L R AS Published on Monday 21 September 2020 - n° 332 - Categories:Thread of the Week

Le Fil de la Semaine n° 332 of September 21st

THIS WEEK'S NEWS HIGHLIGHTS

If there were only five texts to read this week :

FRANCE

* Will the French State renegotiate the buy-back contracts signed before 2011?

* Will the French State renegotiate the buy-back contracts signed before 2011?

THE WORLD

* The European Commission reviews its objectives and indicates how to receive loans and grants.

* The European Commission reviews its objectives and indicates how to receive loans and grants.

* What effects will the American elections have on renewable energies?

* What effects will the American elections have on renewable energies?

PRODUCTS

*You win (a little) with the double-sided and with the vertical panels on the followers.

*You win (a little) with the double-sided and with the vertical panels on the followers.

.jpg) * Nobody knows how much lithium there is on earth!

* Nobody knows how much lithium there is on earth!

.

Other interesting articles :

FRANCE  *The renegotiation of purchase prices is not just a rumour

*The renegotiation of purchase prices is not just a rumour

![]() * CVE brings Intermediate Capital into its capital for €100 million

* CVE brings Intermediate Capital into its capital for €100 million

.

THE WORLD * Will the energy transition fall victim to bad China-Europe relations?

* Will the energy transition fall victim to bad China-Europe relations? * SEIA union wants more PV industries in the US

* SEIA union wants more PV industries in the US

* Storage facilities have never been more important in the United States..

* Storage facilities have never been more important in the United States..

.

THE PRODUCTS * How do silicon-perovskite tandem cells react to strong insolation?

* How do silicon-perovskite tandem cells react to strong insolation?

* Is it possible to reduce the thickness of the wafers (currently 180 microns or µ)?

* Is it possible to reduce the thickness of the wafers (currently 180 microns or µ)? * The complementarity between hydrogen / electricity / heat is great but the cost of hydrogen limits its use.

* The complementarity between hydrogen / electricity / heat is great but the cost of hydrogen limits its use.

.

LES COMPANIES * Daqo further increases its production of silicon and wafers.

* Daqo further increases its production of silicon and wafers.

.

MISCELLANEOUS * Why not reproduce photosynthesis rather than using hydrogen?

* Why not reproduce photosynthesis rather than using hydrogen?

THE DEVELOPMENT OF THESE TITLES

.

FRANCE *Will the French State renegotiate buyback contracts signed before 2011?

*Will the French State renegotiate buyback contracts signed before 2011?

The newspaper Les Echos says that the government is considering renegotiating the buyback contracts granted by the government to solar energy projects before 2011 after the Court of Auditors in 2018 ruled that the incentives were too generous. The aim is to save €600m. The change would be made in the Finance Law for 2021.

The Court of Auditors states that "the tariffs granted before 2011 will represent €2 billion per year until 2030 (i.e. €38.4 billion in total) for a production volume equivalent to 0.7% of the electricity mix".

Such a revision of the tariffs would be unprecedented and would risk generating numerous disputes with the State. Other commentators believe that this would call into question the climate objectives for 2050.

X. Daval believes that if the tariffs at the time (ten years ago) seem disproportionate compared to those of today, the amount of investment to be made in 2010 would correspond to the price of the panels, which were worth 3 euros per watt (i.e. ten times more than at present).

The French government retroactively cut incentives for offshore wind power two years ago, after a long battle with the fledgling industry.

https://www.pv-magazine.com/2020/09/16/french-government-considers-cutting-pre-2011-fits/

PV Magazine of 16 September

Editor's note While the State spends tens of billions of euros trying to keep different sectors of the French economy going, it is surprising that it seeks to save some 600 million a year.

In our situation (it's a fact that the Actualité du Solaire has invested in photovoltaic panels), the amount of our investment made in December 2018 with commissioning in April 2019 cost us €21,278. This is a 2.58 kW installation. By selling all the production to EDF, it has made it possible to collect €16,525 since its installation, resulting in a deficit of €4,753 on the amount of the installation.

* The renegotiation of feed-in tariffs is not just a rumour

* The renegotiation of feed-in tariffs is not just a rumour

The information in the newspaper Les Echos about a renegotiation of the purchase price was not just a rumour.

According to the trade unions Enerplan and the SER, only installations of more than 250 kWp built before 2011 would be affected, but they are furious to learn the news from the press. This measure would only affect 850 contracts. Private individuals and the farming community would be effectively spared by this measure. According to some sources, the administration would determine on a case-by-case basis whether or not the contract is "over-profitable". It would seem that certain contracts of more than 250 KW that do not show such an over-profitability would not be concerned by this renegotiation. The contracts concerned by this renegotiation would be subject to a reduction in their duration by a few years and there would be no reimbursement of payments already received.

Tecsol of 17 September

NDLR On what criteria will the Administration claim that there is too much profitability? What will the unfortunate owner of facilities be able to do in the face of an all-powerful bureaucracy? Only arbitrariness will dominate. If he has not finished paying back his initial loan, how will the bank react? By raising the interest rate on the loan? By putting the PV plant up for sale? Really the change of formula is not clear!

+

SER and SER-Soler emphasise the "catastrophic consequences" of contract termination for power plant builders, operating companies, banks and insurance companies. They recall the effects of such a questioning on the Italian and Spanish players when they had been confronted with the same similar decision.

They do not hesitate to mention the endangerment of the solar sector. They fear the halt of all industrial establishment projects in France. By questioning its word, the State would generate a massive and lasting mistrust of its own commitments.

Tecsol of 17 September

+

The same indignation from Daniel Bour, president of Enerplan, who asks to be received as soon as possible by the Minister of Energy Transition.

Tecsol of 17 September

* CVE brings Intermediate Capital into its capital for €100 million

* CVE brings Intermediate Capital into its capital for €100 million

The CVE Group is raising €100 million in equity capital from the British Intermediate Capital Group to finance its growth. CVE aims to increase its production capacity by a factor of 8 by 2025, reaching 2.3 GW in operation and under construction. Following this operation, CVE's partners will retain control of the company.

CVE recently signed its first RespeeR contracts, its local green electricity solution for businesses and communities, launched its Halo community solar offer in the United States, is deploying bifacial power plants in Chile and France, and is interested in floating solar power plants.

This is the moment that Christophe Caille chose to announce his departure from the presidency of the CVE Group to devote himself to the philanthropic movement "Entrepreneurs for the Planet" that he created in 2019.

Full Sun of September 14th

.

.

THE WORLD * Will the energy transition fall victim to bad China-Europe relations?

* Will the energy transition fall victim to bad China-Europe relations?

For a long time, China has seemed an attractive trading partner to Europeans. In June 2014, British Prime Minister D. Cameron signed a £14bn ($18.5bn) contract with China, including £400m for the energy sector with ZN Shine. At the same time, Huawei eliminated British inverter manufacturers.

In October 2015, a new agreement was signed for China General Nuclear Power Group (CGN) to take a one-third stake in the new Hinkley Point C nuclear power plant.

Very quickly, times changed. ZN Shine ceased operations in Europe in 2015 after violating EU trade rules. Huawei's telecommunications infrastructure is being removed from the UK's emerging 5G mobile network. Hinkley Point C could be the first and last UK nuclear power plant built with Chinese investment as legislators question the safety implications.

A number of factors are contributing to this deterioration :

the ongoing trade wars, Hong Kong's new National Security Act, the alleged withholding of information in the early days of COVID-19, the treatment of Uighurs in Xinjiang province. China has moved from being an economic competitor to a strategic or systemic rival.

China wants to limit access to key elements of the energy transition. The "made in China 2025" focuses on ten key sectors that the country wants to dominate in five years, including electrical equipment, renewable energy and electric vehicles.

Limiting or banning Chinese exports to the West

Could China ban exports of certain products to the United States or Europe? It seems so. We can see this with the ban on exporting its rare earths to the US. China takes a dim view of the development of local supply chains in foreign countries for "energy transition technologies. This trend is evident for electric vehicles as well as for solar energy. Some national and regional governments want to stimulate the manufacture of photovoltaic products.

The West is wary of some Chinese companies

This trend is reinforced by the West's growing desire to target certain Chinese companies: after having accepted the use of Huawei's infrastructures to build the UK's 5G mobile telephone network, the British government did an about-face this year. All Huawei equipment must now be retroactively removed from the British network by 2027. After the change in attitude towards Huawei's 5G, China threatened to end its support for nuclear production in the UK.

In America, Huawei withdrew its solar business entirely from the US after a group of senators proposed banning Huawei inverters from the market.

The EU has tightened its investment filtering rules to give member states more leeway to block foreign direct investment or M&A activity for security reasons. Foreign direct investment from China into Europe fell by 50% between 2016 and 2018.

China Three Gorges (CTG)'s bid to buy Portuguese company EDP - one of the world's largest renewable energy developers - was finally thwarted by the company's shareholders. There are other examples where governments have stopped China's investments, particularly in grids. The Australian government blocked the sale of a majority stake in AusGrid in 2016.

China does not like measures restricting its increasing penetration

Another source of friction is that the EU has made a future carbon tax on imports from non-EU companies a major policy in its economic recovery plans. Such a carbon tax, for example on Indian steel, would prevent the EU's CO2 emissions from being outsourced to foreign suppliers. For some, it is a protectionist policy disguised as a green agenda. China has said any move by the EU to impose its carbon border adjustments will not be welcomed.

GreenTech Media of 14 September

* The European Commission reviews its objectives and indicates how to receive loans and grants.

* The European Commission reviews its objectives and indicates how to receive loans and grants.

The EU will increase its 2030 emission reduction target to "at least 55%" from 40% previously. The President of the European Commission has just announced this. This is an intermediate level between the States that were satisfied with 40% and those that advocated 65%. This heralds an increase in demand in the renewable energy sector.

Other proposals will be presented next summer, but the global climate objective for 2030 should be sufficient to give the market immediate confidence. Further details were also revealed on the €672.5bn ($807bn) stimulus package of the "Green Deal". 37% of the funds will have to be used to meet clean energy targets. To access the €672.5bn in grants and loans available under the recovery plan, countries will submit investment proposals aligned with EU policy goals. The EU will then distribute this funding. Plans must be submitted by April 2021 and implemented by 2026.

The European Commission estimates that to keep warming below 1.5 degrees Celsius, 450 gigawatts of offshore wind power would be needed. This is in line with the timetable of the professional body WindEurope, which recommended 7 GW of offshore wind energy per year until 2030, and 18 GW each year thereafter. This compares to the 3.6 GW of wind turbines deployed at sea in 2019.

Oil consumption will have to fall by a third within ten years, while transport powered by renewable sources - including electricity, biofuels and green hydrogen - will have to increase to 24% of the total.

The exact pace of growth needed in renewable energy is currently the subject of a commission consultation before it presents its plan in June. To kick-start the process, a €1bn innovation fund was opened immediately.

A mechanism being developed will propose that a country can invest in another country and account for emission reductions achieved as part of its own targets.

The EU has developed a strict definition of what it considers "sustainable". Natural gas has not been reduced.

GreenTech Media of 17 September

Editor's note What's great about making commitments at thirty is that you can say anything, please anyone, propose objectives, especially if they are unattainable. At the moment, it pleases and disarms critics, makes people believe that they have been heard and that the world will follow this programme. Then comes an obstacle and the attractive programme is forgotten. Even without a formal obstacle, another concern will arise in the public opinion, and the beautiful programme will be neglected. So let's take these statements to satisfy the environmentalists, who were making a lot of noise without much thought about how to achieve their 1°C or 2°C climate rise, and who had to pay.

For example, the 450 gigawatts of wind power will soon be forgotten when a ship hits a wind turbine platform or platforms. Even without shipwrecks and deaths of sailors, where will we put these wind turbines which should be 112.500 in case of unit power of 4 megawatts (which are the most modern) or 225.000 with 2 MW engines, which are the current ones! Well before half of them are installed, it will be understood that their installations are impossible.

What a joke to offer loans, grants and subsidies for projects to be proposed before April 2021! The deadline is so short that a probably very small fraction of the €672 billion will be allocated. The Commission is proposing an amount that it knows cannot be reached. Today we welcome such an amount. Tomorrow (in July 2021), we will see that the offer was a dead end! By then the proposed amount will have been forgotten, the Commission will have obtained what it was looking for, an image of saviour of the European economy...

Perhaps that's what politics is all about! Making promises without even taking into account realities

* What effect will the US elections have on renewable energy?

* What effect will the US elections have on renewable energy?

We can be sure that RE will continue to prosper thanks to its competitiveness and broad political support.

Mr Trump has done his best to support fossil fuels, but this has not been at the expense of renewables. Many coal-fired power plants have been shut down. Coal companies have gone bankrupt. Major oil and gas pipeline projects have been abandoned or halted by legal action. Several federal measures have been thwarted at the state level. Many states have set targets of zero carbon or 100% renewable energy by mid-century.

The main electoral battleground for energy and climate policy appears to be the Senate, where one-third of the seats are up for election, mostly held by Republicans. Joe Biden has pledged to put the country on the path to energy decarbonization by 2035, but his options for changing that course will be limited if coal-friendly Republican Congressman Mitch McConnell of Kentucky remains Senate majority leader.

If the Democrats gain a majority in both the Senate and the White House, Joe Biden's ambition is to achieve 100 percent clean energy by 2035. This would force states and power companies to accelerate their transformation. The Democratic candidate promises to spend $2 trillion on decarbonizing the economy in his first four years in office, which will spur massive growth in renewable energy generation capacity and grid balancing capacity. Over the next ten years, this would cost $4,500 billion with a significant increase in carbon-free generation capacity and transport and storage infrastructure.

Solar energy :

The American solar market has flourished over the last four years. The industry is expected to add more than 18 GW in 2020, a new record. All this has been achieved despite Section 201 tariffs, the decline in the federal investment tax credit and an uncertain political landscape. Installations could reach 20 GW in 2022. This forecast would be revised upwards in the event of Joe Biden's election. The driving force behind the facilities has been the 30% federal investment tax credit. This rate declines gradually. Joe Biden has promised to restore this tax credit.

Storage :

Under Trump's mandate, there were the four best years (2017 to 2020) of annual storage facilities. These have more than quintupled, more than during Barack Obama's second term as president. Trump does not mention storage in his programme.

Joe Biden believes that storage needs funding for research and development to link it to small modular reactors, green hydrogen and carbon capture. The biggest impact would come from 100% clean electricity by 2035, which would make new gas plants unnecessary and force utilities to build storage facilities.

https://www.greentechmedia.com/articles/read/whats-at-stake-for-clean-energy-in-the-us-election

GreenTech Media of 15 September

* SEIA union wants more PV industries in the US

* SEIA union wants more PV industries in the US

If the United States has a panel production capacity of 7 GW per year, this corresponds to a third of the annual installations. The American union SEIA estimates that the US should have a production capacity of 100 GW of renewable energy (solar, wind, storage).

The organisation calls for major investments by the states and the federal government to develop a wide range of products for solar energy. To reach the 100 GW target to make solar energy 20% of the total US electricity production by 2030, industrial capacities for the production of ingots, wafers, cells, solar glass and machine tools need to be developed. It would also be a question of increasing the national availability of key metals for batteries, notably nickel, manganese and cobalt.

The last ten years have shown global competition and the intervention of foreign governments in export markets. For example, American manufacturers have limited access to the Chinese market since 2013 due to customs duties. SEIA stresses the need not to be overly dependent on imports. Incentives should support the growth of US renewable energy production and encourage US and foreign manufacturers to invest in US production capacity. The US government must invest in its manufacturers to be competitive.

The importance of long-term investment includes both supply and demand incentives, as one without the other cannot sustain a strong U.S. renewable energy manufacturing base in the face of intense global competition". SEIA calls for many measures to encourage investment and manufacturing.

PV Tech of 14 September

Editor's note Coronavirus or not, all countries are becoming aware of their dependence on China and want to do something about it. If not all of them will succeed, reductions in dependency should emerge.

* Storage facilities have never been more important in the United States.

* Storage facilities have never been more important in the United States.

Even as the coronavirus pandemic this spring plunged the US economy into recession, the energy storage industry had its second best quarter in terms of megawatts installed. 48.7 megawatts / 112 megawatt hours were installed in the second quarter, a 10% increase over the previous quarter. This is the fifth consecutive quarterly record for residential storage deployments. This is curious because the installation of batteries usually complements the installation of solar panels, which is especially the case in California and Hawaii. However, the installation of residential panels fell by 25% in the second quarter.

The first phase of LS Power's Gateway battery, as well as projects in Oklahoma and Massachusetts, helped to increase the total of storage installations to 168 megawatts / 288 MWh in the second quarter.

The storage deployed annually is expected to exceed GW for the first time in the US market.

https://www.greentechmedia.com/articles/read/q2-was-second-best-quarter-ever-for-us-energy-storage

GreenTech Media of 9 September

.

.

THE PRODUCTS

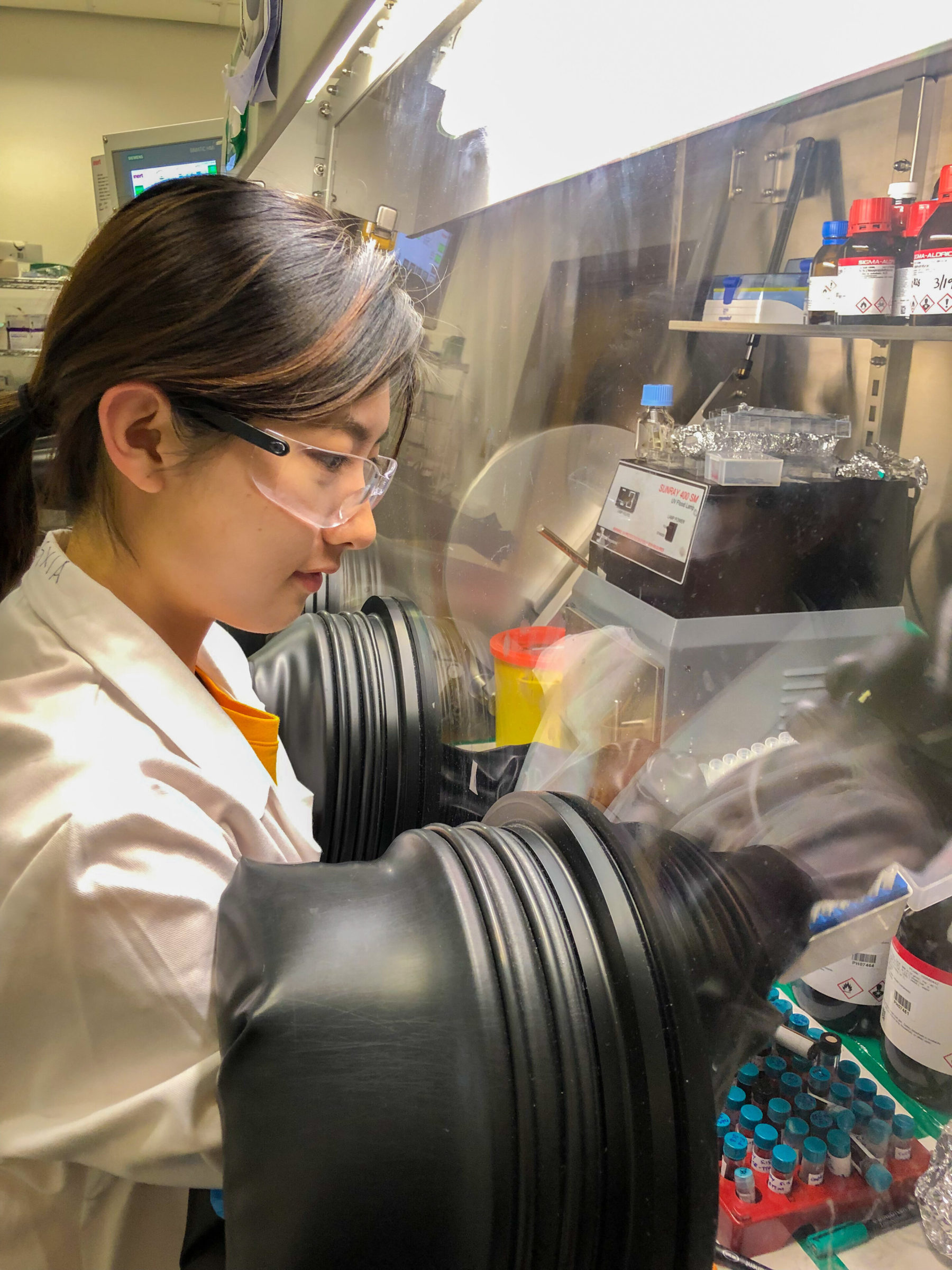

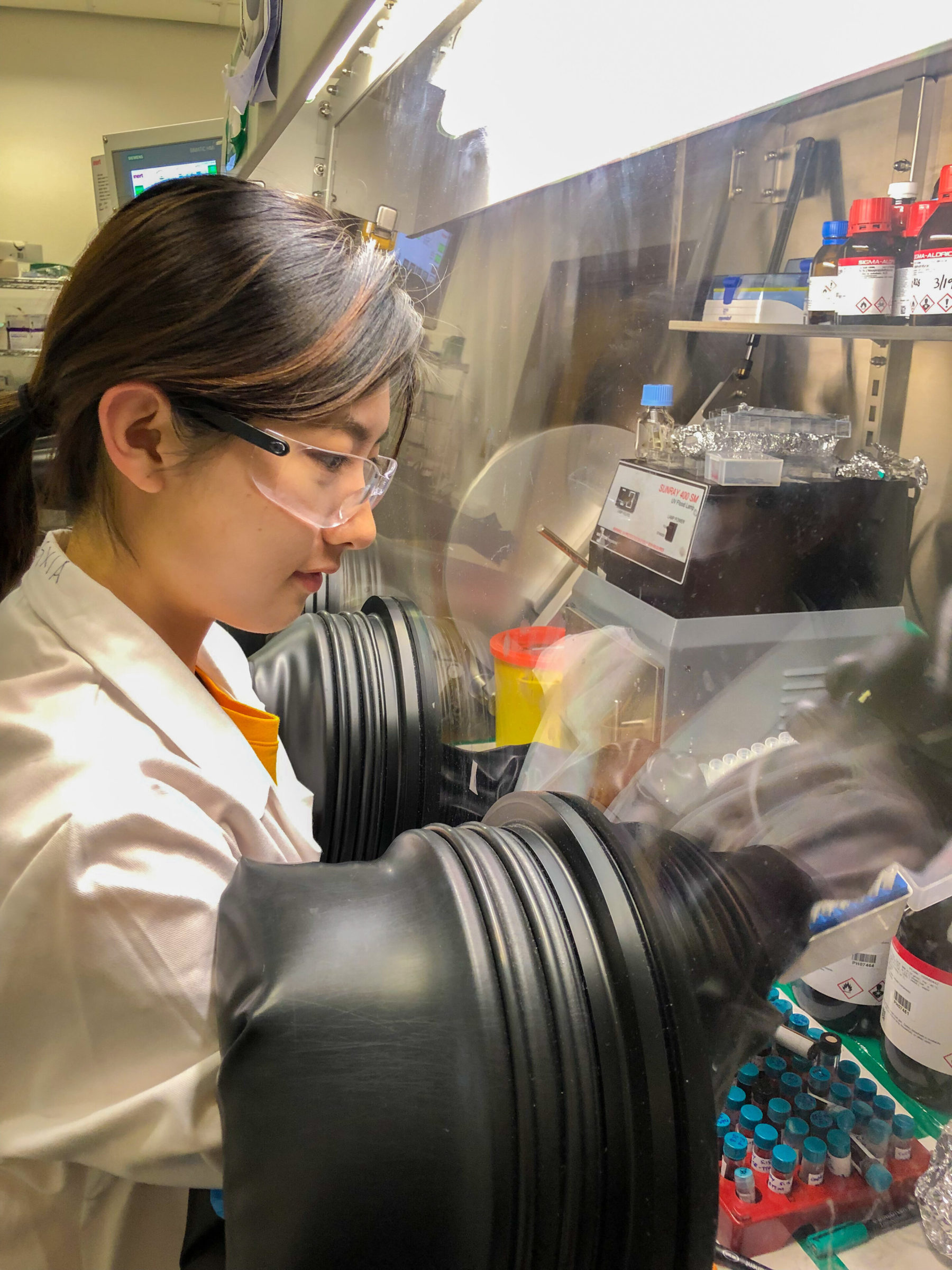

* How do silicon-perovskite tandem cells react to strong insolation?

* How do silicon-perovskite tandem cells react to strong insolation?

In Saudi Arabia, different cells have been placed to test their reaction at high temperatures. Although each cell was set to match the current of the other to prevent the cells from interfering with each other's performance, it was found that the two cells had opposite reactions at very high operating temperatures. This is because the bandgap of the silicon cell is smaller while that of the perovskite is larger. For tandem cells optimised to operate under laboratory conditions, the temperature actually drives the device away from its ideal operating point.

At operating temperatures above 55°C, perovskites with a bandgap of less than 1.68 electron volts under standard test conditions will perform best in a tandem device with a silicon cell.

"This implies that bromide perovskites with a narrower bandgap under standard test conditions (and therefore better phase stability) hold great promise for the commercialization of perovskite-silicon tandem solar cells.

https://www.pv-magazine.com/2020/09/16/tandem-cells-head-outdoors/

PV Magazine of 16 September

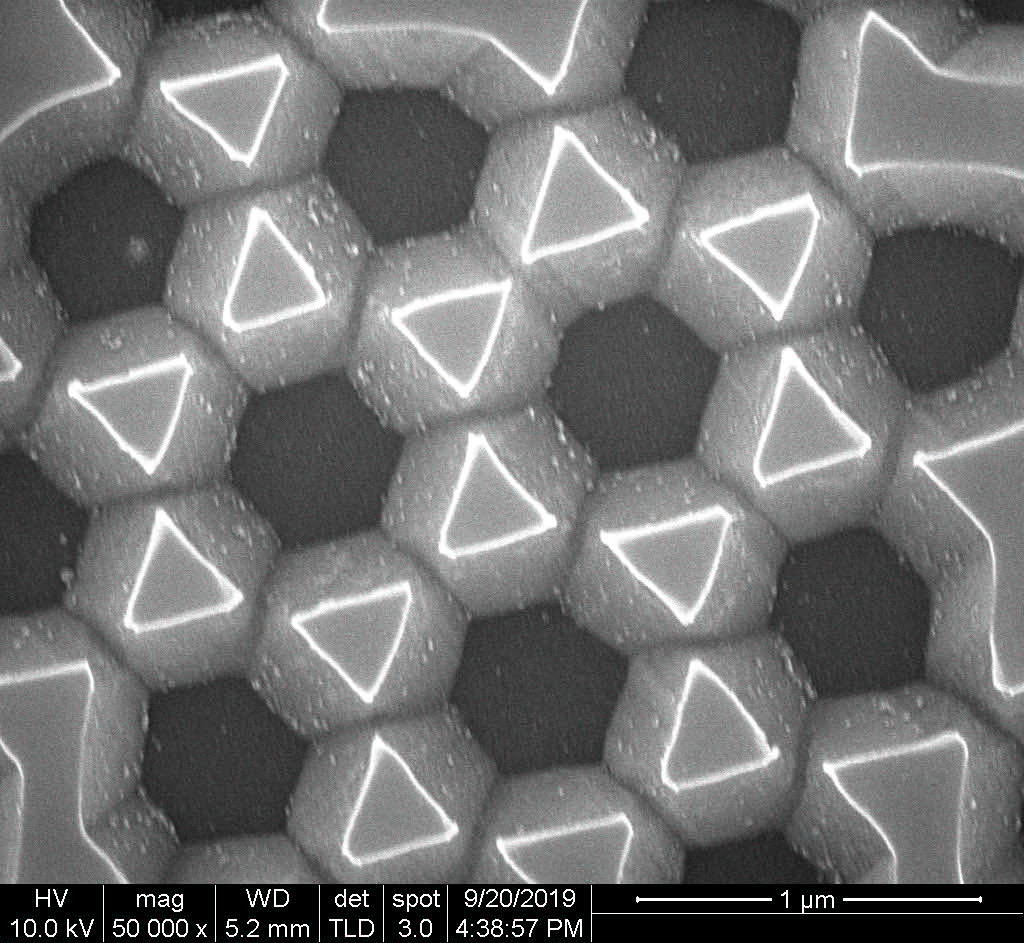

* Is it possible to reduce the thickness of the wafers (currently 180 microns or µ)?

* Is it possible to reduce the thickness of the wafers (currently 180 microns or µ)?

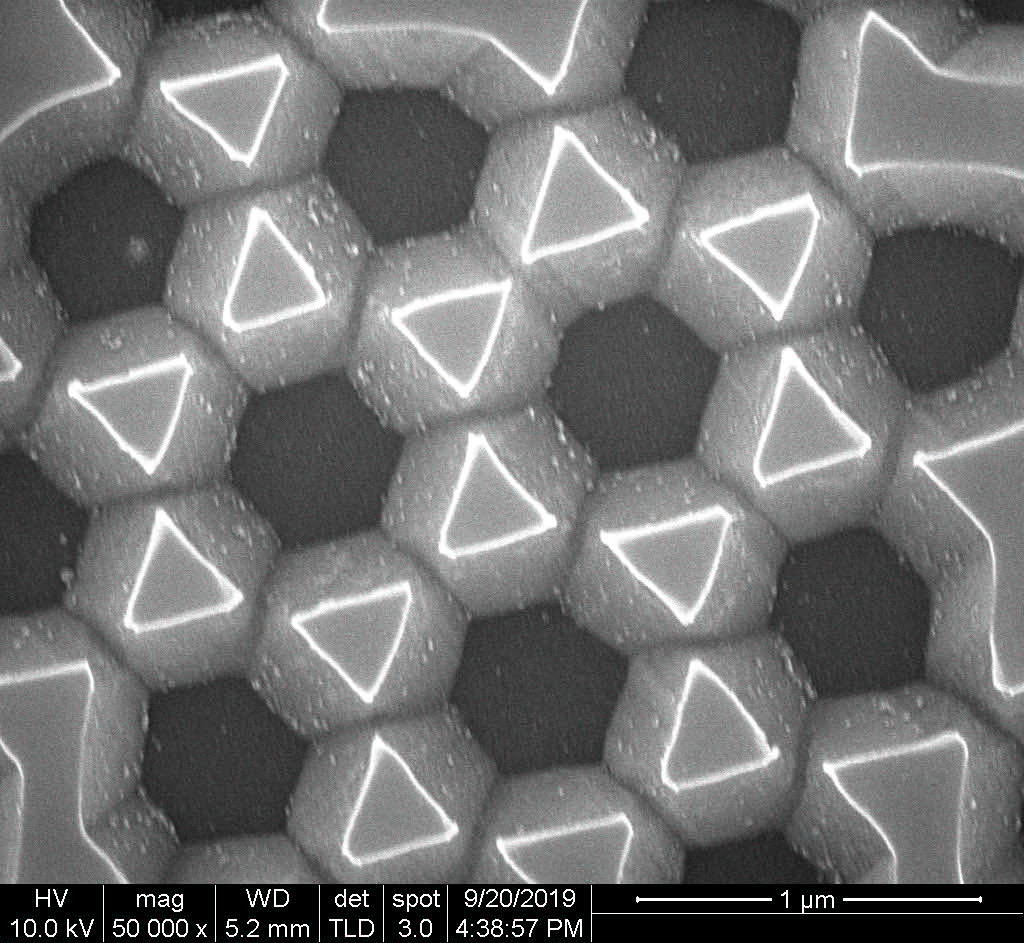

Korean scientists at the KIST have engraved tiny pyramids on the surface of a 50-micron thick silicon cell. They used a combined process of nanosphere lithography and wet etching to make cells with a near hexagonal nanostructure on their surface.

They have shown that these cells, which are of course lighter, are also more flexible: the breakage of thin textured wafers with nanostructures would be considerably reduced, compared to wafers textured in a conventional manner (micro-pyramids).

These cells can be used for other applications and would have higher yields.

https://www.pv-magazine.com/2020/09/16/nanostructures-for-ultrathin-flexible-wafers/

PV Magazine of 16 September

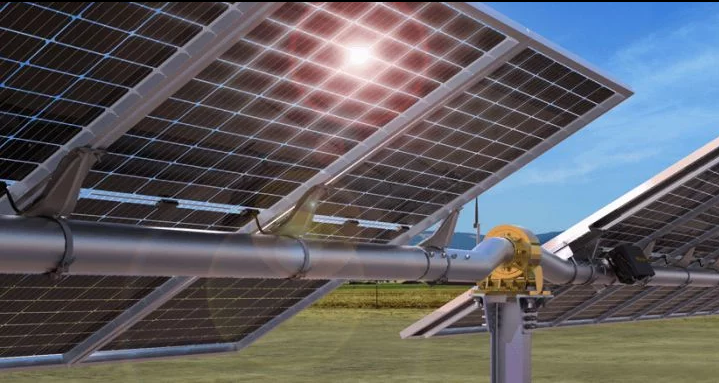

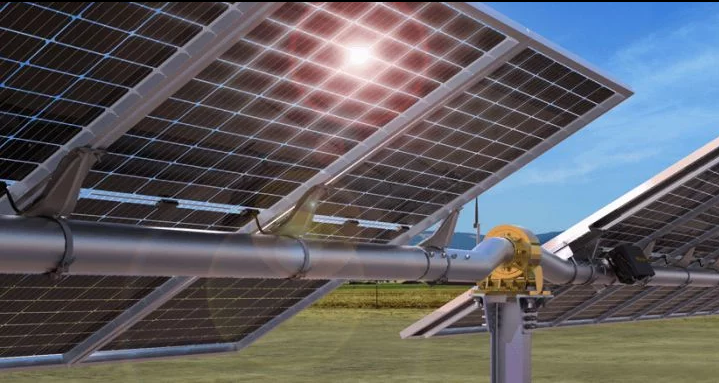

* You win (a little) with the double-sided and with the vertical panels on the followers.

* You win (a little) with the double-sided and with the vertical panels on the followers.

NEXTracker will supply 1 GW of single axis trackers for the fifth phase of the huge Mohammed bin Rashid Al Maktoum solar park in Dubai.

The manufacturer has analysed the extra solar yield offered by two-sided panels compared to single-sided panels, both mounted on single-axis trackers. It claims that the efficiency gain is 5% to 7% in the case of low albedo (20%), which is the case when the panels are installed above grass, gravel or sand. The gain reaches 10 to 12% on a site with high albedo (50%) such as on snow or white fabric.

The manufacturer also found that the gain increased by 0.6 to 1.2% when the panels were placed vertically and not horizontally due to the increased distance from the ground.

The results from PV Evolution Lab and NREL confirm those of NEXTracker: there is only a 3% difference in the case of high albedo and a 1% difference in the case of low albedo.

PV Magazine of 18 September

Editor's note The increase in yield from two-sided panels is now more reasonably estimated, with an increase of 5% to 7% over sand, gravel or grass.

Swiss scientists from ETH (Zurich) have examined the interaction between energy, heat, cooling, fuels and transport. They argue that the conversion of electricity into hydrogen is particularly promising for coupling electricity and heating to compensate for seasonal variations in renewable energy production. This conversion is particularly necessary to maintain zero emissions. The obstacle remains the adequacy of the energy storage system in the short to medium term.

The proposed multi-energy system involves a centralised energy district in which energy is converted and stored at one point and then delivered to end users.

Multi-energy systems can only achieve zero CO2 emissions with winteruse of hydrogen, but the use of such a system increases costs. This technology is particularly important when there is a high difference between seasonal heat and electricity demand. It can compensate for long-term mismatches between renewable energy production and demand.

In order to achieve zero net emissions, renewable energy would need to be 50-90% self-consumed. Hydrogen-generated electricity should be used mainly for winter peak demand and should not exceed 5% of the annual energy demand of the multi-energy system.

"When the gap between thermal needs and electricity demand is high, batteries play an important role and contribute to the majority of system costs, although up to 2% of the annual energy demand," the researchers added.

https://www.pv-magazine.com/2020/09/18/power-to-hydrogen-for-multi-energy-systems/

PV Magazine of 18 September

How long will the supply of lithium last? This metal is indispensable for batteries. However, batteries for electric vehicles are becoming more and more common (+25% per year between 2015 and 2018). Demand in 2015 was 34,600 tonnes, 40% of which was for vehicles. In 2019, it will reach 49,000 tonnes, 60% of which will be for batteries. In other words, the demand for lithium for vehicle batteries rose from 13,840 tonnes to 29,400 tonnes, i.e. more than doubling in three years.

The worldwide electrification of vehicles could absorb the entire lithium supply, according to a study by the Lappeenranta-Lahti University of Technology (LUT) in Finland and the University of Augsburg in Germany.

Moreover, energy consumption will increase with the world population, which is expected to reach 11 million people in 2050, compared with the current 7 billion, or 50% more.

Meeting demand depends on reserves. The quantity of lithium that can be extracted is estimated at between 30 and 95 million tonnes (the USGS estimates it at 80 MT). According to the different sources of evaluation of the current lithium reserves, the world has 26,000 tons, 41,000 T, 56,000 T, or 73,000 T at its disposal.

The study examines eight demand scenarios based on the number of electric vehicles, the use of batteries and their recycling.

In all the scenarios, demand would be assured over the next decade. If there is no recycling, factories would run out of lithium as early as 2040. If there is 73.000 tonnes of lithium remain, and 3 million electric vehicles are on the road, and recycling is put in place, and vehicles are integrated into the network, lithium will be depleted. by the year 2100 "The availability of lithium will become a serious threat to the long-term sustainability of the transport sector unless a set of measures is taken to meet the challenge."It will most likely require the use of battery technologies other than lithium, unless other modes of transport are used in addition to the individual vehicle.

https://www.pv-magazine.com/2020/09/15/how-long-will-the-lithium-supply-last/

PV Magazine of 15 September

Editor's note Lithium batteries have one major drawback: the energy they store lasts only four to six hours. All the researchers want to develop another technology. In the meantime, lithium is being used, especially since many factories only use this metal.

.

.

THE COMPANIES * Daqo further increases its production of silicon and wafers

* Daqo further increases its production of silicon and wafers

Daqo New Energy plans to list its silicon production subsidiary in Xinjiang on the Shanghai stock exchange. The sale of 15% of the capital will allow the creation of a silicon production plant with an annual production capacity of 35,000 tonnes, a monocrystalline solar wafer production unit to meet demand and the financing of the working capital of these units.

Daqo estimates that the annual world demand for silicon will reach 800,000 tonnes by the end of 2021. This increase in demand will drive prices up to $15/kg, well above the prices of 2019 and the first quarter of 2020 when the price had fallen to $6/kg.

PV Tech of 10 September

Editor's note At the beginning of September, Daqo announced a shortage of silicon. The company intends to meet the growing demand. From then on, prices will not be able to remain at their peak of $15/kg. They will come back to around 6 $ / kg while its cost price is below this level.

.

.

MISCELLANEOUS * Why not reproduce photosynthesis rather than using hydrogen?

* Why not reproduce photosynthesis rather than using hydrogen?

Researchers at the University of Cambridge have succeeded in mimicking the ability of plants to convert sunlight into energy (photosynthesis). They have converted sunlight, carbon dioxide and water into oxygen, formic acid, which is a storable fuel that can be used directly or converted into hydrogen.

This is a new method of converting carbon dioxide into a clean fuel. Energy farms could be set up to produce a clean fuel using sunlight and water. This is a promising way to reduce carbon emissions and move away from fossil fuels. However, it is difficult to produce these clean fuels without unwanted by-products. Researchers want to produce a liquid fuel that can also be easily stored and transported.

Their system is based on cobalt-based photo-catalysts embedded in a foil. This constitutes a so-called photo-catalytic sheet. The sheets are coated with semiconducting powders, which can be prepared easily and cheaply in large quantities. This new technology is simple; it produces a clean fuel that is easy to store and has potential for industrial production.

The researchers' test unit was a sheet measuring 20 square centimetres, but they say it should be relatively simple to use sheets measuring several square metres. In addition, formic acid can be accumulated in solution and chemically converted into different types of fuel.

Researchers are now working to optimise their system and improve its efficiency. In addition, they are exploring other catalysts to obtain different fuels from solar energy.

Enerzine of 14 September

.