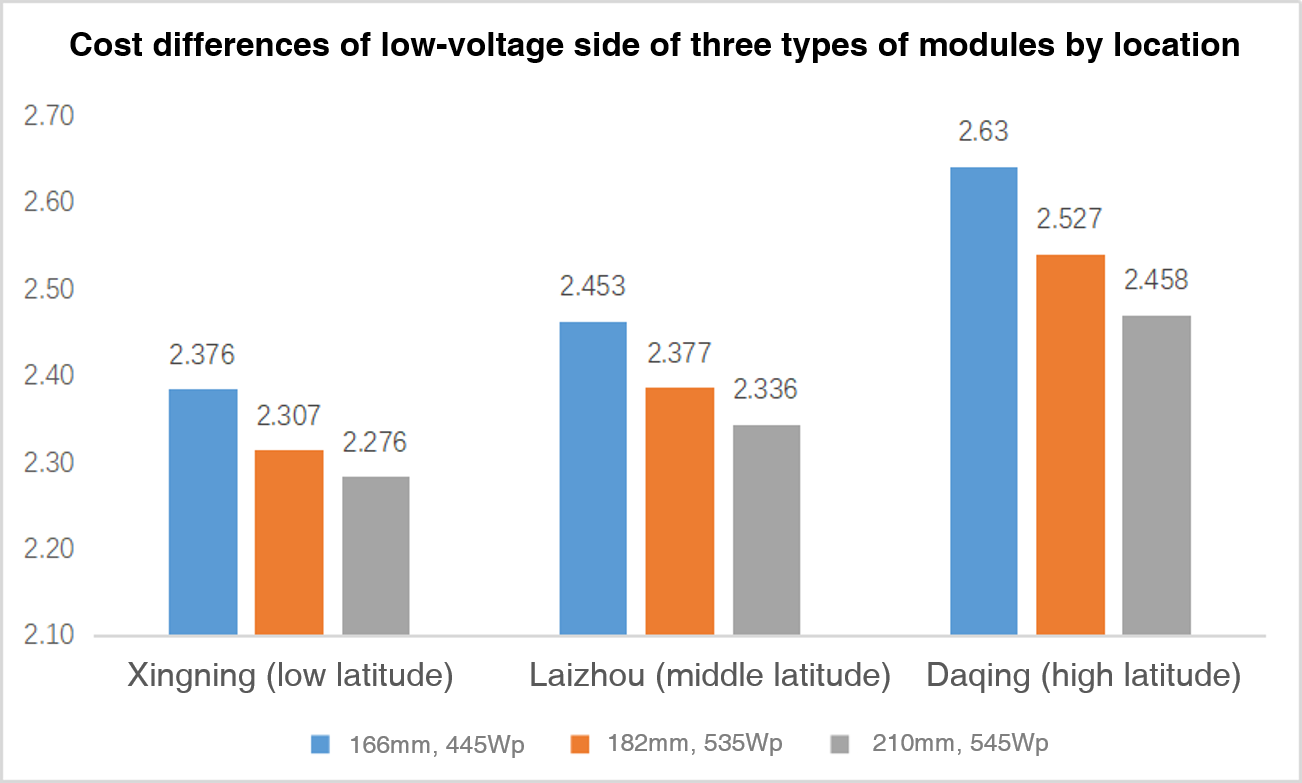

* Comparison between panels with cells of different formats

The debate on the 182 mm and 210 mm formats is resurfacing. Indeed, LONGi, Jinko and JA Solar have recently achieved volume production of panels based on 182 mm wafers.

The panel manufacturers are either looking to upgrade their production line to use the 182 mm format because the 72-cell panels have a power output of 535 Wp. Or to change their equipment to use 210 mm wafers, bringing the production power to 545 Wp. Thus, for the same surface area, the panels using the 210 mm cells have a power of 10 W more than those using the 182 mm format.

Panels using 210 mm wafers have an output power 23% higher than those using the 166 mm format.

The 55-cell panels using the 210-mm format outperform the 72-cell panels using the 182-mm format. Their open circuit voltage is reduced to 38 V. A single panel can combine 36 cells, increasing the output power to 20 kW. This reduces the cost of connections.

A comparison was made between panels using the three formats (210, 182, 166), joined together in the same place, with a string inverter, and compared with a 100 MW PV plant. The aim was to measure the cost of low voltage panels.

For all three panels, the cost decreases as the nominal power increases. In particular, it is lowest for the 210 mm (545 Wp) panels in all test locations. There is a cost difference of 0.1 - 0.17 RMB/W between 210 mm (545 Wp) and 166 mm (445 Wp) panels, and 0.03 - 7 RMB/W (sic) between 210 mm (545 Wp) and 182 mm (535 Wp) panels.

"This means that high-power panels with string inverters have lower costs. Experience shows to what extent the cost of low voltage has been reduced among the high power output panels. The cost estimate takes into account the geographical characteristics of the test sites, the difficulty of installation, the system configuration and the actual state of the PV systems".

"High-power 210 mm panels and string inverters provide impressive cost savings on the low-voltage side, as low voltage increases the power of a string of panels by about 20 kW. As the panels get bigger and bigger to achieve higher power and lower LCOE, it is interesting to see how low voltage panels reduce the cost of the system".

PV InfoLink of 28 September

Editor's note If there was still any doubt, it is raised in favour of a cell format of 210 mm. This format is the future and manufacturers will soon migrate to it.

Having realised that they had to move towards larger sizes, manufacturers will soon imagine a new, larger format. The 210 mm size will soon age in favour of a larger format!

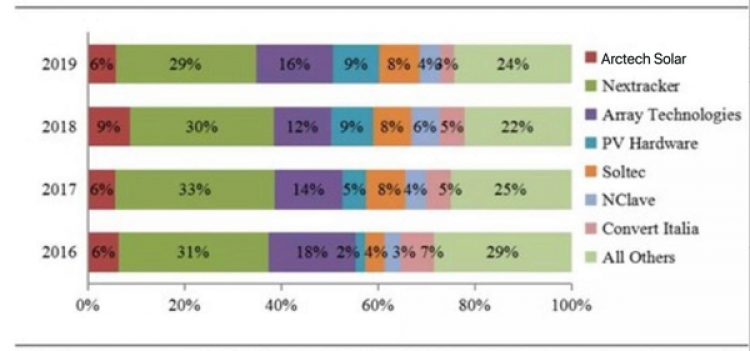

* Trackers, a fast-growing PV niche with a good margin of profit

The tracker market has attracted attention with the recent IPO of China's Arctech Solar, Trina Solar's acquisition of the remaining shares in Nclave, and the announcement of an upcoming listing of Array Technologies. The sector is showing stable returns. This market seems to be growing exponentially.

A Chinese study indicates that if the cost of a system is 3.5 to 4 RMB/watt, the fixed tracker costs 0.3 RMB/watt and the profit reaches 0.2 RMB/watt. A tracker with fixings costs 0.6 RMB / W and leaves a benefit of 0.05 to 0.06 RMB / W.

This allows us to calculate the market volume: if the average price is 0.4 RMB / W and the installed capacity is 200 GW (Editor's note: where does this figure come from? Annual installations are 100 GW and installed capacity since inception is 600 GW), the market value of the tracker industry is around 80 billion dollars, which is roughly equivalent to that of the solar inverter industry.

Artech Solar's figures show a stable price per watt which is rare in the PV industry :

|

2017 |

2018 |

2019 |

|

|

Price per watt, yuan / watt |

0.41 |

0.46 |

0.43 |

|

Racking tracker price |

0.69 |

0.69 |

0.68 |

|

Fixed tracker price |

0.32 |

0.34 |

0.30 |

|

Gross profit per watt, yuan/watt |

0.07 |

0.09 |

0.10 |

|

Gross profit of racking tracker |

0.13 |

0.16 |

0.18 |

|

Gross profit of fixed tracker |

0.05 |

0.06 |

0.07 |

|

Net profit excluding extraordinary profit and loss/watt |

0.01 |

0.02 |

0.03 |

The market share of the different tracker manufacturers :

The two main manufacturers worldwide remain NEXTracker and Array Technologies. The market share of the top five manufacturers is 68%, while the top ten manufacturers account for 88% of the market. Thus the market is highly concentrated and also presents a geographical concentration.

On a global level, in 2019, 35 GW of rack-mounted trackers were installed, an increase of 63% compared to the previous year, with a growth rate much faster than that of the photovoltaic industry in general. According to the Chinese CPIA, in 2019, tracking systems were used in about 16% of new solar installations in China. This market share is expected to increase to 25% by 2025.

In 2019, tracking installations in the US reached 12.1 GW, up 226% from 2018. In the EMEA region, Spanish suppliers such as PV Hardware and Soltec dominate the market.

This growth and profitability has certainly prompted Trina Solar to acquire the remaining capital of the Spanish company Nclave. He says that trackers are one of the main materials for his intelligent PV solution. He proposes the integration of the panels with the trackers.

Despite this very buoyant market, a large number of newcomers are rapidly disappearing. This means that established producers with proven technologies still have the upper hand in the market.

PV Tech of September 23rd

* Vanadium redox flux batteries will only work well with a future membrane.

The membranes must have the following characteristics: conductivity, stability, resistance, vanadium permeability, preferential water transport, which implies a specific morphology. Scientists from the University of Applied Sciences in Rotterdam and the University of Warwick summarise that "the ideal membrane should have a high water selectivity.ion exchange selectivity, high ion conductivity, low water absorption, low swelling, high conductivity, high chemical and thermal stability, and low cost", say the scientists from Rotterdam University of Applied Sciences and Warwick University.

This battery presents the obstacle of a high investment and maintenance cost, as the membranes are an important part of it. This is compounded by the limited operational life of current technology and its low conductivity at high current densities.

The most commonly used membranes are perfluorinated polymer ion exchange membranes. They ensure high conductivity and stability of the ions in acidic and oxidising electrolyte solutions. Nafion, produced by DuPont, is the most commonly used material for these membranes. Its disadvantage is its long-term stability and high price.

Other products are being investigated such as sulfonated aryl skeleton polymers like SPEEK, SPES and SPESK, or anion exchange membranes (AEM).

https://www.pv-magazine.com/2020/09/22/best-membrane-for-vanadium-redox-flow-batteries/

PV Magazine of 22September

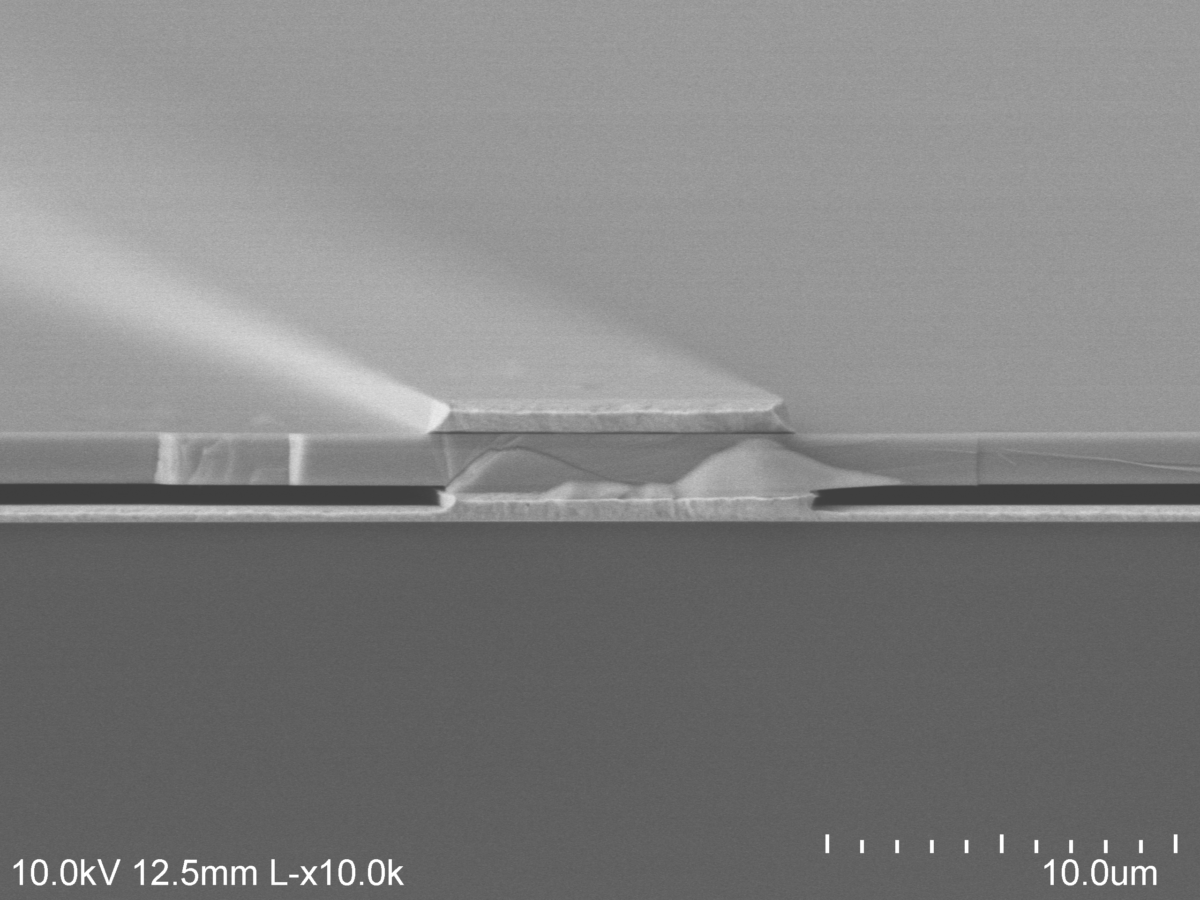

An air-bridge thermo-photovoltaic cell achieves an efficiency of 30% and a reflectance of 99%.

American scientists at the University of Michigan have developed a thermo-photovoltaic (TPV) cell that could be coupled with inexpensive thermal storage to provide energy on demand. The TPV cell is made of indium gallium arsenide (InGaAs). It absorbs most of the radiation to produce electricity, and acts as a near-perfect mirror.

It has an air gap (dark grey in the graph) between the gold substrate and the semiconductor. This air cavity reduces out-of-band photon (OOB) losses by more than four times compared to conventional POS cell architecture.

Thermal storage can be achieved using renewable electricity or high-temperature solar heat.

These cells would be useful for power utilities and developers of large energy storage facilities. They could also be used in unmanned aerial vehicles or astronomical probes, to recover electricity from waste heat or to provide decentralised heat and power.

PV Magazine of 23 September

.

.

THE COMPANIES

* Jinko Solar in the 2nd quarter: sales and profit growth

In the second quarter, Chinese panel manufacturer JinkoSolar shipped 4,469 MW of panels (+31% over last year) for sales of RMB 8.4 billion, or $1.2 billion (+22% over 2019). The gross margin reached 17.9% (compared with 16.5% last year); this increase is due to the larger share produced by the company, which made less use of subcontracting. Operating profit for the second quarter was RMB 435 million (+37% over 2019). Net income for the quarter was RMB 318 million ($47 million) or +154% over 2019. As a result, profitability was significantly improved.

Demand for solar panels fell during the second quarter due to the economic slowdown caused by the Covid-19 pandemic. However, large integrated manufacturers with large production capacity and commercial infrastructure were able to gain market share and better resist fluctuations in panel prices.

JinkoSolar expects to deliver 5 to 5.3 GW of panels in the third quarter, and 18 to 20 GW of panels this year.

https://www.pv-magazine.com/2020/09/23/jinko-posts-47m-second-quarter-profit/

PV Magazine of September 23rd

.

.

MISCELLANEOUS

* Airbus is working on clean aircraft but warns of its cost and constraints

Airbus estimates that zero-emission commercial aviation will be ready by 2035. Three aircraft models have just been presented. The first, comparable in shape to a current model, could carry 120 to 200 passengers and would use gas turbines running on burning hydrogen. It could be equipped with a hydrogen-powered electric motor when additional power is required. It would have a range of 3,700 km.

The second model is a propeller turboprop. It would carry about 100 people and would also use hydrogen combustion in modified gas turbines to produce energy. It could travel up to 2,000 km.

The third could carry 200 passengers and would have a range of almost 4,000 km, with a relatively wide fuselage to accommodate passengers and hydrogen. Here too, Airbus plans to use a combination of hydrogen combustion and fuel cell reaction to optimise the power supply.

While hydrogen has the same energy level as paraffin and accounts for only a third of the weight, hydrogen occupies four times the volume of conventional fuel, making it difficult to use in long-haul flights. Hydrogen should be cooled to -253° Celsius. (Editor's note: close to absolute zero at -273°C). to make it liquid, increase its density. In any case, part of the fuselage should be used to contain hydrogen rather than passengers.

According to Airbus, "the challenge of decarbonising aviation is such that we have no intention of meeting it alone," and the transition to hydrogen would require billions of euros, counting on the cost of hydrogen falling.

Responding to a request from the European Union, McKinsey, in June 2020, estimated that hydrogen flights would only add around 10% to the cost of plane tickets for short-haul flights, or around 5 to 10 dollars. Medium-haul hydrogen flights would require a 30-40% increase in ticket prices because the planes would carry fewer passengers and use 25% less in-flight energy consumption. Passengers on long-haul flights would have to pay 40-50% more for hydrogen technology.

https://www.pv-magazine.com/2020/09/21/airbus-charts-path-to-zero-emission-aviation-by-2035/

PV Magazine of 21 September

McKinsey admits that the switch from paraffin to hydrogen will make airfare a little more expensive. Airbus is clearer, it will cost billions of dollars more, regardless of the airline tickets, which are paid for by the passengers. Since McKinsey's estimate is the result of an order, it is unreliable.

Multiplying the volume of fuel by four is not catastrophic except that it deprives the plane of paying seats and increases the cost of available seats. As for cooling the hydrogen to -253° Celsius, this does not seem reasonable in current use.

.